Global| Jul 24 2013

Global| Jul 24 2013U.S. New Home Sales Advance Further in June

Summary

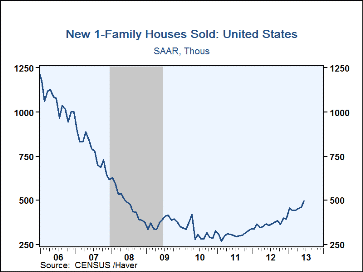

New home sales advanced 8.3% in June to 497,000, up 38.1% from a year ago and the largest volume since May 2008. Sales for May 2013 and the prior two months were revised a bit lower, however, with May now at 459,000 compared with [...]

New home sales advanced 8.3% in June to 497,000, up 38.1% from a year ago and the largest volume since May 2008. Sales for May 2013 and the prior two months were revised a bit lower, however, with May now at 459,000 compared with 476,000 reported initially. Consensus forecasts were looking for 481,000 in June. All these volume figures are quoted as seasonally adjusted annual rates.

Sales were again mixed m/m by region. The percentage gain was strongest in the Northeast, up 18.5% from May to 32,000 for June; in the West, sales were up 13.8% to 124,000 and in the South, 10.9% to 274,000. Those in the Midwest, which were reported a month ago with a 40.7% jump, gave back some of that in a downward revision from 83,000 to 76,000; then in June, they fell to 67,000. This is, though, still 36.7% above a year ago.

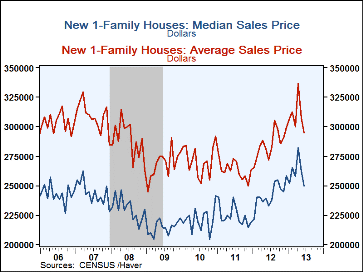

Home prices decreased again in June, by 5.0% for the median price to $249,700, following a 6.8% reduction in May. They do remain 7.4% ahead of June 2012. Average prices were $295,000 this June, down 4.0% from May and up 8.5% from a year ago.

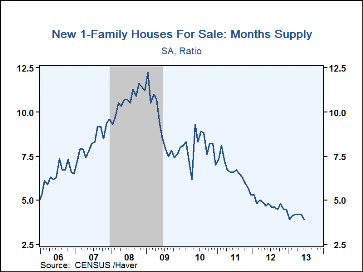

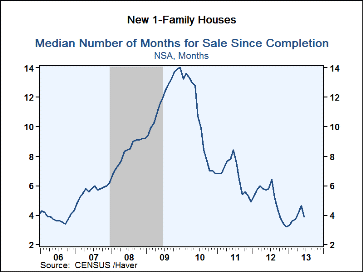

As we noted a month ago, supply conditions in the new home market are tight. The inventory of unsold homes inched upward the last couple of months, but the months' supply of new homes dipped to 3.9 in June, the lowest since October 2004. The length of time to sell a new home retreated in June to 3.9 months from 4.6 in May. These figures compare to 14.0 months at the end of 2009.

The data in this report are available in Haver's USECON database. The consensus expectation figure is from the Action Economics survey and is available in the AS1REPNA database

| U.S. New Home Sales | June | May | Apr | Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Total SAAR, 000s | 497 | 476 | 453 | 38.1 | 368 | 306 | 321 |

| Northeast | 32 | 27 | 28 | 100.0 | 29 | 21 | 31 |

| Midwest | 67 | 76 | 61 | 36.7 | 47 | 45 | 45 |

| South | 274 | 247 | 260 | 46.5 | 196 | 168 | 173 |

| West | 124 | 109 | 104 | 14.8 | 97 | 72 | 74 |

| Median Price (NSA, $) | 249,700 | 262,800 | 282,100 | 7.4 | 242,108 | 224,317 | 221,242 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.