Global| Jan 24 2019

Global| Jan 24 2019U.S. Leading Economic Indicators Decrease

Summary

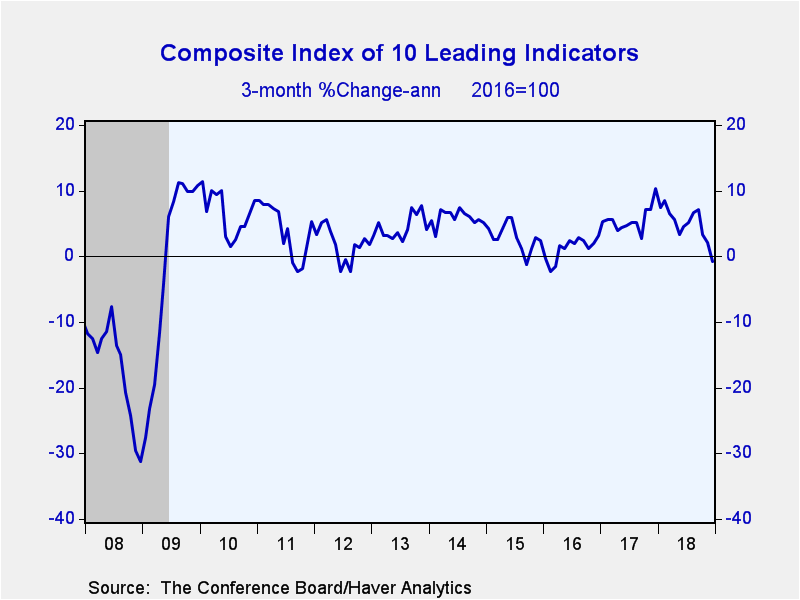

The Conference Board's Composite Index of Leading Economic Indicators declined 0.1% (+2.1% year-on-year) during December following an unrevised 0.2% gain in November. The Action Economics Forecast Survey expected a 0.1% decrease. The [...]

The Conference Board's Composite Index of Leading Economic Indicators declined 0.1% (+2.1% year-on-year) during December following an unrevised 0.2% gain in November. The Action Economics Forecast Survey expected a 0.1% decrease. The series is comprised of 10 components which tend to precede changes in the overall economy. As a result of the government shutdown two of the components of the index -- new orders for consumer goods and materials as well as building permits -- are not available for December, thus the Conference Board forecast these series. Moreover, a third component, nondefense capital goods orders is based on preliminary November data. Given this, there is a high likelihood of a revision to the December reading of the Index of Leading Indicators. The Conference Board also postponed the regularly scheduled benchmark revisions of the composite indicators until all underlying data are available.

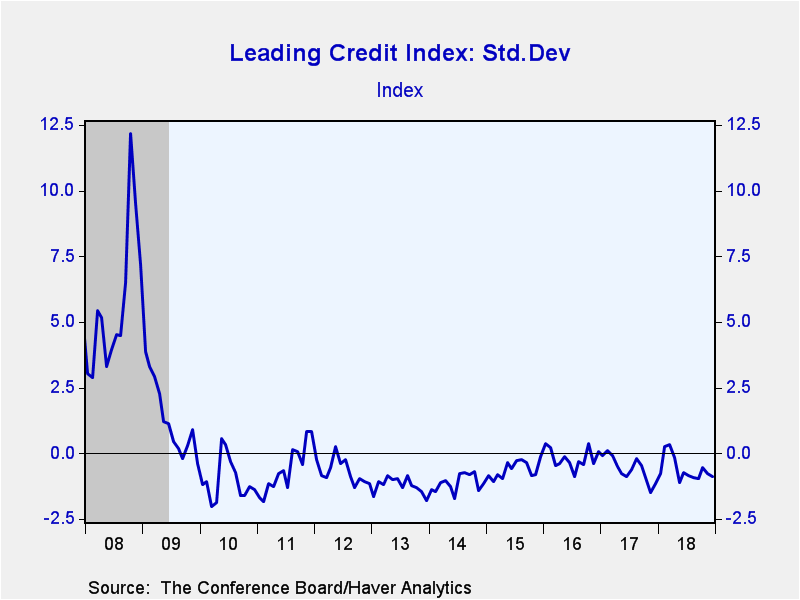

The drop in equities prices in December was the biggest contributor to the negative reading. Weakness in the ISM new orders index as well as building permits also drove the index lower. Lower claims, looser credit conditions, improved consumer expectations for business/economic conditions, a steeper yield curve and some strength in both measures of manufacturing orders made positive contributions. Three-month growth in the leading index fell at a 0.7% annual rate, the largest decline in almost three years.

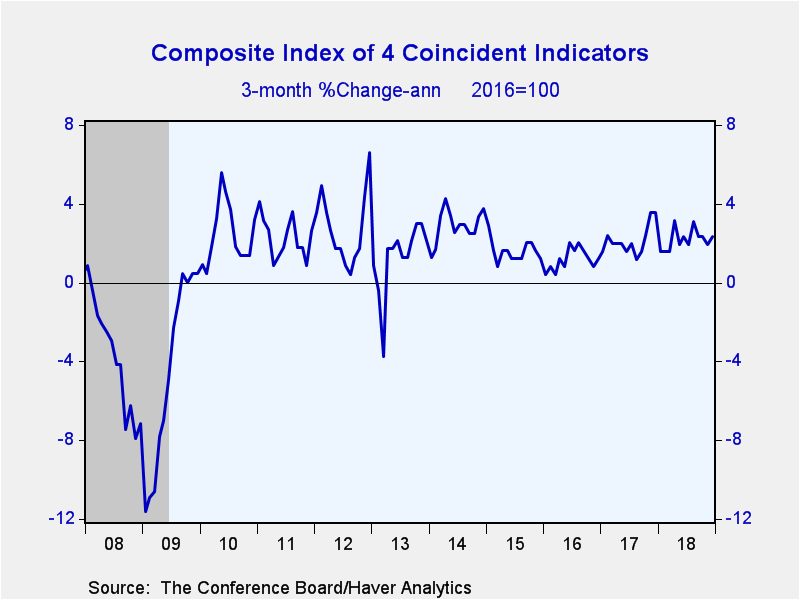

The Index of Coincident Economic Indicators increased 0.2% (4.3% y/y) in December following an unrevised 0.2% gain during November. All of the index components -- changes in personal income less transfer payments, industrial production, nonagricultural payroll employment and manufacturing & trade sales -- made positive contributions. Three-month growth in the coincident index increased at a 2.3% annual pace, in line with recent trends.

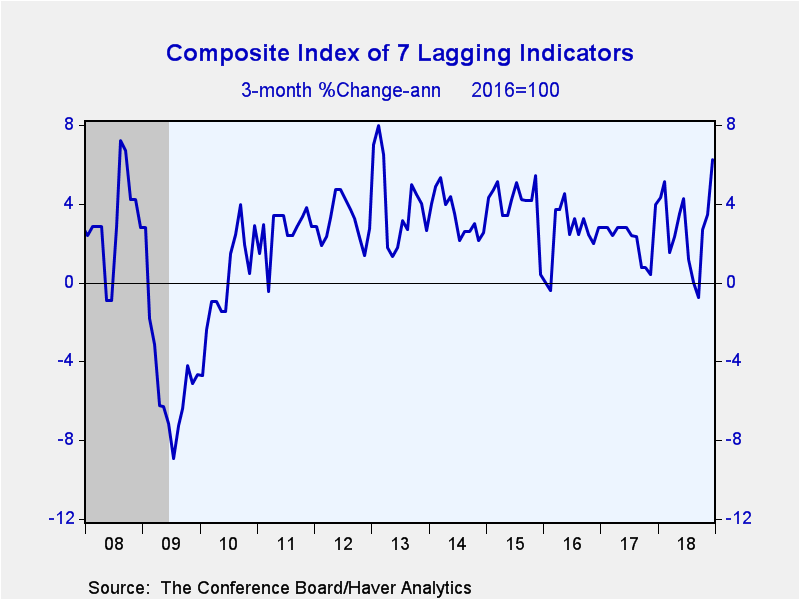

The Index of Lagging Economic Indicators increased 0.5% last month (2.8% y/y) following upwardly revised 0.5% growth in November. Strength in commercial & industrial loans outstanding and the six-month growth in the services CPI drove the majority of the gain. The average duration of unemployment was the only negative contributor. The three-month growth in the lagging index jumped at 6.2% annual rate, the fastest pace in six years.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The expectations are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators (%) | Dec | Nov | Oct | Dec Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Leading | -0.1 | 0.2 | -0.3 | 2.1 | 5.9 | 4.1 | 1.2 |

| Coincident | 0.2 | 0.2 | 0.2 | 4.3 | 2.2 | 1.8 | 1.3 |

| Lagging | 0.5 | 0.5 | 0.6 | 2.8 | 2.5 | 2.6 | 2.9 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates