Global| Mar 15 2019

Global| Mar 15 2019U.S. JOLTS: Job Openings Remain Abundant

by:Tom Moeller

|in:Economy in Brief

Summary

The Bureau of Labor Statistics reported that the total job openings rate increased to 4.8% during January and matched the record high. The job openings rate is the job openings level as a percent of total employment plus the job [...]

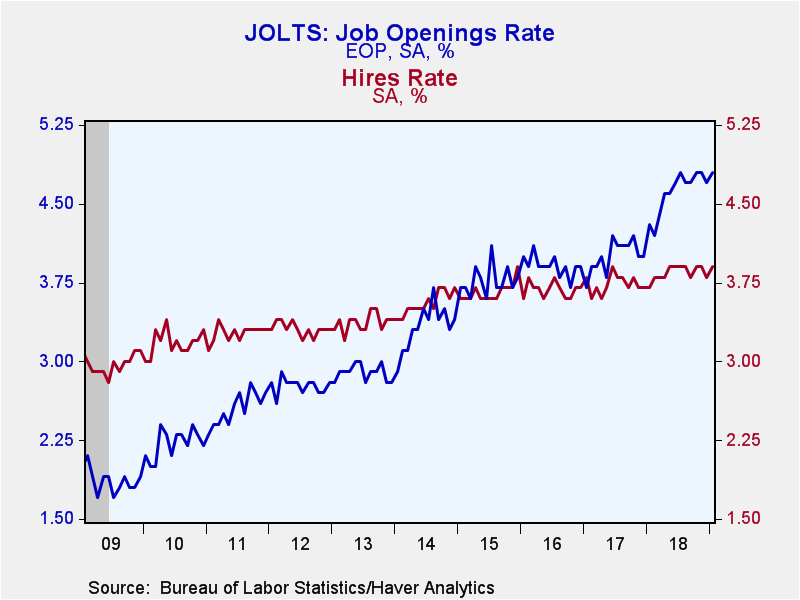

The Bureau of Labor Statistics reported that the total job openings rate increased to 4.8% during January and matched the record high. The job openings rate is the job openings level as a percent of total employment plus the job openings level. Finding workers to fill those openings became a bit more successful. The hiring rate improved to 3.9%, but has been moving sideways for about a year. In this tight labor market, employers remain hesitant to let people go. The layoff & discharge rate dropped to a record low of 1.1%. And with jobs plentiful, workers seem ready to seek out new positions. The quits rate held steady at a near-record 2.3%. The JOLTS data begin in 2000.

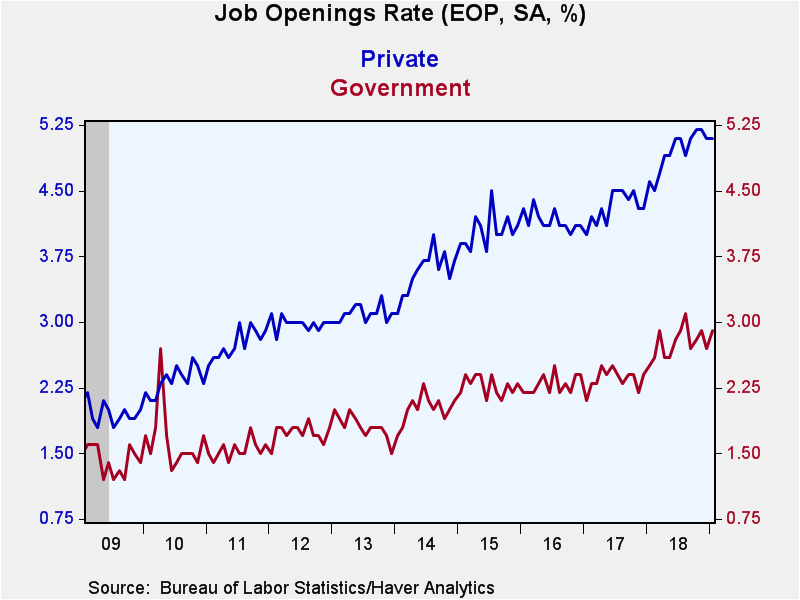

The private-sector job openings rate eased slightly to a near-record 5.1%. In leisure & hospitality, the rate held at 6.2%. In professional & business services, it eased to 5.9%, but remained up from 5.1% twelve months earlier. In education & health services, the rate strengthened to a record 5.5%, but in trade, transportation & utilities, it fell to a still-strong 5.0%. The rate held at 3.9% in construction and in manufacturing, it remained low at 3.4%. The job openings rate in government improved to 2.9%, and remained up sharply versus the 2009 low of 1.2%.

The level of job openings increased 15.0% in January to 7.581 million. Private-sector openings increased 0.6% (14.6% y/y) while government sector job openings rose 19.8% y/y.

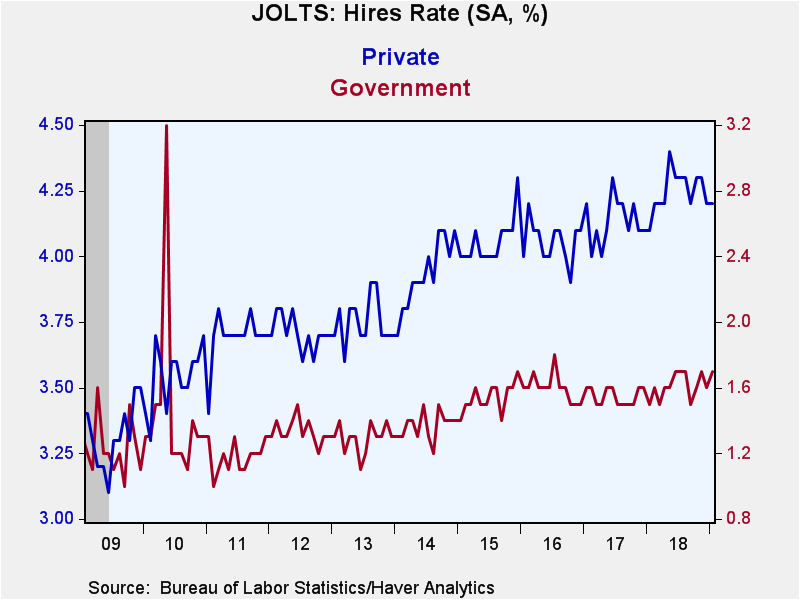

The private-sector hiring rate eased to 4.2% and remained below May's eleven-year high of 4.4%. The rate in leisure & hospitality jumped to 6.7%. In professional & business services it weakened to 5.3%, and remained below the 2017 high of 6.1%. The construction sector's hiring rate rose sharply to 5.7%, and nearly equaled the January 2017 high of 5.8%. The hiring rate in trade, transportation & utilities fell sharply to 4.0%, the lowest level in a year. In education & health services, the rate held steady at 3.0%. In manufacturing, the rate was firm at 2.8%. The hiring rate in government has been moving sideways near 1.7%.

Total hiring increased 5.0% y/y to a near-record 5.801 million. Hiring in the private sector rose 4.5% y/y while government sector hiring strengthened 12.7% y/y.

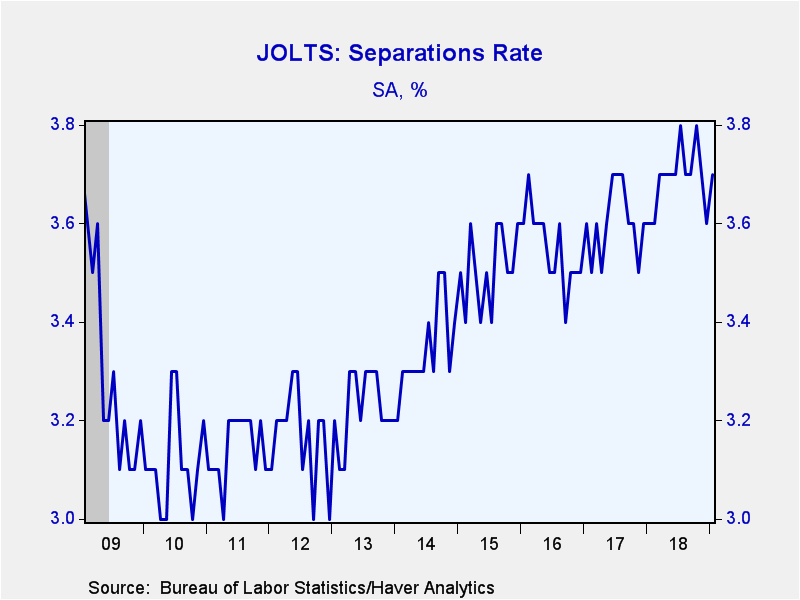

With the strong labor market, the overall job separations rate has risen to 3.7% and remained near the expansion high. The private sector separations rate increased to 4.1%, but was below the cycle high of 4.2% reached in July. The separations rate in government rose slightly to 1.6%.

The level of separations strengthened 4.4% y/y. In the private sector, they were up 4.2% y/y led by an 18.8% surge in the construction sector. In educational and health services separations rose 7.7% y/y but in trade, transportation & utilities, separations eased 0.5%. Leisure & hospitality job separations increased 4.5% y/y but in manufacturing, they fell 1.4% y/y. In the financial sector, separations decreased 13.5% y/y. Separations in the information sector also declined 10.3% y/y but professional & business services job separations rose 5.9% y/y. Separations in the government sector increased 7.5% y/y.

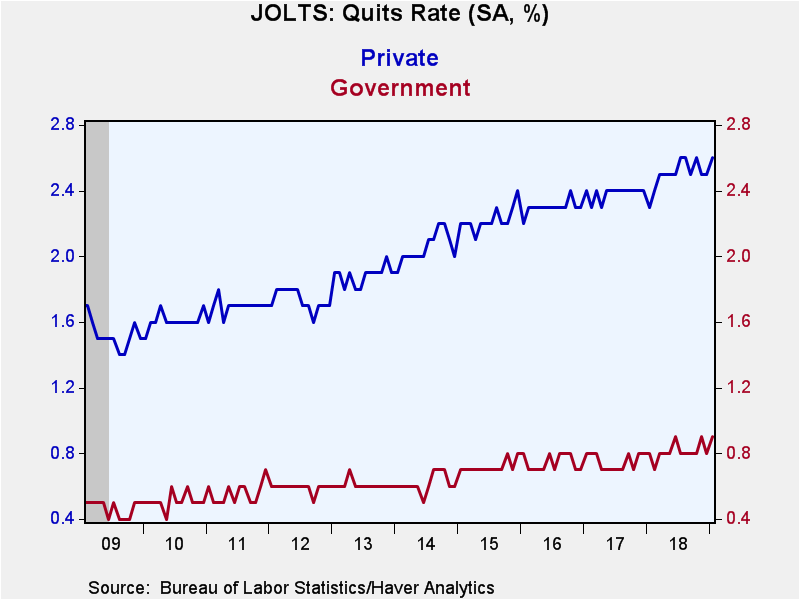

In another sign of a strong labor market, the level of quits rose 13.5% y/y to 3.490 million in January. The quits rate of 2.3% remained up sharply from 1.3% at the beginning of the expansion. The private-sector quits rate held at 2.6%, the highest level in 13 years. The government sector quits rate surged to a record 0.9%.

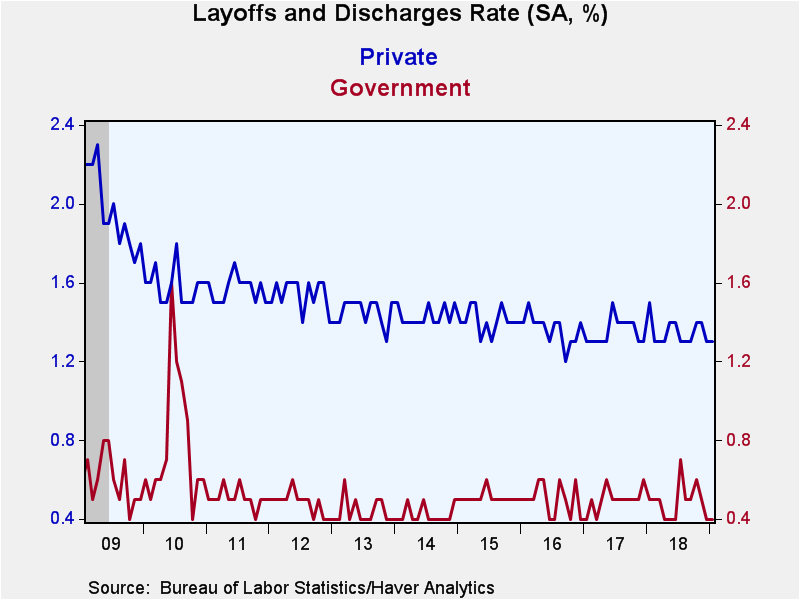

The level of layoffs in the private sector declined 11.2% y/y and the layoff rate held steady at 1.3%, down from the 2009 high of 2.2%. The government sector layoff rate held at the record low 0.4%.

The Job Openings & Labor Turnover Survey (JOLTS) dates to December 2000 and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey, SA) | Jan | Dec | Nov | Jan'18 | Jan'17 | Jan'16 |

|---|---|---|---|---|---|---|

| Job Openings, Total | ||||||

| Rate (%) | 4.8 | 4.7 | 4.8 | 4.3 | 3.7 | 4.0 |

| Total (000s) | 7,581 | 7,479 | 7,626 | 6,591 | 5,624 | 5,977 |

| Hires, Total | ||||||

| Rate (%) | 3.9 | 3.8 | 3.9 | 3.7 | 3.8 | 3.6 |

| Total (000s) | 5,801 | 5,717 | 5,821 | 5,525 | 5,528 | 5,214 |

| Layoffs & Discharges, Total | ||||||

| Rate (%) | 1.1 | 1.2 | 1.3 | 1.3 | 1.2 | 1.3 |

| Total (000s) | 1,723 | 1,751 | 1,889 | 1,934 | 1,735 | 1,806 |

| Quits, Total | ||||||

| Rate (%) | 2.3 | 2.3 | 2.3 | 2.0 | 2.2 | 2.0 |

| Total (000s) | 3,490 | 3,391 | 3,379 | 3,022 | 3,154 | 2,883 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.