Global| Aug 26 2009

Global| Aug 26 2009U.S. New Home Sales Improve Again; Case-Shiller Price Index Rises

Summary

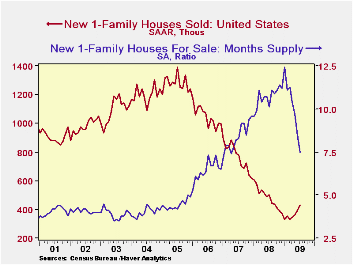

Sales of new single-family homes rose again in July, the fourth consecutive monthly gain. The seasonally adjusted annual rate was 433,000, up 9.6% from an upwardly revised 395,000 in June and the largest monthly amount since September [...]

Sales of new single-family homes rose again in July, the fourth consecutive monthly gain. The seasonally adjusted annual rate was 433,000, up 9.6% from an upwardly revised 395,000 in June and the largest monthly amount since September 2008. Sales were 13.4% below the year earlier amount; while still a sizable shrinkage, this compares very well with the worst of these year-to-year comparisons, 45.9% as recently as January. In fact, it is the most favorable yearly comparison ("least unfavorable", is perhaps better) since April 2006.

The latest sales increase is more encouraging than the previous month's because it was accompanied by almost steady prices. The median price was $210,100 compared to $210,400 in June. More, the June number was revised up from $206,200. Further price encouragement comes from yesterday's report of the S&P Case Shiller Index for June. That widely watched measure of existing home prices rose 0.7%, its first positive monthly move since May 2006.*

Sales volume advanced in three of the four regions. The Northeast led with a 16.2% gain, month-on-month. For July, its sales ran 9.8% AHEAD of July 2008, the first yearly rise since October 2007. Sales in the South increased 16.2% from upwardly revised amounts in June and May. And volume in the West increased 1.0% from mildly revised figures in the prior months. In contrast, some of the recent gain in the Midwest was revised away and sales there fell 7.6% in July. So the pattern is still quite uneven around the country. And the actual numbers remain very small Still, they're mostly headed in a good direction.

The market's aggregate condition continues to improve, as the overhang of unsold homes continues to fall. The decline in July was 3.2%; in conjunction with the sales gain, this put the months' supply of unsold homes at 7.5 months, down an entire month from June's figure and well off the 12.4 months registered in January.*Note there are two distinctions in these price series. The median price of new homes included in this dataset is simply that, the median price of the houses actually sold during the period, regardless of their characteristics. The Case-Shiller Index, firstly, pertains to existing homes, but secondly, it measures the price movements in the exact houses since the last time they were sold. So the weighted average price change that makes the index covers only price change with quality held constant. Both measures are valid, but they explain different kinds of price developments.

| US New Homes | July | June | May | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Total Sales (SAAR, 000s) | 433 | 395 | 362 | -13.4% | 479 | 768 | 1,049 |

| Northeast | 45 | 34 | 25 | +9.8 | 35 | 64 | 64 |

| Midwest | 61 | 66 | 48 | -4.7 | 69 | 118 | 161 |

| South | 222 | 191 | 202 | -18.4 | 264 | 408 | 559 |

| West | 105 | 104 | 87 | -14.6 | 111 | 178 | 266 |

| Median Price (NSA, $) | 210,100 | 210,400 | 221,400 | -11.5 | 230,408 | 243,742 | 243,067 |

| S&P Case-Shiller House Price Index (January 1980=100) | N.A. | 141.31 | 140.26 | -15.5 | 165.95 | 196.98 | 204.84 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates