Global| Aug 08 2013

Global| Aug 08 2013U.S. Mortgage Delinquency Rates Continue To Fall

by:Tom Moeller

|in:Economy in Brief

Summary

An improved job market and lower interest rates are helping home buyers service mortgage debt. The share of home mortgages that are notably delinquent fell to 5.88% during Q2'13. That's down from 7.31% one year earlier and below the [...]

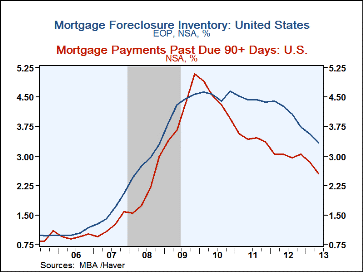

An improved job market and lower interest rates are helping home buyers service mortgage debt. The share of home mortgages that are notably delinquent fell to 5.88% during Q2'13. That's down from 7.31% one year earlier and below the 9.67% peak in Q4'09. The decline reflects a drop in home foreclosures to 3.33% of loans versus 4.27% one year earlier and 4.64% at the Q4'10 peak. Loans that are 90 days or more past due fell to 2.55% of the total from 3.04% in Q2'12 and 5.09% in Q4'09.

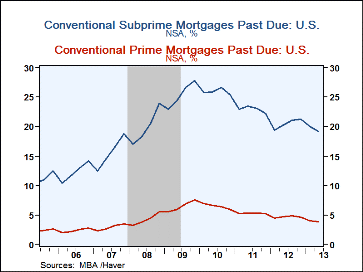

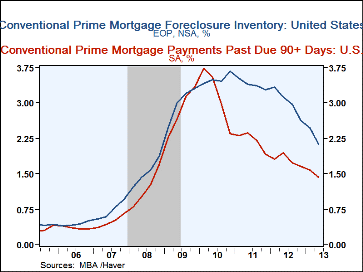

The overall decline in delinquency rates is due to the improved debt-servicing ability of both prime (67% of the total) and subprime (11% of the total) borrowers. (Servicing of FHA and VA loans also has improved significantly.) The percentage of conventional prime borrowers that are in foreclosure or 90 days or more delinquent fell to 3.50% of the total from 4.98% one year ago. At the beginning of 2010 the rate peaked at 7.08%. Mortgages that are in foreclosure declined to 2.13% of the total from 3.12% in Q2'12 and from 3.67% at the Q4'10 peak. The percentage of loans that are 90 days or more past due dropped to 1.37% of the total from 1.86% twelve months earlier. The percentage peaked at 3.70% in Q4'09.

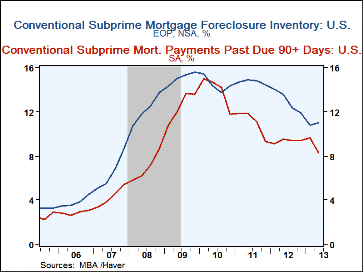

Foreclosure and delinquency rates on conventional subprime mortgages, as might be expected, are relatively high. They fell to 19.05% of total loans last quarter from 22.79% twelve months ago. The rate peaked at 30.56% in Q4'09. The percentage of subprime loans that are in foreclosure fell to 11.01% last quarter from 13.63% one year earlier and from 15.58% at the Q4'09 peak. The percentage that are 90 days or more past due fell to 8.04% of total loans versus 9.16% in Q2'12 and from 14.98% at the peak.

Data on residential mortgage delinquencies are contained in Haver's MBAMTG database.

| Delinquency Rates: Residential Mortgages (%, NSA) | Q2'13 | Q1'13 | Q4'12 | Q3'12 | Q2'12 | Q4'11 | Q4'10 |

|---|---|---|---|---|---|---|---|

| All Mortgages: 90 Days & Over Plus in Foreclosure | 5.88 | 6.39 | 6.78 | 7.03 | 7.31 | 7.73 | 8.60 |

| In Foreclosure | 3.33 | 3.55 | 3.74 | 4.07 | 4.27 | 4.38 | 4.64 |

| Past Due 90 Days or More | 2.55 | 2.84 | 3.04 | 2.96 | 3.04 | 3.35 | 3.96 |

| Conventional Prime: 90 Days & Over Plus in Foreclosure | 3.50 | 4.05 | 4.34 | 4.69 | 4.98 | 5.32 | 6.25 |

| In Foreclosure | 2.13 | 2.47 | 2.62 | 2.97 | 3.12 | 3.28 | 3.67 |

| Past Due 90 Days or More | 1.37 | 1.58 | 1.72 | 1.72 | 1.86 | 2.04 | 2.58 |

| Conventional Subprime: 90 Days & Over Plus in Foreclosure | 19.05 | 20.36 | 21.70 | 21.74 | 22.79 | 24.35 | 27.39 |

| In Foreclosure | 11.01 | 10.79 | 11.93 | 12.38 | 13.63 | 14.45 | 14.41 |

| Past Due 90 Days or More | 8.04 | 9.57 | 9.77 | 9.36 | 9.16 | 9.90 | 12.98 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates