Global| Oct 16 2019

Global| Oct 16 2019U.S. Mortgage Applications for Refinancing Rise While Those for Purchase Slip

by:Sandy Batten

|in:Economy in Brief

Summary

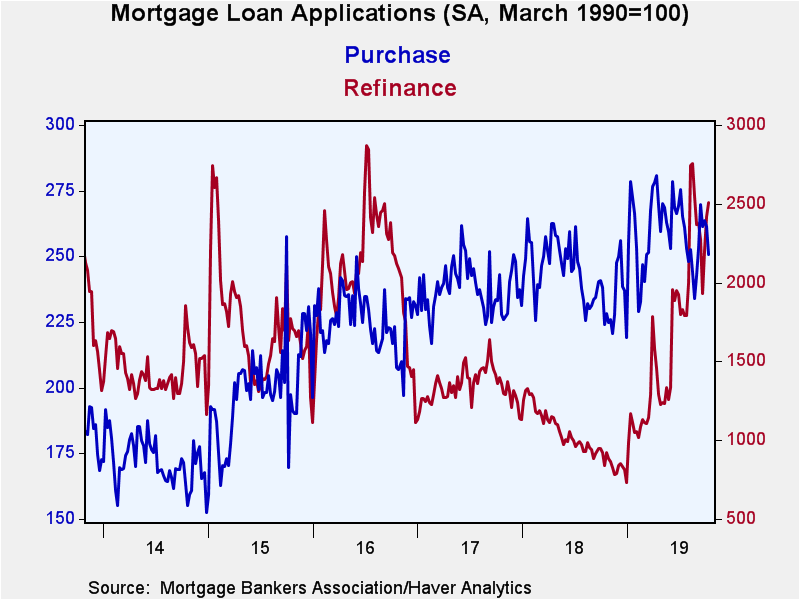

The Mortgage Bankers Association reported that its Mortgage Loan Index edged up 0.5% w/w (81.8% y/y) in the week ending October 11, following a 5.2% rise in the previous week. Applications to refinance a loan increased 3.6% w/w [...]

The Mortgage Bankers Association reported that its Mortgage Loan Index edged up 0.5% w/w (81.8% y/y) in the week ending October 11, following a 5.2% rise in the previous week. Applications to refinance a loan increased 3.6% w/w (199.0% y/y), slowing from strong weekly gains in each of the previous two weeks. Purchase applications slipped for the third week of the past four, falling 4.1% w/w (+11.9% y/y) in the week ending October 11 on top of a 0.9% w/w decline in the previous week.

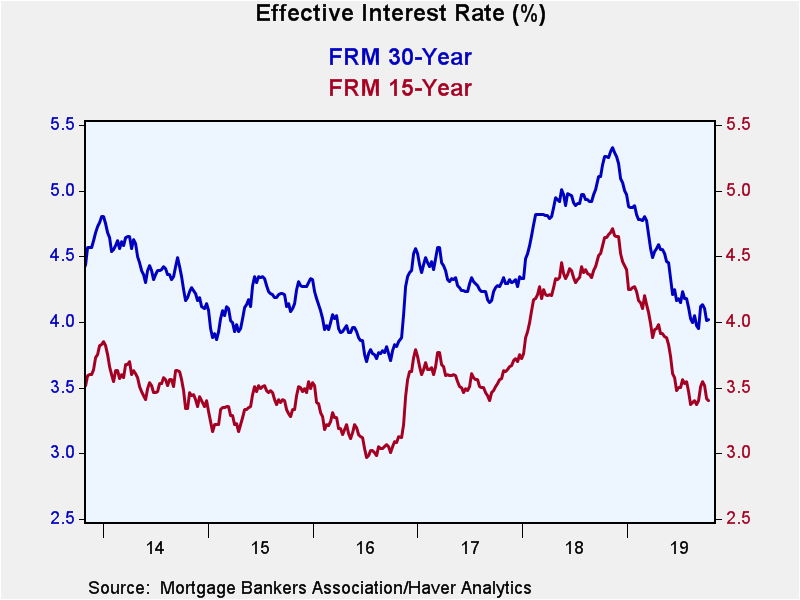

The effective interest rate on a 15-year fixed-rate mortgage fell to 3.40% from 3.42%, its third consecutive weekly decline. It has fallen more than 120 basis points since October a year ago. The effective rate on a 30-year fixed-rate loan edged up to 4.02% from 4.01%, but remains well below the November 2018 high of 5.33%. The effective rate on a 30-year Jumbo mortgage slipped 2 bp to 3.96 and also remains well below its late-2018 high of 5.09%. The rate on an adjustable 5-year mortgage rebounded to 3.46% after its sharp drop to 3.37% in the previous week.

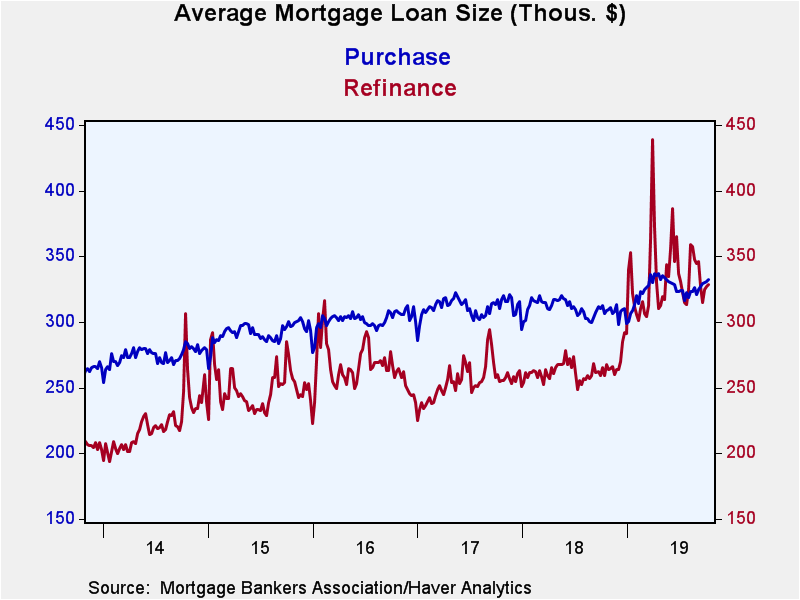

The average mortgage loan size rose slightly to $329,900 (+14.4% y/y) from $328,600, its third consecutive weekly increase. The average loan size for purchases increased to $332,100 (8.4% y/y). For refinancings, the average loan size edged up to $328,600 (26.7% y/y).

Applications for fixed-rate loans rose 84.8% y/y. This is the second fastest annual growth of fixed-rate loan applications since 2012. Adjustable rate loan applications increased 42.4% y/y.

The survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for each index is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 10/11/19 | 10/04/19 | 09/27/19 | Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total Market Index | 0.5 | 5.2 | 8.1 | 81.8 | -10.4 | -17.8 | 15.6 |

| Purchase | -4.1 | -0.9 | 0.9 | 11.9 | 2.1 | 5.6 | 13.3 |

| Refinancing | 3.6 | 9.8 | 14.2 | 199.0 | -24.3 | -34.0 | 17.3 |

| 15-Year Mortgage Effective Interest Rate (%) | 3.40 | 3.42 | 3.52 | 4.63 (Oct.'18) | 4.35 | 3.59 | 3.22 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates