Global| Mar 13 2019

Global| Mar 13 2019U.S. Mortgage Loan Applications Rise

Summary

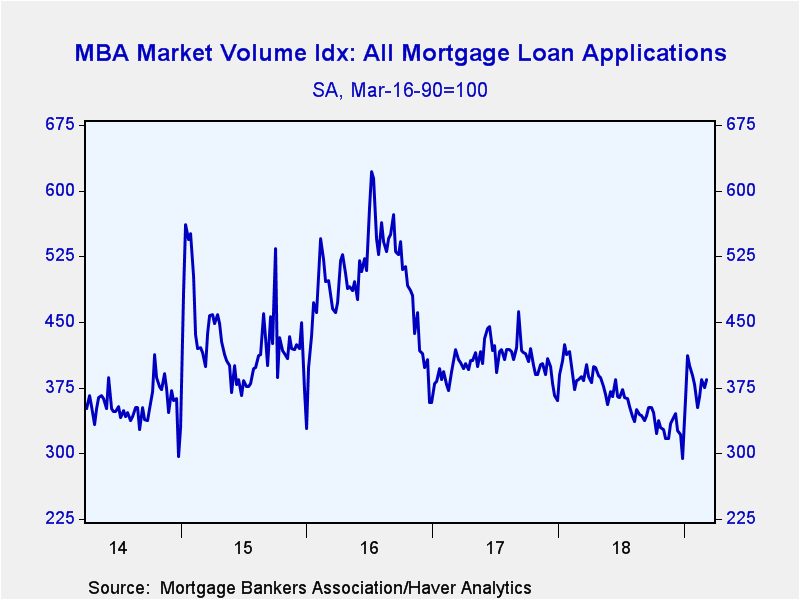

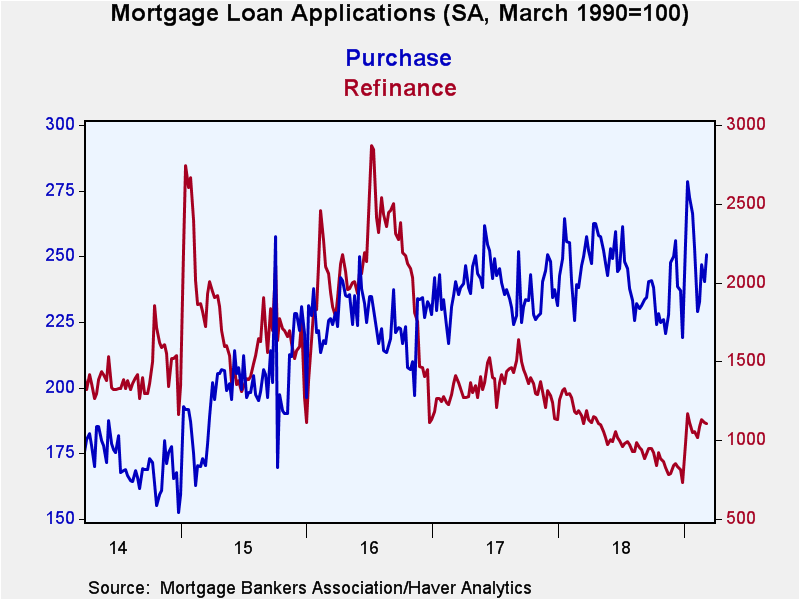

The Mortgage Bankers Association reported that its total Mortgage Applications Index rose 2.3% (-0.9% year-on-year) during the week ending March 8. After double-digit gains in early January and then four consecutive monthly declines, [...]

The Mortgage Bankers Association reported that its total Mortgage Applications Index rose 2.3% (-0.9% year-on-year) during the week ending March 8. After double-digit gains in early January and then four consecutive monthly declines, applications have stabilized. Applications to purchase a home increased 4.3% (1.7% y/y), while refinance activity edged down 0.2% (-4.4% y/y).

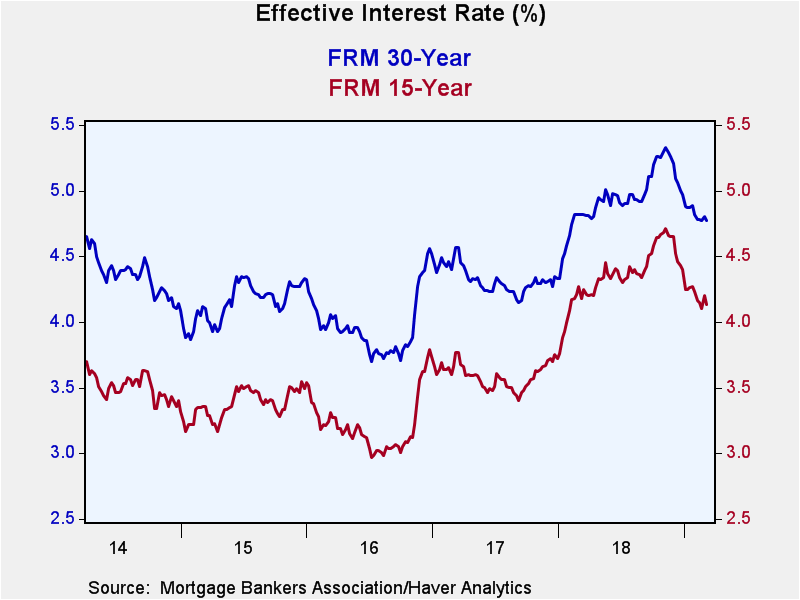

The effective interest rate on a 15-year fixed-rate mortgage decreased to 4.13%. Rates hit a seven-and-a-half year high of 4.71% in early in November and have been on a declining trend since. The effective rate on a 30-year fixed-rate loan edged lower to 4.77%. The rate on a Jumbo 30-year loan rose to 4.55%, while adjustable 5-year mortgage rates moved down to 4.19%.

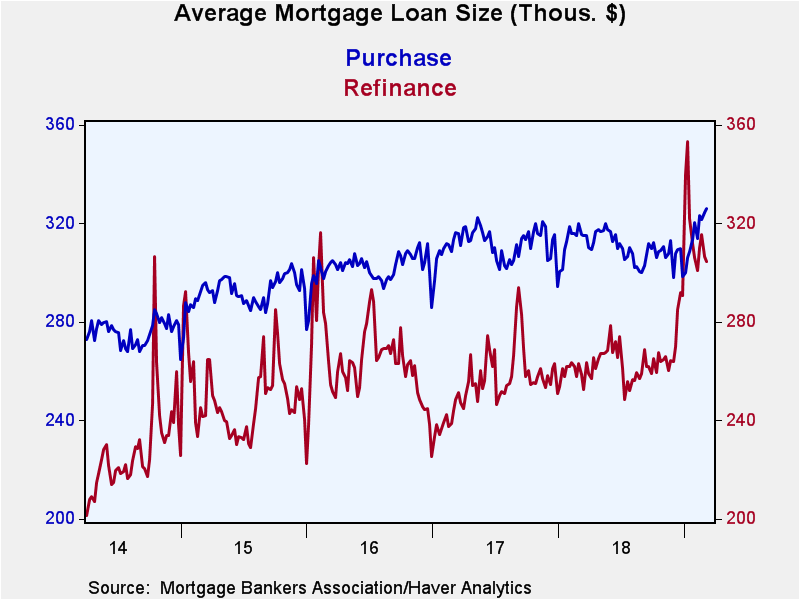

The average mortgage loan size ticked up to $317,600 (8.5% y/y). For purchases, the average loan size increased to $326,000 (3.4% y/y). The average refinance loan size declined to $304,400 (+17.7% y/y).

Applications for fixed-rate loans decreased 1.0% y/y, while applications for adjustable-rate loans increased 1.1% y/y.

The survey covers over 75% of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. The base period and value for all indexes is March 16, 1990=100. The figures for weekly mortgage applications and interest rates are available in Haver's SURVEYW database.

| MBA Mortgage Applications (%, SA) | 3/8/2019 | 3/1/2019 | 2/22/2019 | Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total Market Index | 2.3 | -2.5 | 5.3 | -0.9 | -10.4 | -17.8 | 15.6 |

| Purchase | 4.3 | -2.6 | 6.1 | 1.7 | 2.1 | 5.6 | 13.3 |

| Refinancing | -0.2 | -2.0 | 4.6 | -4.4 | -24.3 | -34.0 | 17.3 |

| 15-Year Mortgage Effective Interest Rate (%) | 4.13 | 4.20 | 4.10 | 4.22 (Mar '18) | 4.35 | 3.59 | 3.22 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates