Global| Aug 31 2007

Global| Aug 31 2007U.S. Personal Income Gains 0.5% in July; Spending Recovers from June Weakness

Summary

Personal income rose 0.5% in July, slightly firmer than June's 0.4%. Consensus forecasts had pointed to a 0.3% July rise. This monthly increase put the 12-month change at 6.6%. The PCE chain price index rose just 0.1% during July, [...]

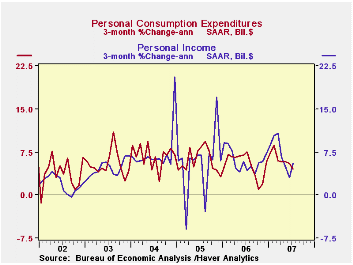

Personal income rose 0.5% in July, slightly firmer than June's 0.4%. Consensus forecasts had pointed to a 0.3% July rise. This monthly increase put the 12-month change at 6.6%.

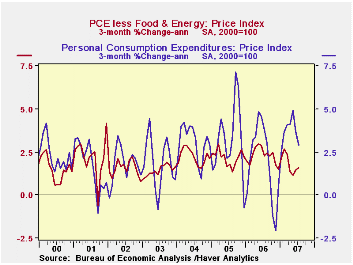

The PCE chain price index rose just 0.1% during July, following June's 0.2%, which was a shade more than originally reported. The core PCE price measure also rose 0.1% and it too was revised to 0.2% from 0.1% in June. The total price index is up a mere 2.1% on the year, and the core rate 1.9%. annualized, the gain in core prices came in at 1.6% over the last three months. The increase in the total PCE price index was 2.9% during the same three months (AR), down from the 3.7% three-month-gain in June and 4.9% through May.

Wages & salaries increased 0.5% (7.2% y/y) in July and factory sector wages rose just 0.2% (6.6% y/y) after a 0.5% June rise.Wage & salary income in service-producing industries rose 0.6% (8.1% y/y) after a 0.5% increase in June while pay in the government sector rose 0.2% (4.5% y/y).

Interest income grew 0.7%, picking up to 2.7% y/y, while dividend income rose 1.0% (14.8% y/y), about the same as during the prior six months.

Personal current taxes increased 0.3% (11.0% y/y). That left disposable personal income to grow 0.6% (6.0% y/y) after a 0.4% June gain. Real disposable personal income thus rose 0.5% last month, extending an improvement from a 0.1% decline during May and a 0.2% rise in June.

Personal consumption expenditures increased just 0.4% in July following a 0.2% gain during June. Expectations were for 0.3% rise. Durable goods purchases recovered somewhat, with a 0.3% increase after June's 1.6% fall. Motor vehicle outlays rose 0.5%, after their 3.7% drop in June, although they were 3.0% below July 2006. Spending on furniture & other household equipment was up 0.5%, and June's decline, originally 1.0%, was revised to 0.3%. Spending on gasoline continued to decline, in July by 0.6%. The year/year change is now -3.9%, reflecting this July decline and the surge in the corresponding month last year. Spending on apparel turned up by 1.0% after June's 0.8% fall; year/year growth thus improved to 4.2% from June's 3.7%. Outlays in the big services sector expanded 0.4% following June's 0.6% advance and were 5.8% above a year ago.

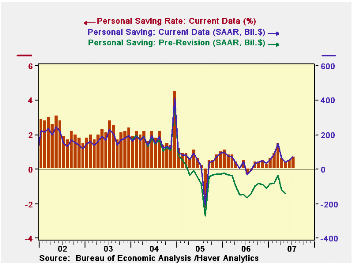

The personal saving rate was 0.7% in July. This is not "high", but signifies a better performance than we had been aware of. After the July revisions put the saving rate back up into positive territory, now it seems to show negative only under special circumstances, just as Hurricane Katrina and last summer's striking surge in gasoline prices. Most of the time, people seem to be able to fit their spending to their income.

| Disposition of Personal Income | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Personal Income | 0.5% | 0.4% | 6.6% | 6.6% | 5.9% | 6.2% |

| Personal Consumption | 0.4% | 0.2% | 4.7% | 5.9% | 6.2% | 6.4% |

| Saving Rate | 0.7% | 0.5% | -0.3% (July 06) | 0.4% | 0.5% | 2.1% |

| PCE Chain Price Index | 0.1% | 0.2% | 2.1% | 2.8% | 2.9% | 2.6% |

| Less food & energy | 0.1% | 0.1% | 1.9% | 2.2% | 2.2% | 2.1% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.