Global| Jun 23 2021

Global| Jun 23 2021U.S. Mortgage Loan Applications Increase 2.1%

Summary

• Applications for both purchase and refinance increase. • Rates rise on fixed-rate mortgages, rates ease slightly on adjustable-rate loans. • Average loan size edges down for loans to purchase, increases up for refinance loans. The [...]

• Applications for both purchase and refinance increase.

• Rates rise on fixed-rate mortgages, rates ease slightly on adjustable-rate loans.

• Average loan size edges down for loans to purchase, increases up for refinance loans.

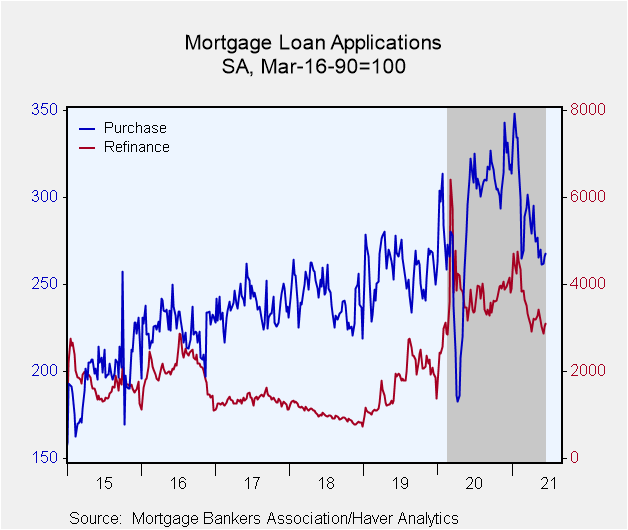

The Mortgage Bankers Association's Loan Applications Index increased 2.1% (-11.2% y/y) in the week ended June 18, following a 4.2% increase in the previous week. Applications to purchase a home rose 0.6% (-14.3% y/y) after increasing 1.6% the week before. Applications for refinancing rose 2.8% (-9.4% y/y) after the previous week's 5.5% rise.

The number of applications for refinancing edged up to 62.5% of total applications in the June 18 week from 61.7% the week before. That share is down from 73.1% during all of December. The adjustable-rate mortgage (ARM) share of activity rose back up to 3.9% after dipping to 3.8% the prior week.

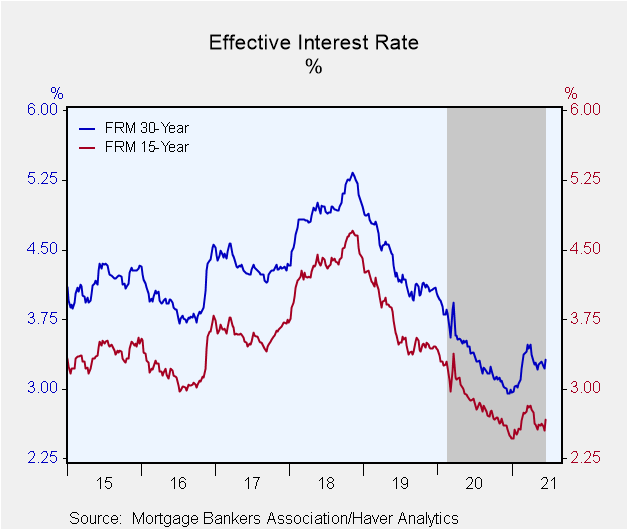

The effective interest rate on a 30-year mortgage rose to 3.32% in the latest week from 3.22% the week before. The all-time low in this survey was 2.95% in the weeks of December 11 and 18, 2020. The recent high was 3.48% the week of March 19. The effective 15-year rate was up 12 basis points in the June 18 week to 2.67%. The effective rate for a 30-year Jumbo mortgage was up five basis points in that week to 3.39%. The rate on a 5-year ARM fell five basis points to 2.78%.

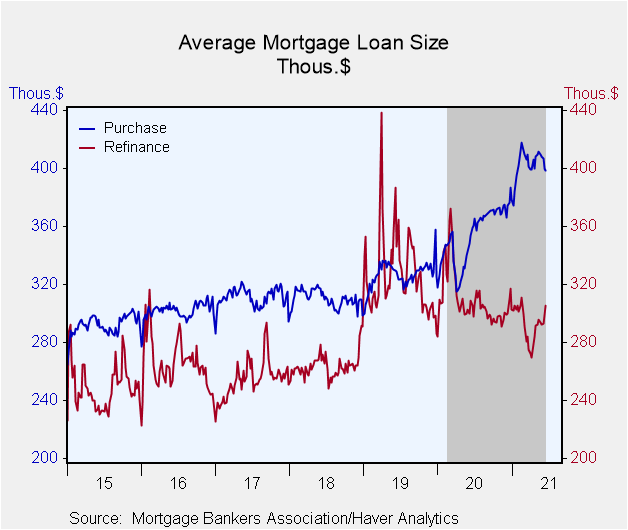

The average mortgage loan size rose 0.7% (+4.3% y/y) to $340,200 in the June 18 week. The average size of a loan to purchase a house fell 0.3% (+11.0% y/y) to $398,700. The average size of a refinanced loan rose 2.0% (-0.1% y/y) to $305,200.

Applications for fixed-rate loans rose 2.0% (-12.0% y/y), in the June 18 week, a second increase after sizable declines in each of the prior three weeks. Applications for adjustable-rate mortgages rose 5.3% (12.6% y/y) following a 1.1% gain.

This survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for all indexes is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 06/18/21 | 06/11/21 | 06/04/21 | Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total Market Index | 2.1 | 4.2 | -3.1 | -11.2 | 63.0 | 32.4 | -10.4 |

| Purchase | 0.6 | 1.6 | 0.3 | -14.3 | 11.4 | 6.6 | 2.1 |

| Refinancing | 2.8 | 5.5 | -5.1 | -9.4 | 111.0 | 71.1 | -24.3 |

| 30-Year Effective Mortgage Interest Rate (%) | 3.32 | 3.22 | 3.24 | 3.41

(Jun '20) |

3.40 | 4.34 | 4.94 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.