Global| Dec 06 2013

Global| Dec 06 2013U.S. Personal Income Edges Down in October

Summary

Personal income fell in October by 0.1% (+3.4% y/y) after a gain of 0.5% in September. An October rise of 0.3% had been forecast in the Action Economics consensus survey. The drop occurred in farm income, down 15.2% in the month and [...]

Personal income fell in October by 0.1% (+3.4% y/y) after a gain of 0.5% in September. An October

rise of 0.3% had been forecast in the Action Economics consensus survey.

The drop occurred in farm income, down 15.2% in the month and reversing

September's similar increase which had come from a lawsuit settlement

payout. Dividend income was also down, 0.7%, but was up 8.0% from a

year ago. The main wage and salary element edged up 0.1% in October (+3.2%

y/y), with private industry wages up 0.1% and government salaries flat.

Nonfarm proprietors' income was up 0.2% (6.1% y/y) and rental income 0.4% (10.0%

y/y). Interest income edged up 0.1% (+3.0%), following three months of

0.1% decreases. Transfer payments were flat with September (+4.3% y/y). A

rise in personal taxes cut into disposable income, which was down 0.2% (2.6% y/y) and,

when adjusted for inflation, also fell 0.2% (1.8% y/y).

Personal income fell in October by 0.1% (+3.4% y/y) after a gain of 0.5% in September. An October

rise of 0.3% had been forecast in the Action Economics consensus survey.

The drop occurred in farm income, down 15.2% in the month and reversing

September's similar increase which had come from a lawsuit settlement

payout. Dividend income was also down, 0.7%, but was up 8.0% from a

year ago. The main wage and salary element edged up 0.1% in October (+3.2%

y/y), with private industry wages up 0.1% and government salaries flat.

Nonfarm proprietors' income was up 0.2% (6.1% y/y) and rental income 0.4% (10.0%

y/y). Interest income edged up 0.1% (+3.0%), following three months of

0.1% decreases. Transfer payments were flat with September (+4.3% y/y). A

rise in personal taxes cut into disposable income, which was down 0.2% (2.6% y/y) and,

when adjusted for inflation, also fell 0.2% (1.8% y/y).

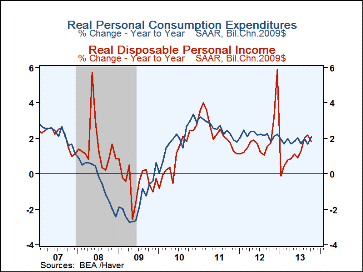

Personal consumption expenditures rose 0.3% (2.7% y/y) in October, slightly better than September's 0.2%. Motor vehicle purchases recovered by 0.4% (+4.4% y/y) after September's 4.0% drop. Spending on clothing also recovered, rising 1.2% (+2.8% y/y), after falling moderately in both September and August. Spending on furnishings and household equipment was up 0.4% (+5.2% y/y), reversing a revised 0.2% downtick in September. Services outlays were up 0.2% (+2.9% y/y). Real PCE also gained 0.3% in the month, making 2.1% year-on-year.

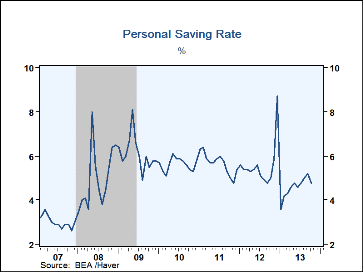

The personal savings rate fell to 4.8% in October from an upwardly revised 5.2% in September. The total amount of personal saving was off 1.6% from a year ago.

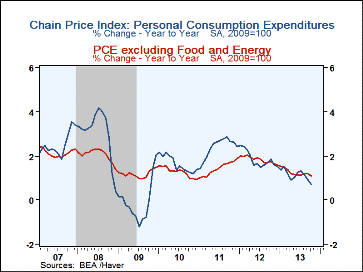

The PCE chain price index was flat in October and up just 0.7% year-on-year. Durable goods prices were down 0.2% (-1.8% y/y) and nondurable goods prices were down 0.4% (-1.2% y/y). Services prices edged up 0.1% (1.8% y/y). Less food & energy, the chain price index rose 0.1% (1.1% y/y) for a fourth straight month.

The personal income & consumption figures are available in Haver's USECON and USNA databases. The consensus expectation figure is in the AS1REPNA database.

| Personal Income & Outlays (%) | Oct | Sep | Aug | Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Personal Income | -0.1 | 0.5 | 0.5 | 3.4 | 4.2 | 6.1 | 2.9 |

| Wages & Salaries | 0.1 | 0.4 | 0.6 | 3.2 | 4.3 | 4.1 | 2.0 |

| Disposable Personal Income | -0.2 | 0.5 | 0.6 | 2.6 | 3.9 | 4.8 | 2.8 |

| Personal Consumption Expenditures | 0.3 | 0.2 | 0.3 | 2.7 | 4.1 | 5.0 | 3.8 |

| Personal Saving Rate | 4.8 | 5.2 | 5.0 | 5.0 (Oct'12) |

5.6 | 5.7 | 5.6 |

| PCE Chain Price Index | -0.0 | 0.1 | 0.1 | 0.7 | 1.8 | 2.4 | 1.7 |

| Less Food & Energy | 0.1 | 0.1 | 0.1 | 1.1 | 1.7 | 1.4 | 1.3 |

| Real Disposable Income | -0.2 | 0.4 | 0.5 | 2.0 | 1.7 | 2.4 | 1.1 |

| Real Personal Consumption Expenditures | 0.3 | 0.1 | 0.2 | 2.1 | 2.2 | 2.5 | 2.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.