Global| Apr 13 2021

Global| Apr 13 2021U.S. NFIB Small Business Optimism Index Rises in March

Summary

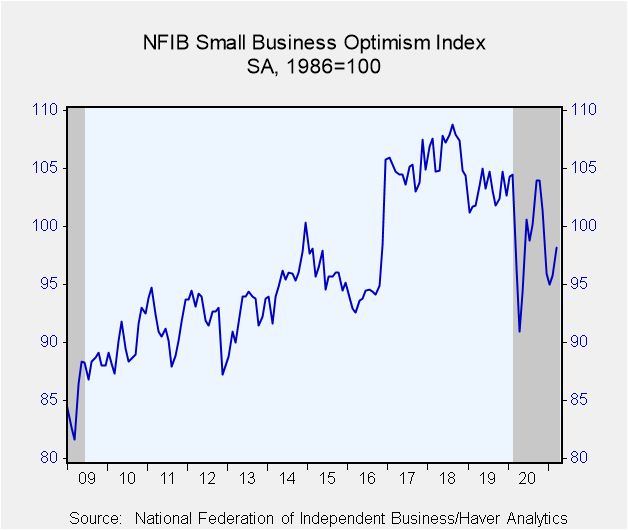

• The NFIB Small Business Optimism Index rose 2.4 points in March to 98.2. • The March reading returns to the historic average since last November. The National Federation of Independent Business (NFIB) reported that its Small [...]

• The NFIB Small Business Optimism Index rose 2.4 points in March to 98.2.

• The March reading returns to the historic average since last November.

The National Federation of Independent Business (NFIB) reported that its Small Business Optimism Index improved to 98.2 in March, up from 95.8 during February. The NFIB release stated that "March's reading is the first return to the average historical reading since last November".

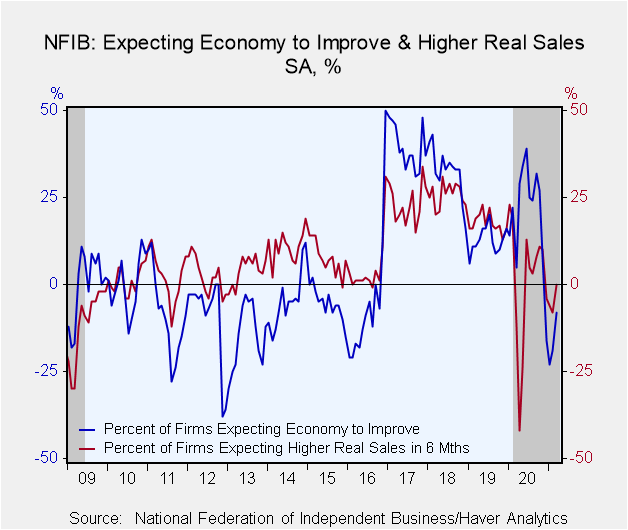

An improved net -8% of respondents felt that the economy would improve, better than February's -19%. A net even percent of firms expected higher real sales in March, an improvement from the -8% in February. Earnings trends over the past three months declined four points to a net negative 15%.

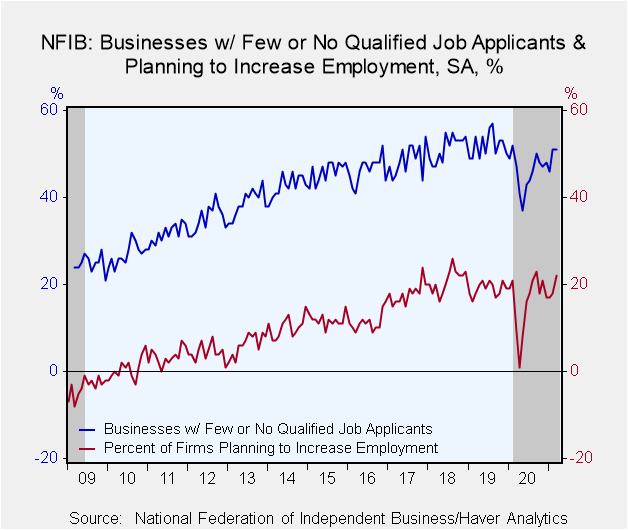

A net 11% of firms thought that now was a good time to expand, close to the 13% twelve months ago. A net 22% of firms planned to increase employment, inching close the recent high of 23% last September. But 20% of owners reported capital outlays in the next three to six months, down three points from February.

Fifty-one percent of firms found few or no qualified candidates to fill job openings last month, unchanged from February and up from a low of 37% last May.

Credit was hard to get by a negligible one percent of respondents, the same reading since January.

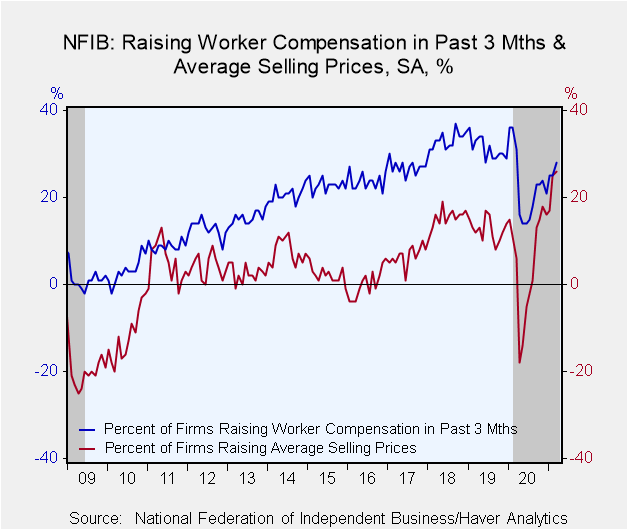

Pricing power strengthened slightly, with a net 26% of firms raising prices in March from a net 25% in February. That remained up from the price deflation reported early last year. A net 28% of firms raised worker compensation in March, up from 25% in February.

Important issues for small businesses were lessened quality of labor (24%), finding eligible workers to fill open positions, and rising labor costs (7%).

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Mar | Feb | Jan | Mar '20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 98.2 | 95.8 | 95.0 | 96.4 | 99.6 | 103.0 | 106.7 |

| Firms Expecting Economy to Improve | -8 | -19 | -23 | 5 | 20 | 13 | 32 |

| Firms Expecting Higher Real Sales | 0 | -8 | -6 | -12 | 1 | 18 | 26 |

| Firms Reporting Now Is a Good Time to Expand the Business | 11 | 6 | 8 | 13 | 13 | 25 | 30 |

| Firms Planning to Increase Employment | 22 | 18 | 17 | 9 | 16 | 19 | 21 |

| Firms With Few or No Qualified Applicants for Job Openings (%) | 51 | 51 | 46 | 47 | 46 | 52 | 51 |

| Earnings Trends | -15 | -11 | -16 | -6 | -16 | -5 | -2 |

| Firms Reporting that Credit Was Harder to Get | 1 | 1 | 1 | 3 | 3 | 4 | 4 |

| Firms Raising Average Selling Prices | 26 | 25 | 17 | 6 | 5 | 13 | 15 |

| Firms Raising Worker Compensation | 28 | 25 | 25 | 31 | 23 | 31 | 33 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates