Global| Feb 03 2017

Global| Feb 03 2017U.S. ISM Nonmanufacturing Index Inches Down; Prices Strengthen Further

Summary

The Composite Index of Nonmanufacturing Sector Business Activity from the Institute for Supply Management (ISM) decreased to 56.5 in January from 56.6 during December. December was revised from 57.2. January's value again represents a [...]

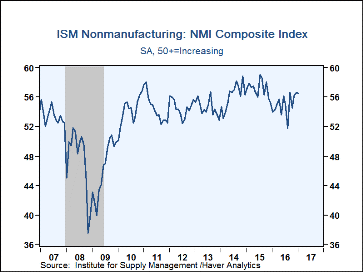

The Composite Index of Nonmanufacturing Sector Business Activity from the Institute for Supply Management (ISM) decreased to 56.5 in January from 56.6 during December. December was revised from 57.2. January's value again represents a high from October 2015, even as it shows a modest shortfall from the Action Economics Forecast Survey expectation of 57.0. During all of 2016, the index eased to 55.0 from 57.1 in 2015. The ISM data are diffusion indexes where readings above 50 indicate expansion.

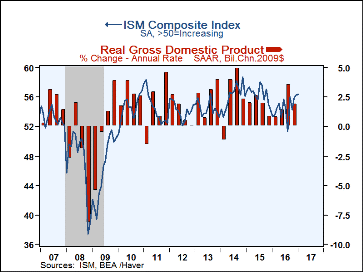

Haver Analytics constructs a Composite Index using the nonmanufacturing ISM index and the ISM factory sector measure that was released Wednesday. This composite rose to 56.4 in January from 56.3 in December, and was also the highest level since October of 2015. For all of last year, the composite index declined to 54.5 from 56.4 in 2015. During the last ten years, there has been a 73% correlation between this index and the q/q change in real GDP.

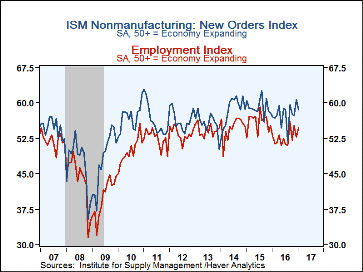

Among the nonmanufacturing components, the business activity index decreased to 60.3 in January, exactly reversing its December increase to 60.9; this is, however, still higher than any of the previous 12 months. The new orders index also fell, moving to 58.6 from 60.7 in December. The supplier deliveries index increased to 52.5 from 52.0 and was equal to or very modestly higher than all the months of 2016 except June, when it was 54.0. The employment index has traced a saw-tooth pattern in recent months and increased this time by 2 points to 54.7 following a December decline of 2.5 points to 52.7.

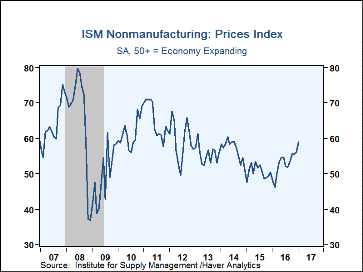

The prices paid series rose sharply to 59.0 in January from 56.1 the month before, and was at the highest level since April 2014. Twenty percent (NSA) of respondents reported paying higher prices while seven percent said they paid lower prices.

The export order series fell to 48.0 from 53.0; the latest value was, however, higher than January 2016, at 45.5. By contrast, the imports index increased this January to 54.0 from 50.0 in December. The order backlog measure rose to 50.0 after two noticeable declines took it to 48.0 in December. Each of these last few measures is not seasonally adjusted.

The NMI figures are available in Haver's USECON database, with additional detail in the SURVEYS database. The expectations figure from Action Economics is in the AS1REPNA database.

| ISM Nonmanufacturing Survey (SA) | Jan | Dec | Nov | Jan'16 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Composite Diffusion Index | 56.5 | 56.6 | 56.2 | 54.0 | 54.9 | 57.1 | 56.2 |

| Business Activity | 60.3 | 60.9 | 60.3 | 54.4 | 58.0 | 60.8 | 59.6 |

| New Orders | 58.6 | 60.7 | 57.4 | 57.0 | 57.5 | 59.2 | 58.5 |

| Employment | 54.7 | 52.7 | 55.2 | 52.9 | 52.6 | 56.0 | 54.8 |

| Supplier Deliveries (NSA) | 52.5 | 52.0 | 52.0 | 51.5 | 51.5 | 52.5 | 51.8 |

| Prices Index | 59.0 | 56.1 | 55.6 | 48.1 | 52.7 | 50.6 | 56.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates