Global| Dec 30 2010

Global| Dec 30 2010U.S. Initial Unemployment Insurance Claims Hit 2-1/2-Year Low

Summary

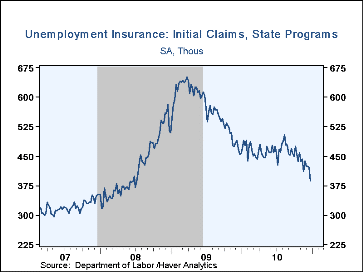

Initial claims for unemployment insurance dropped last week to 388,000 from 422,000 during the prior period (revised from 420,000). This was the lowest count since 385,000 on July 12, 2008, and also the first below 400,000 since that [...]

Initial claims for unemployment insurance dropped last week to 388,000

from 422,000 during the prior period (revised from 420,000). This was the

lowest count since 385,000 on July 12, 2008, and also the first below

400,000 since that time. The four-week moving average declined from

426,500 a week ago to 414,000, the lowest since July 26, 2008.

Consensus forecasts had looked for basically no change at 420,000.

Initial claims for unemployment insurance dropped last week to 388,000

from 422,000 during the prior period (revised from 420,000). This was the

lowest count since 385,000 on July 12, 2008, and also the first below

400,000 since that time. The four-week moving average declined from

426,500 a week ago to 414,000, the lowest since July 26, 2008.

Consensus forecasts had looked for basically no change at 420,000.

We checked the seasonal factors to see if the timing of the Christmas holiday might have distorted this reported performance. But the Labor Department's seasonals have a pattern very similar to that in December 2004, which had the same configuration of dates. After seasonal adjustment, initial claims then were basically flat through the part of December corresponding to these latest weeks, indicating that the seasonals fully accounted for the sharp rise in actual claimants as Christmas approached. There seems to be no statistical reason, then, to distrust this current sharp drop in seasonally adjusted initial claims. That is, it may signal a genuine improvement in labor market conditions.

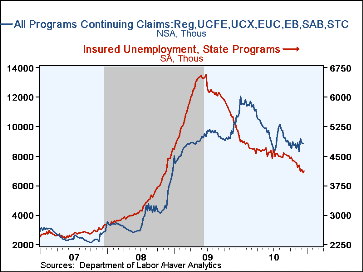

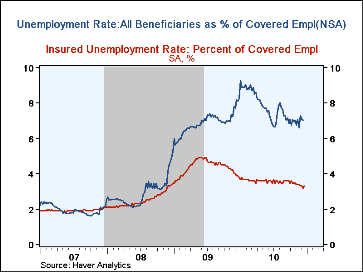

The other aspects of the report don't yield quite the improvement that initial claims do, although they cover earlier periods of December. Continuing claims for state-administered programs, reported today for the December 18 week, rose 57,000 to 4.128 million and partially reversed the prior week's 96,000 decline. This put the four-week average at 4.120 million, the lowest since November 22, 2008. The insured unemployment rate ticked back up to 3.3% from the previous week's 3.2%. There were minimal revisions to previous weeks' figures. These claimants are, however, only about half of the total number of people currently receiving unemployment insurance. Regular extended benefits, with eligibility dependent on conditions in individual states, fell 73,747 to 819,269 on that program's latest reporting date, December 11. The other extra program, Emergency Unemployment Compensation program, referred to as EUC 2008, saw a 77,741 decline to 3,711,288 beneficiaries in the December 11 week.

A grand total of all claimants for unemployment insurance includes extended and emergency programs and specialized programs covering recently discharged veterans, federal employees and people in state-run "workshare" programs, among others. All together, on December 11, the total number of all these program recipients was 8.867 million, off 17.6% y/y. We calculated a broader insured unemployment rate by taking this grand total as a percent of the covered employment series. That rate was just over 7% on December 11; it had peaked at 9.3% on January 2, 2010.

Two other programs, disaster unemployment assistance (DUA) and trade readjustment allowance (TRA), are reported through a different Labor Department channel and have no new data this week. All of these individual program data are not seasonally adjusted.

Data on weekly unemployment insurance programs are contained in Haver's WEEKLY database, including the seasonal factor series, and they are summarized monthly in USECON. Data for individual states, including the unemployment rates that determine individual state eligibility for the extended benefits programs and specific "tiers" of the emergency program, are in REGIONW, a database of weekly data for states and various regional divisions.

| Unemployment Insurance (000s) | 12/25/10 | 12/18/10 | 12/11/10 | Y/Y % | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 388 | 422 | 423 | -14.5 | 572 | 419 | 321 |

| Continuing Claims | 4128 | 4,071 | -19.9 | 5,809 | 3,340 | 2,549 | |

| Insured Unemployment Rate(%) | 3.3 | 3.2 | 3.9 (12/09) |

4.4 | 2.5 | 1.9 | |

| Total "All Programs" (NSA)* | -- | 8,867M | -17.6% | 9.170M | 3.931M | 2.634M |

*Excludes disaster unemployment assistance and trade readjustment allowance

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates