Global| Dec 21 2007

Global| Dec 21 2007U.S. Personal Consumption & Prices Firm, Income Light

by:Tom Moeller

|in:Economy in Brief

Summary

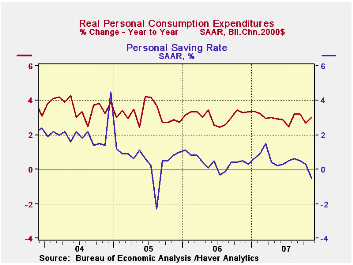

Personal consumption expenditures surged 1.1% last month after an upwardly revised 0.4% rise. The November increase beat Consensus expectations for a 0.7% rise. Adjusted for inflation spending rose 0.5% after the upwardly revised 0.1% [...]

Personal consumption expenditures surged 1.1% last month after an upwardly revised 0.4% rise. The November increase beat Consensus expectations for a 0.7% rise. Adjusted for inflation spending rose 0.5% after the upwardly revised 0.1% uptick. Three month growth in real spending rose to 3.4% (AR).

Spending on discretionary items was firm led by a 1.8% (9.6% y/y) jump in real spending on household furniture & appliances. Spending on apparel also rose a firm 0.9% (5.6% y/y) but spending on motor vehicles fell 0.8% (+2.4% y/y). Spending on electricity surged 5.9% (6.9% y/y) but real spending on gasoline fell 0.3% (-0.6% y/y). Medical care spending rose 0.2% and spending on recreation fell 0.1%). Spending on food rose 0.7% (2.2% y/y). Real spending excluding food & energy rose 0.4% (3.2% y/y). These detailed spending figures are available in Haver's USNA database.

The PCE chain price index surged 0.6%%,

lifted by higher energy prices. The core PCE price index gained a

steady 0.2% but y/y growth in core prices picked up further

to 2.2%. Three month growth in core prices rose to 2.9% (AR) due to

faster growth in services prices where the three month growth of 4.0%

was the fastest since late 2005.

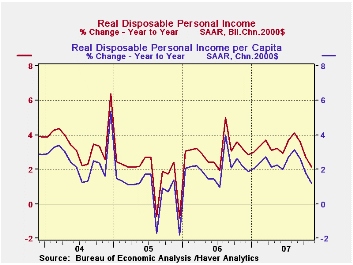

Personal income during November rose 0.4% and the gain fell just short of expectations for a 0.5% rise. The October increase was unrevised at 0.2%. Three month growth in income was 4.2% (AR), its worst since June.

Lower interest rates caused a shortfall in interest income of 0.4% (+6.2% y/y) which was the same decline as in October. Conversely, growth in dividend income held steady at 0.9% (12.6% y/y), the same as during the prior two months.

Growth in wages & salaries picked back up to 0.6% (5.2% y/y) after an unchanged reading for October. Three month growth amounted to 5.3%. Factory sector wages rose 0.4% (2.2% y/y) after declining during the prior two months.Wage & salary income in the private service-producing industries rose 0.7% (6.1% y/y) after no change in October. Wages in the government sector again increased 0.4% (4.6% y/y).

Personal current taxes rose a firm 0.7% (8.1% y/y) and that left disposable personal income to rise 0.3% (5.8% y/y). Adjusted for inflation disposable personal income fell 0.3% (+2.1% y/y) for the second month of decline. That left the three month growth in real DPI negative at -0.9%, its worst since June.

| Disposition of Personal Income | November | October | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Personal Income | 0.4% | 0.3% | 6.1% | 6.6% | 5.9% | 6.2% |

| Personal Consumption | 1.1% | 0.4% | 6.7% | 5.9% | 6.2% | 6.4% |

| Saving Rate | -0.5% | 0.3% | 0.5% (Nov. 06) | 0.4% | 0.5% | 2.1% |

| PCE Chain Price Index | 0.6% | 0.3% | 3.6% | 2.8% | 2.9% | 2.6% |

| Less food & energy | 0.2% | 0.2% | 2.2% | 2.2% | 2.2% | 2.1% |

by Tom Moeller December 21, 2007

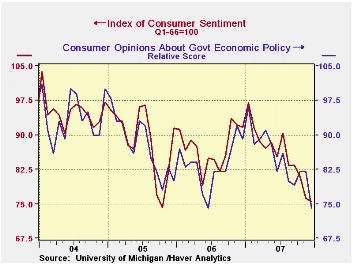

The University of Michigan's consumer sentiment index for all of this month fall 0.9% to 75.5.That was somewhat better than the reading at mid-month and it beat expectations for a December reading of 74.9. Nevertheless it left sentiment down 17.7% y/y.

Somewhat improved expectations caused the better December result. Expected business conditions during the next year fell only 6.8% (-35.2% y/y), an improvement from the -11.0% preliminary reading. Expectations for business conditions during the next five years also improved 6.6% (-16.5% y/y) from the November level and versus the initial read of a m/m decline. Down still is the result versus 3Q. Expectations for personal finances fell further by 2.6% (-9.7% y/y).

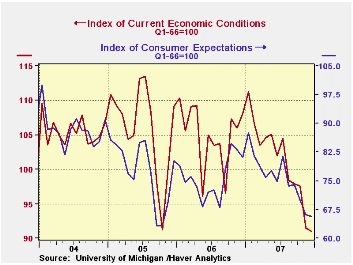

The current conditions index in fact was revised lower from

the mid-month reading and fell 0.5% after a hefty 6.3% November

decline. Current buying conditions for large household goods improved

modestly m/m but remained down 13.0% from last December. The view of

current personal finances, however, slid 3.0% for the second sharp

monthly decline (-17.6% y/y).

The rise in gasoline prices raised expectations for inflation during the next twelve months to 4.4% (slightly lower than the mid-month read) from 4.3% in November and from 3.5% one year ago. For the next five to ten years expectations were for a 3.6% rise in prices.

Opinions about government policy dropped 9.8% m/m which brought this opinion measure down 16.9% from one year ago.

The University of Michigan survey is not seasonally adjusted.The reading is based on telephone interviews with about 500 households at month-end; the mid-month results are based on about 300 interviews. The summary indexes are in Haver's USECON database, with details in the proprietary UMSCA database.

Consumer sentiment, the economy, and the news media is a 2004 paper from the Federal Reserve Bank of San Francisco and it can be found here.

| University of Michigan | Dec (Final) | Dec (Prelim) | Nov | Dec y/y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 75.5 | 74.5 | 76.1 | -17.7% | 87.3 | 88.5 | 95.2 |

| Current Conditions | 91.0 | 92.1 | 91.5 | -15.8% | 105.1 | 105.9 | 105.6 |

| Expectations | 65.6 | 63.2 | 66.2 | -19.2% | 75.9 | 77.4 | 88.5 |

by Robert Brusca December 21, 2007

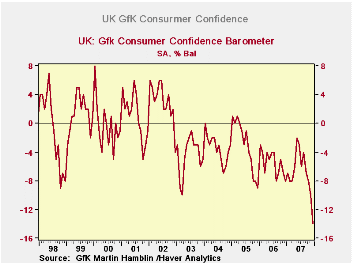

The GFK consumer sentiment report for the UK continues to

plunge and it is one of the clearest signs of trouble in the UK

economy. The CBI survey on retailing earlier had signaled some weakness

and expectations of a softer January to boot. But actual sales data

(released today) showed a gain in November although food accounted for

all the volume increase. While the Bank of England struggles with

policy, consumers seem to have made up their minds about where the

balance of risk lies.

At a reading of -14 the GFK index is at its weakest point in

over 10 Years. Still, households rate their financial situation as the

best in 10 years currently. In this environment their plans for making

major purchases are the lowest they have been in 10 Years. Consumers

rate the general economic situation in the past 12-months as the worst

in the past two years and in the bottom four percent over ten years.

They assess inflation as the worst in 10 years.

While BOE is concerned about inflation too, a recent wage

survey finds that wages deals have been contained in their recent range

and in fact are not accelerating. Of course while that may be good news

to the BOE, it is another factor pressuring consumers as energy prices

rise.

The outlook for the next 12-months score very weak readings

for the household financial situation and the general economic

situation both in the bottom 15 percentile of their respective ranges

for two years and about the bottom quarter of the range over 10-years.

The major purchases index is at the 50% mark for the next 12 months

compared to the past two years’ range, but that is a bottom 25% reading

over the past 10 years. Obviously the consumer sector has been weak and

is weakening again. Stratified by income, both high and low income

respondents see conditions as among their poorest in 10 years.

| GFK Consumer Survey | ||||||

|---|---|---|---|---|---|---|

| % of 2Yr | % of 10Yr | |||||

| Dec-07 | Nov-07 | Oct-07 | Sep-07 | Range | Range | |

| Consumer Confidence | -14 | -10 | -8 | -7 | 0.0% | 0.0% |

| Current | ||||||

| Household Financial Situation | 25 | 25 | 25 | 25 | 100.0% | 100.0% |

| Major Purchases | -14 | -7 | -5 | -3 | 0.0% | 0.0% |

| Last 12 Months | ||||||

| Household Financial Situation | -1 | 0 | 2 | 4 | 37.5% | 40.0% |

| General Economic Situation | -36 | -32 | -30 | -29 | 0.0% | 4.2% |

| CPI | 74 | 73 | 69 | 64 | 100.0% | 100.0% |

| Savings | 33 | 35 | 38 | 38 | 52.6% | 84.5% |

| Next 12-Months | ||||||

| Household Financial Situation | 8 | 9 | 13 | 12 | 14.3% | 14.3% |

| General Economic Situation | -26 | -21 | -17 | -19 | 0.0% | 26.7% |

| Unemployment | 30 | 31 | 29 | 27 | 35.7% | 62.5% |

| Major Purchases | -19 | -20 | -18 | -20 | 50.0% | 25.0% |

| Savings | 19 | 20 | 19 | 17 | 63.6% | 85.2% |

| By Income | ||||||

| Lower | -19 | -16 | -14 | -13 | 0.0% | 0.0% |

| Upper | -7 | -6 | -3 | -1 | 0.0% | 0.0% |

by Robert Brusca December 21, 2007

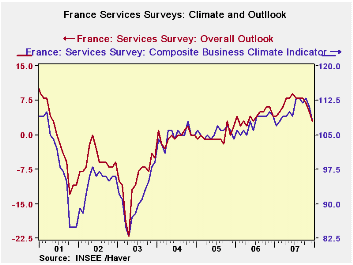

The service sector is beginning to ease in France. The index

is down form its peak if 113 in October. As a percent of its range the

December reading is still in the top 17% of its range. The outlook

reading at +3 stands in the 80.6 percentile of its range and is still

in the top 20% of that range. Expected sales for the 3-months ahead are

in the 67th percentile of their range, the top third, roughly.

Employment expectations are still firm in their range. Over the past

three months observed employment is nearly in the top quarter of its

range whereas expected employment in the three months ahead slips to

the top third at a reading of 10 which is in the 68th percentile of its

range.

These readings generally show that the outlook is a bit weaker

than the current or recent past readings have been. And while the

slowdown and drop off is clear on the chart it is also true that the

survey levels are still firm; what we must wait and see is how far this

expected softening may go.

Insee released today a separate survey on industry in which

morale fared much better than for services. It is surprising with the

concerns over the strong euro that it is the service sector where

morale is fading faster. This could have something to do with the

financial turmoil that has been in train, of course. But industry is

holding up much better despite its competitiveness pressures. Even in

that survey, however, there are more concerns among executives about

the outlook for production in their own business sector. French

consumer spending on MFG goods in also November worked its way lower

showing an unexpected drop. This spending results may have been

affected by recent transits strikes.

There is evidence of strain in the French economy. All of

these reports will bear watching as we turn the calendar sheet to a new

month and new a new year. We will come upon this new year with the

economy a bit more challenged than usual in France, across the Euro

Area, in the US and elsewhere.

| France INSEE Services Survey Jan 2000-date | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dec-07 | Nov-07 | Oct-07 | Sep-07 | %tile | Rank | Max | Min | Range | Mean | |

| Climate Indicator | 108 | 111 | 113 | 112 | 83.3 | 18 | 113 | 83 | 30 | 102 |

| Climate: 3-Mo Moving avg | 111 | 112 | 113 | 113 | 92.8 | 5 | 113 | 85 | 28 | 102 |

| Climate: 12-Mo Moving avg | 110 | 110 | 110 | 110 | 99.6 | 2 | 110 | 91 | 20 | 101 |

| Outlook | 3 | 5 | 7 | 8 | 80.6 | 23 | 9 | -22 | 31 | -1 |

| Sales | ||||||||||

| Observed 3-mos | 14 | 17 | 18 | 18 | 83.3 | 7 | 19 | -11 | 30 | 6 |

| Expected 3-mos | 9 | 13 | 14 | 14 | 67.9 | 38 | 18 | -10 | 28 | 7 |

| Sales Price | ||||||||||

| Observed over 3-Mos | 0 | -2 | 1 | 2 | 33.3 | 33 | 8 | -4 | 12 | 0 |

| Expected over 3-Mos | -2 | 2 | -1 | 1 | 30.0 | 69 | 5 | -5 | 10 | 1 |

| Employment | ||||||||||

| Observed over 3-Mos | 14 | 8 | 3 | 8 | 73.5 | 5 | 23 | -11 | 34 | 5 |

| Expected over 3-Mos | 10 | 11 | 17 | 9 | 68.2 | 13 | 17 | -5 | 22 | 5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates