Global| Mar 16 2018

Global| Mar 16 2018U.S. JOLTS: Job Openings, Hires and Layoffs Rise

Summary

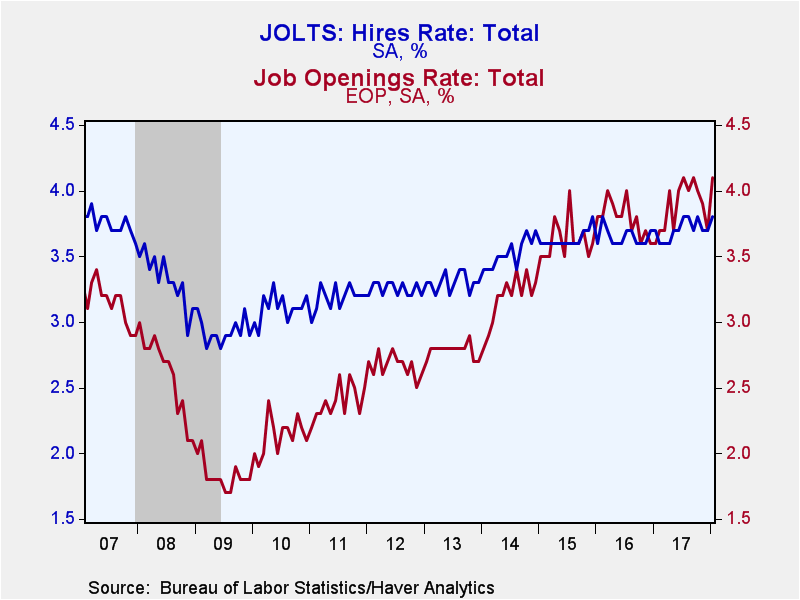

The Bureau of Labor Statistics reported that the total job openings rate jumped to 4.1% in January, matching the record rate reached in the middle of last year. The hiring rate rose to 3.8%. Over the last three years the hiring rate [...]

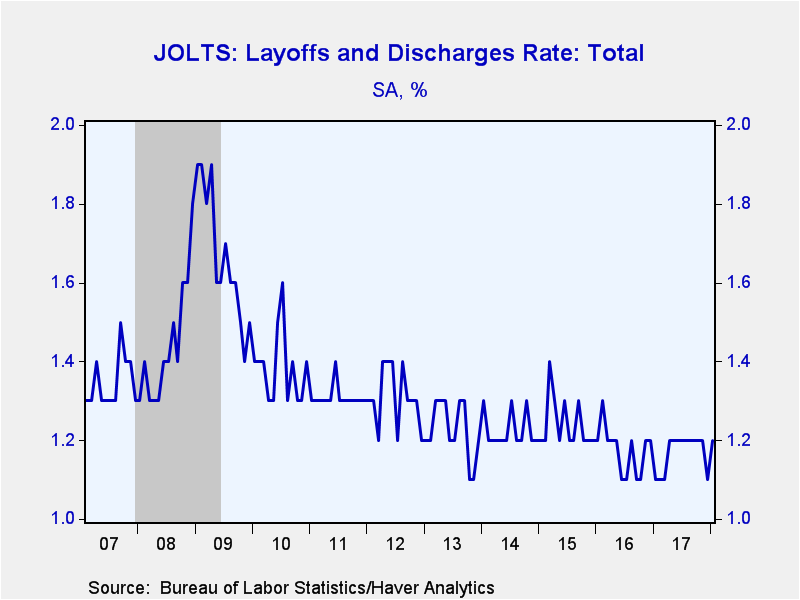

The Bureau of Labor Statistics reported that the total job openings rate jumped to 4.1% in January, matching the record rate reached in the middle of last year. The hiring rate rose to 3.8%. Over the last three years the hiring rate has been hovering between 3.6% and 3.8%. The layoff rate picked up to 1.2% in January but has been range-bound between 1.1% and 1.2% during the previous two years.

The private sector job openings rate jumped to 4.4% in January; a year ago it was 3.9%. Construction, manufacturing, trade, transportation & utilities, professional services and education & health all showed gains in openings. Leisure & hospitality was the only sector to show declines. The job openings rate in the government sector increased to 2.5% in January from 2.3% in December.

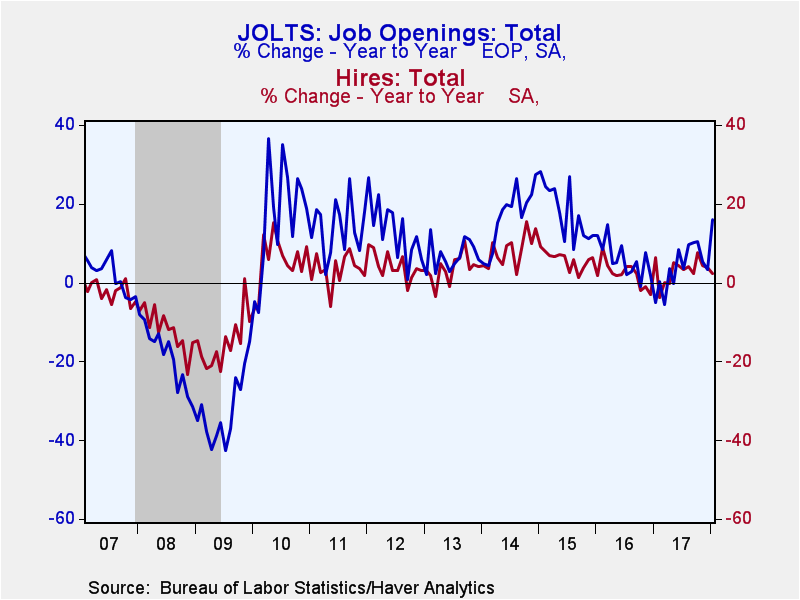

The level of job openings jumped 11.4% to a record 6.3 million in January driven by an 11.8% gain in private sector openings to a peak 5.8 million. Total economy job openings are up 15.9% from a year ago, while private sector openings have risen 15.7% year-on-year. Openings in construction led the gain, up 57.2% from a year ago, followed by trade and transportation (33.4% y/y) and leisure & hospitality (20.8%). Openings in government have grown 18.4% from a year ago.

The private sector hiring rate increased to 4.2% in January driven by gains in construction, manufacturing, education & health services and leisure & hospitality. Private sector hiring rose 1.4% for the month, with 2.7% growth for the year. The factory sector led the pack, up 16.9% from a year ago, while hiring in construction was down 14.9% year-on-year. Government hiring fell 3.4% in January and is down 3.7% year-on-year.

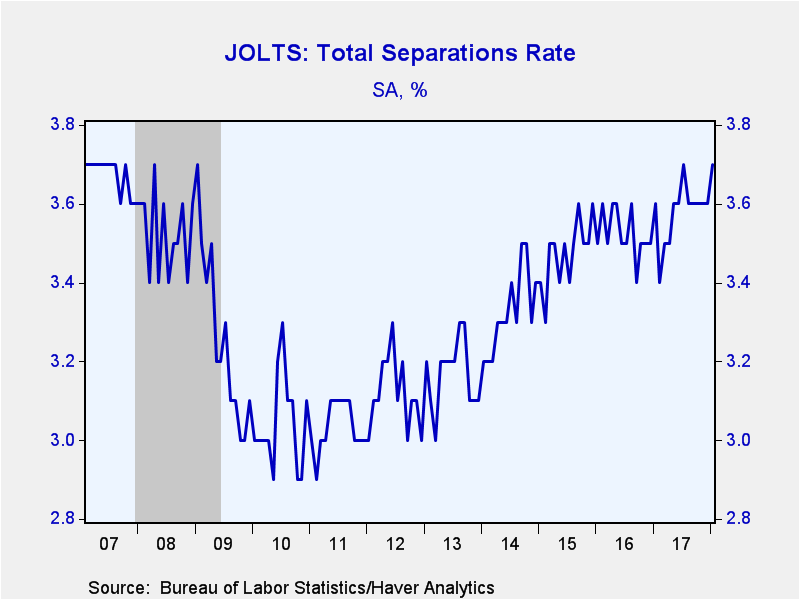

The overall job separations rate increased 1.8% (3.5% y/y) in January to a cycle peak of 5.4 million. The separation rate matched the cycle high of 3.7% notched six months ago. Total layoffs rose 6.5% and are up 6.2% from a year ago. Private sector layoffs jumped 8.1% for the month and are up 6.8% from a year ago.

The Job Openings & Labor Turnover Survey (JOLTS) survey dates to December 2000 and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey, SA) | Jan | Dec | Nov | Jan '17 | Jan '16 | Jan '15 | |

|---|---|---|---|---|---|---|---|

| Job Openings, Total | |||||||

| Rate (%) | 4.1 | 3.7 | 3.9 | 3.6 | 3.8 | 3.5 | |

| Total (000s) | 6,312 | 5,667 | 5,933 | 5,444 | 5,729 | 5,113 | |

| Hires, Total | |||||||

| Rate (%) | 3.8 | 3.7 | 3.7 | 3.7 | 3.6 | 3.6 | |

| Total (000s) | 5,583 | 5,524 | 5,514 | 5,460 | 5,130 | 5,036 | |

| Layoffs & Discharges, Total | |||||||

| Rate (%) | 1.2 | 1.1 | 1.2 | 1.1 | 1.2 | 1.2 | |

| Total (000s) | 1,762 | 1,655 | 1,735 | 1,659 | 1,722 | 1,723 | |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates