Global| Aug 25 2020

Global| Aug 25 2020U.S. New Home Sales Soar in July

by:Sandy Batten

|in:Economy in Brief

Summary

• New single-family home sales increased 13.9% m/m in July, up 58% from their April low and well above expectations. • Sales fell in the Northeast but rose in the other three regions, notably in the Midwest. • Prices were mixed. Sales [...]

• New single-family home sales increased 13.9% m/m in July, up 58% from their April low and well above expectations.

• Sales fell in the Northeast but rose in the other three regions, notably in the Midwest.

• Prices were mixed.

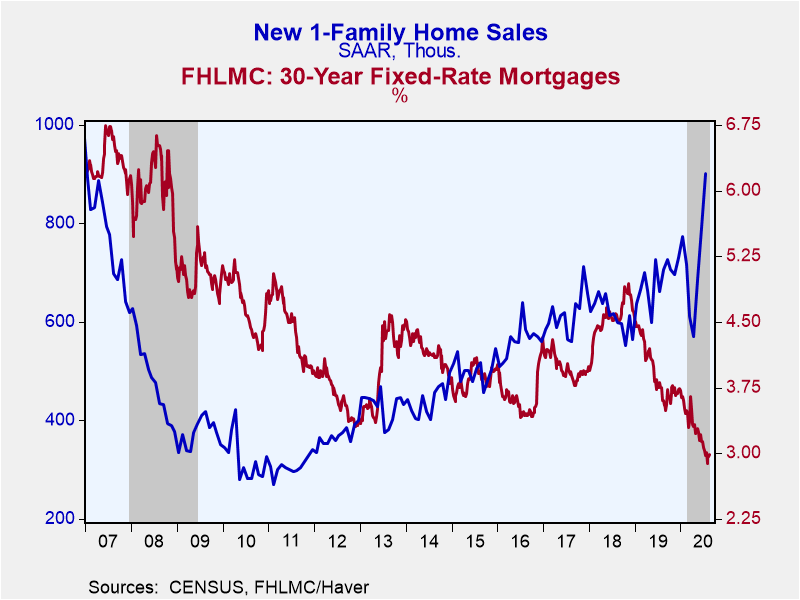

Sales of new single-family homes increased 13.9% m/m (36.3% y/y) to 901,000 in July, the highest pace of sales since December 2006. This followed an upwardly revised 15.1% m/m jump to 791.000 in June (initially 776,000). The Action Economics Forecast Survey expected sales of 788,000 in June. Sales have risen 58% from their April low.

The rise in home sales is occurring against a backdrop of declining interest rates on fixed-rate mortgages to more than 45-year lows. The rate on a 30-year fixed-rate mortgage fell to an average 3.02% in July from 3.16% in June and 3.47% in February before the lockdowns.

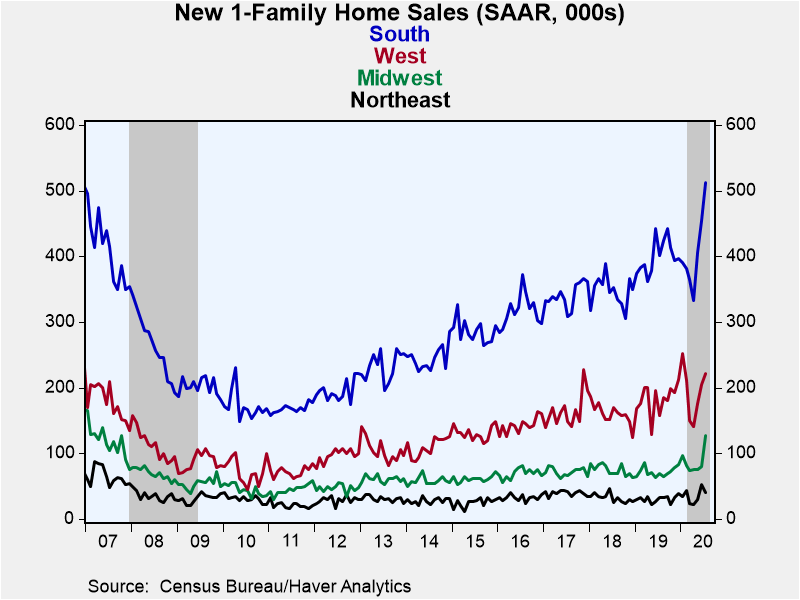

After having jumped 73.3% m/m in June, sales in the Northeast retreated in July, falling 23.1% m/m (+25.0% y/y) to 40,000 in July. Sales in the other three major regions increased in July, led by the Midwest where sales jumped up 58.8% m/m (81.4% y/y) to 127,000 following a modest 6.7% m/m rise in June. Sales in the South gained 13.0% m/m (27.6% y/y) to 513,000 in July while sales in the West strengthened 7.8% m/m (40.8% y/y) to 221,000 after double digit monthly increases in both May and June.

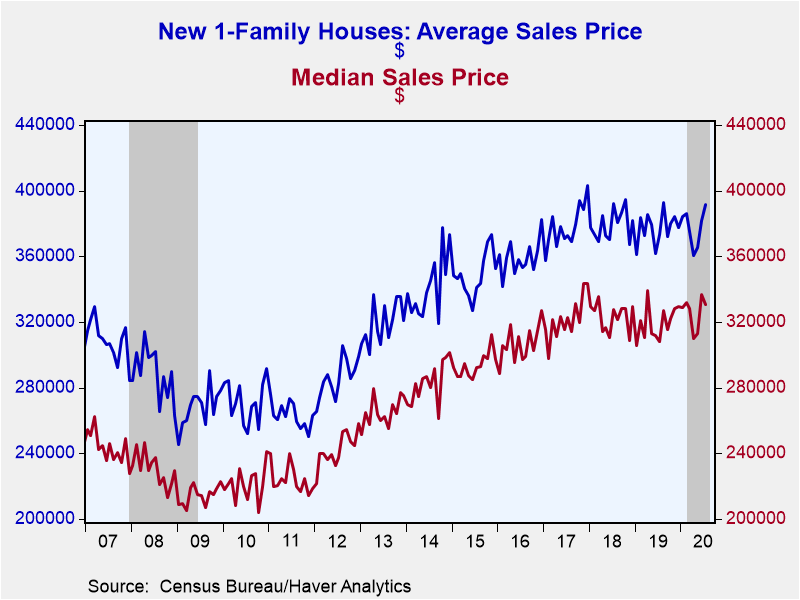

The median price of a new home slipped 1.9% m/m (+7.2% y/y) to $330,600 in July. In contrast, the average price of a new home rose 2.5% m/m (4.8% y/y) to $391,300 in July. Home prices, which are not seasonally adjusted, have been range-bound for the past few years.

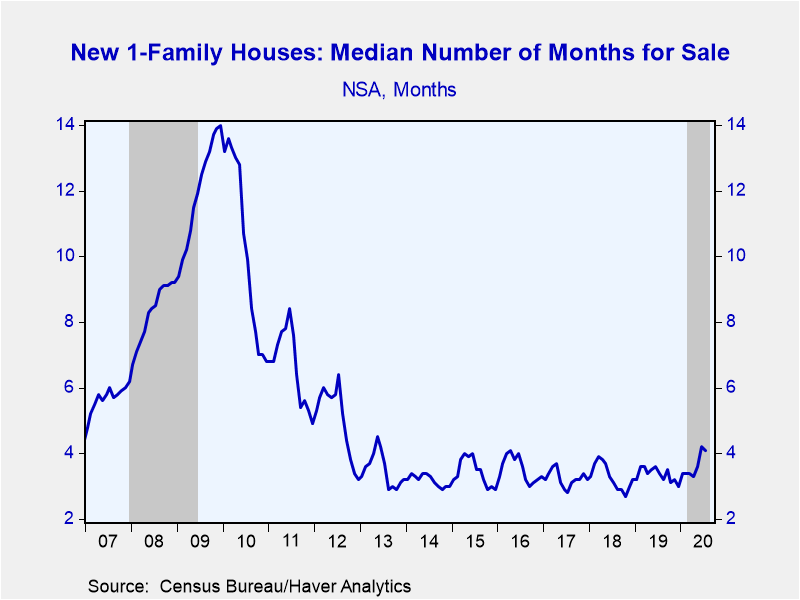

The months' supply of new homes on the market declined sharply again in July to 4.0 months from 4.6 in June, 5.4 in May and 6.8 in April (the most recent high). The median number of months a new home stayed on the market edged down to 4.1 months in July from an upwardly revised 4.2 months in June.

New home sales activity and prices are available in Haver's USECON database, while MBA loan applications can be found in SURVEYW. The consensus expectation figure from Action Economics is available in the AS1REPNA database.

| U.S. New Single-Family Home Sales (SAAR, 000s) | Jul | Jun | May | Jul Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total | 901 | 791 | 687 | 36.3 | 685 | 614 | 616 |

| Northeast | 40 | 52 | 30 | 25.0 | 30 | 32 | 40 |

| Midwest | 127 | 80 | 75 | 81.4 | 72 | 75 | 72 |

| South | 513 | 454 | 406 | 27.6 | 400 | 347 | 341 |

| West | 221 | 205 | 176 | 40.8 | 183 | 160 | 164 |

| Median Price (NSA, $) | 330,600 | 337,000 | 312,900 | 7.2 | 319,267 | 323,125 | 321,633 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates