Global| Mar 21 2013

Global| Mar 21 2013U.S. Leading Economic Indicators Continue To Firm

by:Tom Moeller

|in:Economy in Brief

Summary

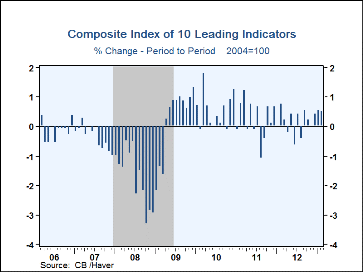

The index of Leading Economic Indicators, published by the Conference Board, increased 0.5% (2.0% y/y) during February after a revised 0.5% January increase, initially reported as 0.2%. Eighty percent of the component series had a [...]

The index of Leading Economic Indicators, published by the Conference Board, increased 0.5% (2.0% y/y) during February after a revised 0.5% January increase, initially reported as 0.2%. Eighty percent of the component series had a positive influence on the index. A steeper interest rate yield curve, the leading credit index, more building permits and a longer average workweek were the primary drivers of last month's gain. These were offset by lower consumer expectations for business & economic conditions and fewer real orders for nondefense capital goods excluding aircraft.

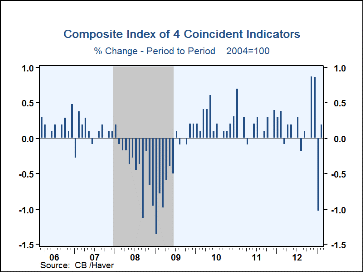

The index of coincident indicators gained 0.2% (1.4% y/y) in February after a revised 1.0% January decline, earlier reported as a 0.4% rise. The increase in industrial production and the rise in nonagricultural payrolls had the largest positive influences on the index last month, followed by marginal gains in business sales and personal income less transfers.

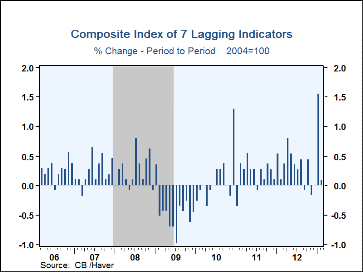

The index of lagging economic indicators ticked up 0.1% but rose a firm 4.6% y/y. A still-strong 64.3% of the component series increased last month. Minimal m/m gains in most of the component series were offset by a decline in the average duration of unemployment.

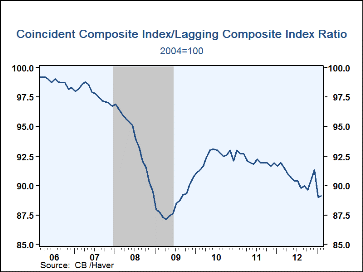

Another leading economic series is the ratio of coincident-to-lagging indicators. It measures how the economy is performing versus its excesses. The figure ticked slightly higher last month but the previously reported large January increase was revised away.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The forecast figure for the Consensus are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.