Global| Aug 23 2011

Global| Aug 23 2011U.S. New Home Sales Remain in the Doldrums

Summary

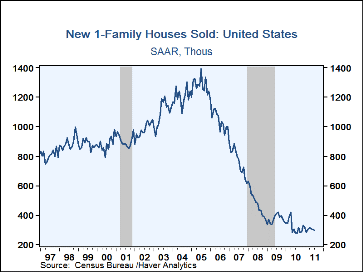

Total new home sales decreased 0.7% in July, a third successive reduction. June's sales were revised from 312,000 to 300,000, and May's from 315,000 to 309,000. The July volume was a bit weaker than forecast; the Action Economics [...]

Total new home sales decreased 0.7% in July, a third successive reduction. June's sales were revised from

312,000 to 300,000, and May's from 315,000 to 309,000. The July volume was a bit weaker than forecast;

the Action Economics consensus had anticipated a 1% rise. At the same time, the year-on-year comparison

improved to +6.8% after a decline in June of 2.3%.

Total new home sales decreased 0.7% in July, a third successive reduction. June's sales were revised from

312,000 to 300,000, and May's from 315,000 to 309,000. The July volume was a bit weaker than forecast;

the Action Economics consensus had anticipated a 1% rise. At the same time, the year-on-year comparison

improved to +6.8% after a decline in June of 2.3%.

The sales performance varied widely by region; the South saw a 7.4% drop to 163,000 and the West a 5.9% drop to 64,000. But sales in the Midwest edged up from 42,000 to 43,000 and those in the Northeast surged from 14,000 to 28,000. Home sales have fallen by three-quarters from the record 1,279,000 during all of 2005.

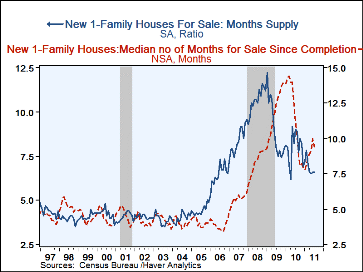

The inventory of unsold homes remained steady at June's 6.6 months' supply (revised from 6.3 months); the last four months have hovered tightly around 6.5-6.6, the lowest levels since late 2006, except for the downtick during the first-time home buyers' credit period in the spring of 2010. The actual number of new homes for sale eased to 165,000, as construction remains slow. Completed new homes were taking 9.4 months to sell on median, down from June's reading of 10.0 months.

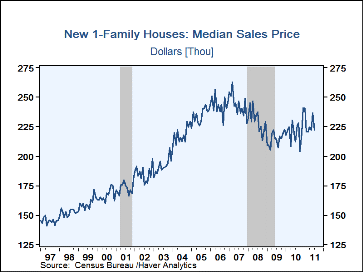

The median price of a new single family home dropped back 6.3% m/m to $222,000 compared to June's $235,800.

The data in this report are available in Haver's USECON database.

| U.S. New Home Sales | Jul | Jun | May | Y/Y % | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Total (SAAR, 000s) | 298 | 300 | 309 | 6.8 | 321 | 374 | 482 |

| Northeast | 28 | 14 | 19 | -3.4 | 31 | 31 | 35 |

| Midwest | 43 | 42 | 42 | 0 | 45 | 54 | 69 |

| South | 163 | 176 | 173 | 0 | 173 | 202 | 265 |

| West | 64 | 68 | 75 | 45.5 | 74 | 87 | 113 |

| Median Price (NSA, $) | 222,000 | 226,800 | 221,900 | 4.7 | 221,242 | 214,500 | 230,408 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.