Global| Aug 11 2011

Global| Aug 11 2011U.S. Initial Unemployment Insurance Claims Dip Back Below 400K

Summary

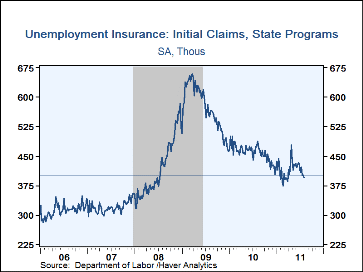

Initial unemployment insurance claims fell last week to 395,000, the first reading below the key 400,000 level since April 2. The July 30 week was revised to 402,000 from& 400,000. Consensus expectations had been for 400,000 initial [...]

Initial unemployment insurance claims fell last week to 395,000, the first

reading below the key 400,000 level since April 2. The July 30 week

was revised to 402,000 from& 400,000. Consensus expectations had been

for 400,000 initial claims for last week. The four-week moving average edged

down to 405,000.

Initial unemployment insurance claims fell last week to 395,000, the first

reading below the key 400,000 level since April 2. The July 30 week

was revised to 402,000 from& 400,000. Consensus expectations had been

for 400,000 initial claims for last week. The four-week moving average edged

down to 405,000.

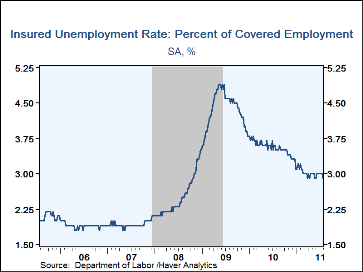

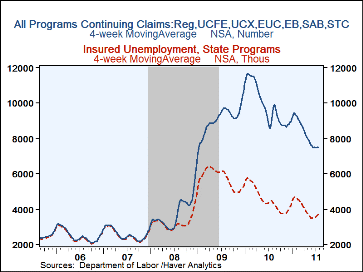

Continuing claims for unemployment insurance declined in their latest reading, reaching 3.688M in the July 30 week, the lowest since mid-April. The insured unemployment rate decreased to 2.9% versus 3.0%. These claimants, however, were only about half of the total number of people currently receiving unemployment insurance. Regular extended benefits, with eligibility dependent on conditions in individual states, rose about 10,000 to 543,513 during the week ending July 23 (the latest figure available); this is, however, 25.0% below a year ago. According to the Labor Department, the extended benefits were available in 32 states and the District of Columbia. A companion program, Emergency Unemployment Compensation, referred to as EUC 2008, saw 3.158M beneficiaries that week, down from 3.185M the week before and 23.8% less than a year ago.

A grand total of all claimants for unemployment insurance includes the extended and emergency programs and specialized programs covering recently discharged veterans, federal employees and those in state-run "work share" programs. All together, during the July 23rd week, these recipients totaled 7.480M, which is down 20.7% y/y.

Data on weekly unemployment insurance programs are contained in Haver's WEEKLY database, including the seasonal factor series, and they are summarized monthly in USECON. Data for individual states, including the unemployment rates that determine individual state eligibility for the extended benefits programs and specific "tiers" of the emergency program, are in REGIONW, a database of weekly data for states and various regional divisions. Action Economics estimates are in AS1REPNA.

| Unemployment Insurance (000s) | 8/06/11 | 7/30/11 | 7/23/11 | Y/Y % | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 395 | 402 | 401 | -17.4 | 459 | 574 | 418 |

| Continuing Claims | -- | 3,688 | 3,748 | -17.6 | 4,544 | 5,807 | 3,338 |

| Insured Unemployment Rate(%) | -- | 2.9 | 3.0 | 3.5 (8/7) |

3.6 | 4.4 | 2.5 |

| Total "All Programs" (NSA) | -- | -- | 7.480 | -20.7 | 9.850M | 9.163M | 3.903M |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.