Global| May 23 2012

Global| May 23 2012U.S. New Home Sales in Partial Rebound

Summary

New home sales recovered 3.3% in April to 343,000. This gain partially reversed March's 7.3% fall, revised from 7.1% reported originally, and put April up 9.9% from a year ago. The April volume exceeded the consensus expectations for [...]

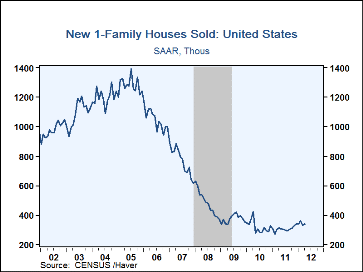

New home sales recovered 3.3% in April to 343,000. This gain partially reversed March's 7.3% fall, revised from 7.1% reported originally, and put April up 9.9% from a year ago. The April volume exceeded the consensus expectations for 335,000. Prior months' volumes were revised somewhat higher. These sales volume figures are quoted at seasonally adjusted annual rates.

The regional pattern of sales was mixed. There were huge gains in the Midwest, 28.2% to 50,000, and West, 27.5% to 88,000. These both reversed similar drops in March. In the Northeast, April sales increased 7.7% to 28,000, but in the South they fell 10.6% to 177,000.

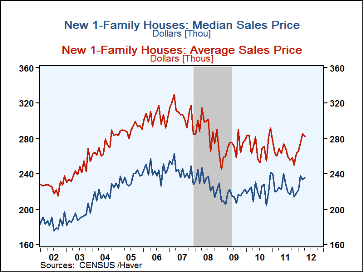

The median price of a new single family home rose 0.7% m/m to $235,700 from March's $234,000; March was revised downward slightly from $234,500 reported last month, but prior months were revised upward. April's median is 4.9% ahead of a year ago.& At the same time, the average price fell 1.1% in April, interrupting a four-month uptrend.

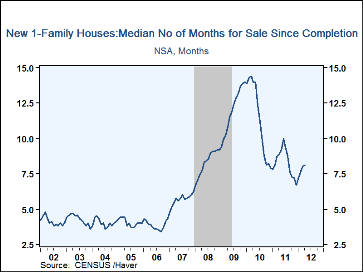

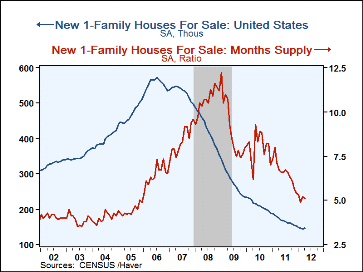

The length of time to sell a new home edged up to 8.1 months in April from 8.0 in March; this marked a fourth consecutive monthly increase from 6.7 months in December. Despite this slowing, the time from completion to sale remains less than in April of 2011, which saw a median 8.9 months, and April of 2010 at 14.0 months.& Recent construction has also been slow, of course, so that the inventory of unsold homes remains very low, at 146,000 units nationwide, just barely above the all-time low of 144,000 in March. This is a 5.1-month supply at the current sales rate.

The data in this report are available in Haver's USECON database. The consensus expectation figure is from the Action Economics survey and is available in the AS1REPNA database.

| U.S. New Home Sales | April | Mar | Feb | Y/Y % | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|

| Total (SAAR, 000s) | 343 | 332 | 358 | 9.9 | 307 | 321 | 374 |

| Northeast | 28 | 26 | 26 | 16.7 | 21 | 31 | 31 |

| Midwest | 50 | 39 | 48 | 22.0 | 45 | 45 | 54 |

| South | 177 | 198 | 193 | 4.7 | 169 | 173 | 202 |

| West | 88 | 69 | 91 | 12.8 | 72 | 74 | 87 |

| Median Price (NSA, $) | 235,700 | 234,000 | 237,700 | 4.9 | 224,317 | 221,242 | 214,500 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.