Global| May 20 2021

Global| May 20 2021U.S. Initial Unemployment Claims Drift Lower

Summary

• Initial claims fall to yet another pandemic low. • But state continuing claims and insured unemployment rate rise. • PUA and PEUC continuing claims turn back down. Initial claims for unemployment insurance fell 34,000 in the week [...]

• Initial claims fall to yet another pandemic low.

• But state continuing claims and insured unemployment rate rise.

• PUA and PEUC continuing claims turn back down.

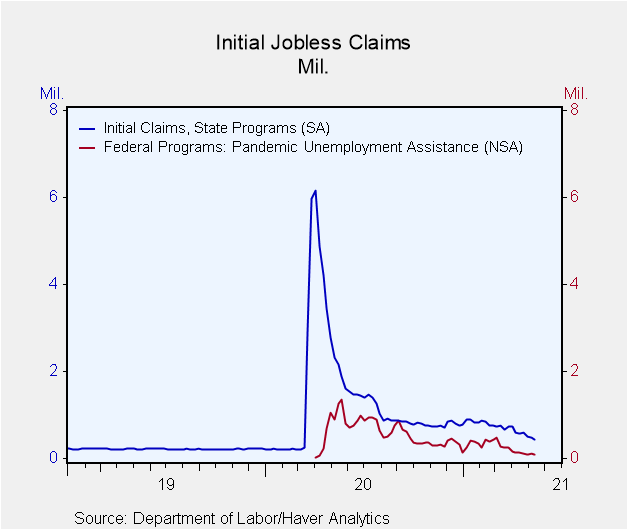

Initial claims for unemployment insurance fell 34,000 in the week ended May 15 to 444,000 from a slightly revised 478,000 in the previous week (initially 473,000). The Action Economics Forecast Survey panel expected 460,000 new claims. The latest week's figure represents still another new low since the start of the pandemic in March 2020, but as we pointed out last week, it remains larger than pre-pandemic levels, which were somewhat above 200,000. The 4-week moving average was 504,750 in the week ended May 15, also a pandemic low, from 535,250 in the previous week.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program declined by 8,592 (actual number, not rounded) to 95,086 in the week ended May 15 from a revised 103,086 (initially 103,571) in the previous week. The PUA program provides benefits to individuals, such as the self-employed, who are not eligible for regular state unemployment insurance benefits. Given the brief history of this program, these and other COVID-related series are not seasonally adjusted.

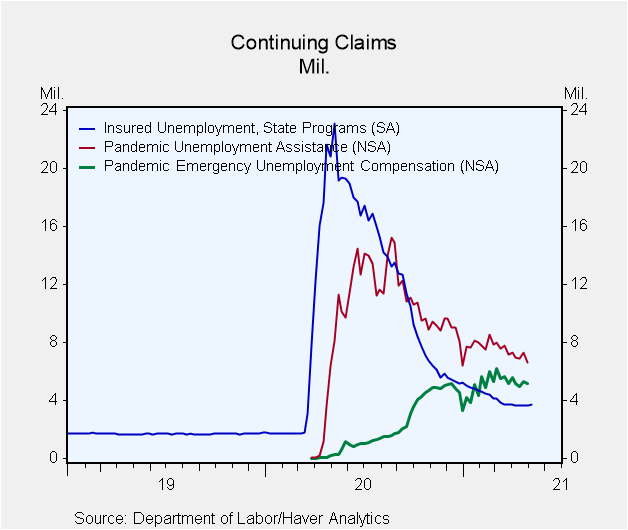

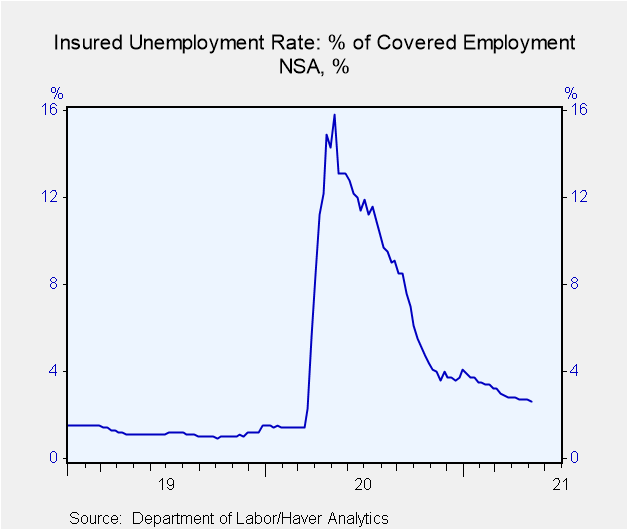

Continuing claims for regular state unemployment insurance rose 111,000 in the week ended May 8 to 3.751 million from 3.640 million the previous week. The state insured rate of unemployment ticked upward to 2.7% from 2.6% in the prior week. It reached 15.9% in May 2020, while the average rate in 2018 and 2019 was 1.2%.

Continuing PUA claims were 6.605 million in the week ended May 1, down 679,000 from the week before. Also in the May 1 week, the number receiving Pandemic Emergency Unemployment Compensation (PEUC) fell 150,000 to 5.141 million. This program covers people who have exhausted their state benefits.

The total number of all state, federal, and PUA and PEUC continuing claims was 15.975 million in the May 1 week, down from 16.862 million the week before and the lowest since 12.586 million in the week of April 4, 2020, just as the pandemic-related unemployment programs were getting under way. This grand total is not seasonally adjusted.

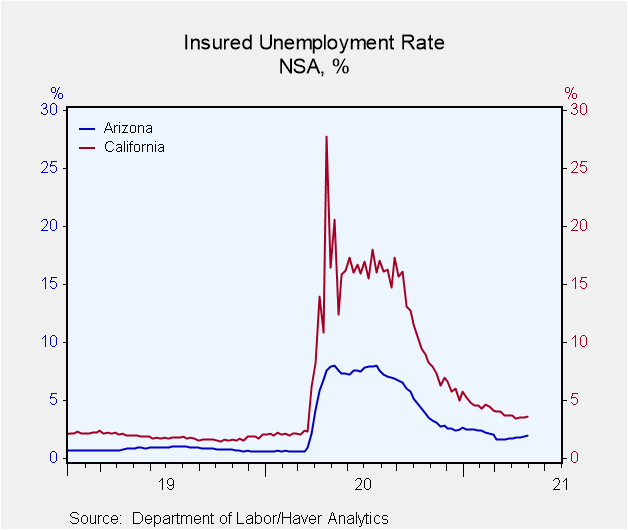

The state insured rates of unemployment in regular programs continued to vary widely. In the week ending May 1, the highest insured unemployment rates were in Nevada (6.07%), Connecticut (4.64%), Rhode Island (4.33%), Alaska (4.33%), Vermont (4.31%) and New York (4.06%). The lowest rates were in South Dakota (0.65%), Kansas (0.74%), Nebraska (0.74%), Utah (0.91%), Alabama (0.96%) and North Dakota (1.04%). Insured unemployment rates in other large states included California (3.58%), Texas (2.10%) and Florida (1.56%). These state rates are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 05/15/21 | 05/08/21 | 05/01/21 | Y/Y % | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 444 | 478 | 507 | -79.3 | 1352 | 218 | 220 |

| Initial Claims (NSA) | 455 | 492 | 514 | -79.0 | 1353 | 218 | 221 |

| Initial Claims Pandemic Unemployment Assistance (NSA) | 95 | 104 | 102 | -- | -- | -- | -- |

| Continuing Claims | -- | 3,751 | 3,640 | -83.8 | 10,380 | 1,699 | 1,754 |

| Continuing Claims (NSA) | -- | 3,684 | 3,694 | -84.0 | 10,370 | 1,704 | 1,763 |

| Continuing Claims Pandemic Unemployment Assistance (NSA) | -- | -- | 6,605 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 2.7 | 2.6 |

13.9 |

7.1 | 1.2 | 1.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates