Global| Oct 16 2018

Global| Oct 16 2018U.S. JOLTS: Job Openings Rate Hits Another Record

Summary

The Bureau of Labor Statistics reported that the total job openings rate rose to a record 4.6% in August; July was revised higher to 4.5%. The job openings rate is the job openings level as a percent of total employment plus the job [...]

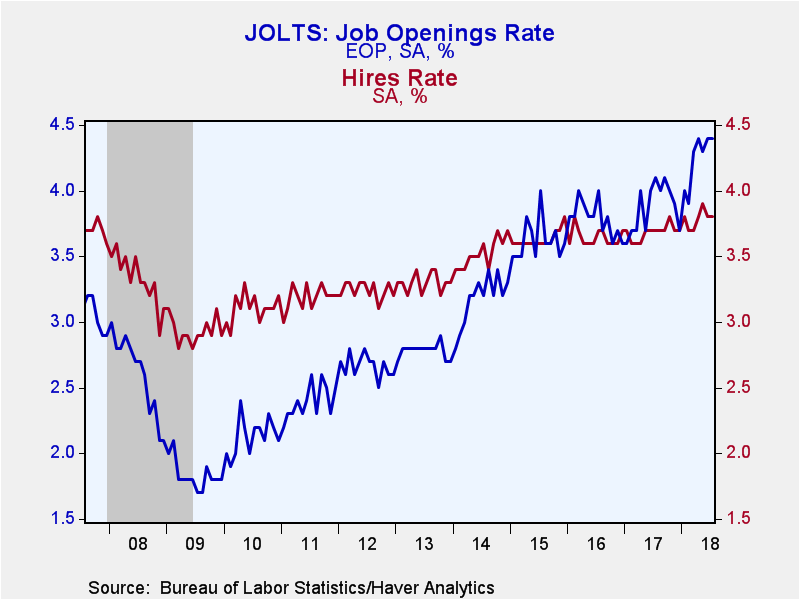

The Bureau of Labor Statistics reported that the total job openings rate rose to a record 4.6% in August; July was revised higher to 4.5%. The job openings rate is the job openings level as a percent of total employment plus the job openings level. The hiring rate increased to 3.9%, matching the eleven-year high reached in May. Meanwhile, the quits rate, a measure of confidence in job prospects, was unchanged at a 17-year high of 2.4%. The JOLTS data begin in 2000.

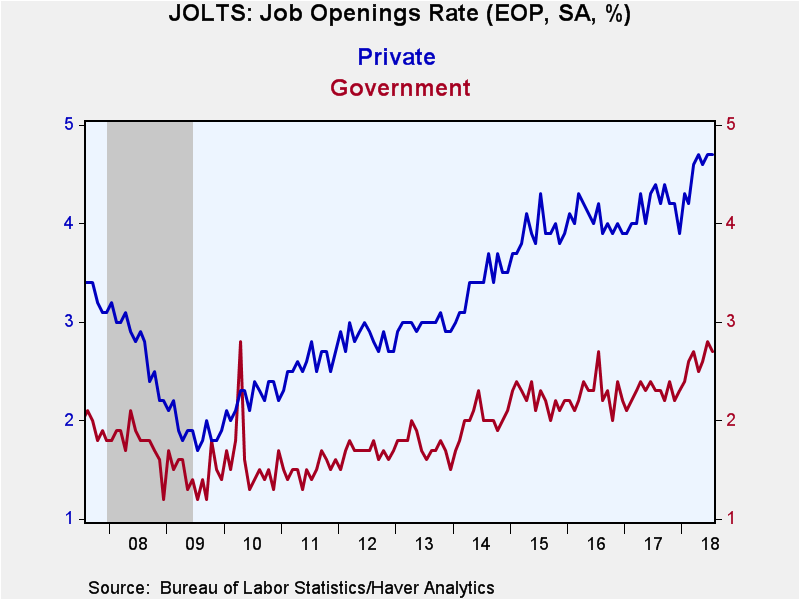

The private-sector job openings rate remained at July’s record 4.8% (though July’s data was revised higher). Leisure & hospitality held steady at July’s downwardly revised 5.7%, while professional & business services jumped to 5.9%, the highest rate in three years. In education & health services, the share increased to 5.1%, while in construction it rose to 3.9% a 17-year high. The rate in manufacturing slipped to 3.7% and in trade, transportation & utilities it declined to 4.4%. The job openings rate in government eased to 2.9% from July’s upwardly revised record level of 3.0%.

The level of job openings increased 0.8% month-to-month (18.1% year-on-year) to 7.136 million in August following an upwardly revised 3.7% July gain. Private-sector openings jumped 17.0% y/y with the factory sector revving 17.3% y/y and construction 38.6% y/y. Openings in professional & business services advanced 27.0% y/y; leisure & hospitality gained 17.4% y/y; trade, transportation & utilities increased 15.5% y/y; and education & health services were up 6.7% y/y. Government sector job openings gained 29.4% y/y.

The private-sector hiring rate in August rose to 4.3% matching May’s eleven-year high. The rate in leisure & hospitality was unchanged at 6.5% as was professional & business services at 5.6%. In education & health services, the share eased to 2.9%. In manufacturing and construction the hiring rate declined to 2.9% and 4.9% respectively. Meanwhile, hiring in trade, transportation & utilities jumped to 4.4% a 12-year high. The hiring rate in government slipped to 1.5%.

Total hiring rose 1.2% (5.0% y/y) in August to 5.784 million. Hiring in the private sector increased 5.2% y/y with trade, transportation & utilities jumping 17.2% and leisure & hospitality gaining 5.9% y/y. Professional & business employment increased 1.8% y/y and educational & health services were up 1.3% y/y. Factory sector hiring slowed to 2.2% y/y and construction sector fell 10.3% y/y.

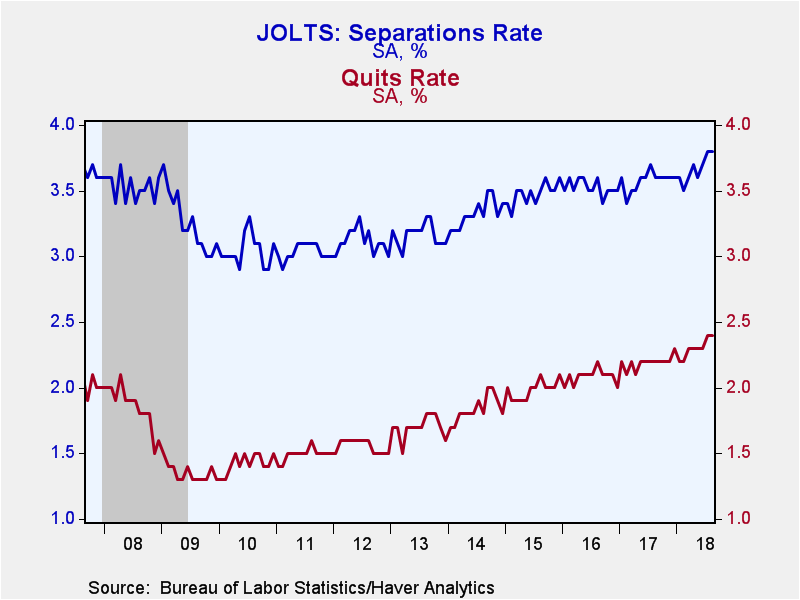

The overall job separations rate remained at July’s 12-year high of 3.8%. Private sector separations rose to a cycle of 4.2%. The level of overall separations increased 2.0% (6.8% y/y) to 5.706 million. In the private sector they were up 6.7% y/y led by trade, transportation & utilities (20.4%) and manufacturing (15.4% y/y). Leisure & hospitality gained 7.2% y/y and professional & business services edged up 0.4% y/y. Meanwhile construction fell 9.4% y/y and education & health services inched down 0.3% y/y. Separations in the government sector gained 8.0% y/y.

The level of quits edged down 0.9% (+12.7% y/y) to 3.577 million in August. Still, the quits rate held steady at July’s record of 2.4%. The private sector quit rate was also unchanged at 2.7%. The rate rose in the financial sector to 1.8%, a ten-year high. Meanwhile, professional & business services declined to 3.4%.

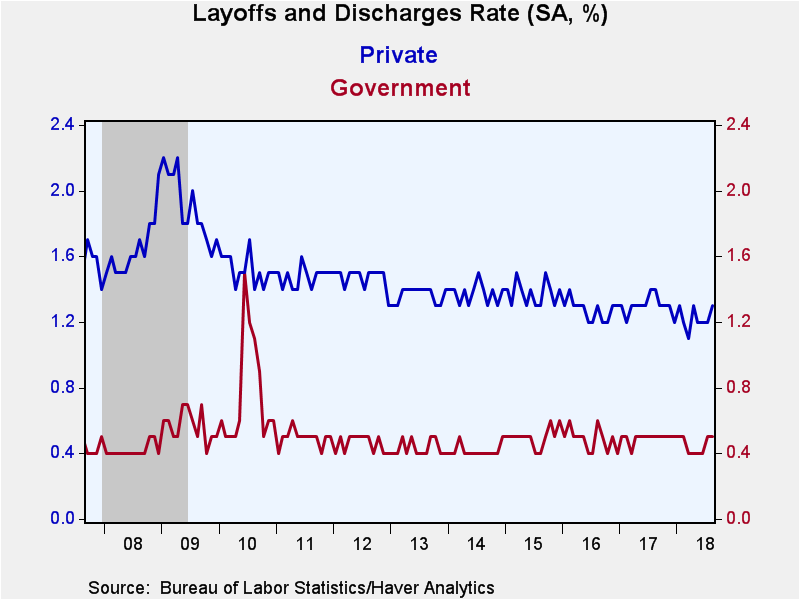

The level of layoffs jumped 10.9% (-0.4% y/y) to 1.798 million, raising the layoff rate to 1.2%. In the private sector, the layoff rate increased to 1.3%. Of note, the layoff rate continued it ascent in trade, transportation & utilities to a three-year high of 1.4%. Professional & business services advanced to 2.1% while the government sector was unchanged at 0.5%.

The Job Openings & Labor Turnover Survey (JOLTS) survey dates to December 2000 and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey, SA) | Aug | Jul | Jun | Aug'17 | Aug'16 | Aug'15 |

|---|---|---|---|---|---|---|

| Job Openings, Total | ||||||

| Rate (%) | 4.6 | 4.5 | 4.4 | 4.0 | 3.7 | 3.6 |

| Total (000s) | 7,136 | 7,077 | 6,822 | 6,044 | 5,515 | 5,365 |

| Hires, Total | ||||||

| Rate (%) | 3.9 | 3.8 | 3.8 | 3.7 | 3.7 | 3.6 |

| Total (000s) | 5,784 | 5,713 | 5,677 | 5,507 | 5,294 | 5,083 |

| Layoffs & Discharges, Total | ||||||

| Rate (%) | 1.2 | 1.1 | 1.1 | 1.2 | 1.2 | 1.2 |

| Total (000s) | 1,798 | 1,622 | 1,652 | 1,805 | 1,675 | 1,674 |

| Quits, Total | ||||||

| Rate (%) | 2.4 | 2.4 | 2.3 | 2.2 | 2.2 | 2.1 |

| Total (000s) | 3,577 | 3,608 | 3,477 | 3,173 | 3,161 | 2,926 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates