Global| Dec 23 2014

Global| Dec 23 2014U.S. Personal Income Has Moderate Gain, Spending Is Up 0.6% in November

Summary

Personal income rose 0.4% in November (4.2% y/y) after October's 0.3%, revised modestly from 0.2%. The November increase was slightly below expectations in the Action Economics Forecast Survey for a 0.5% gain. Wages & salaries were up [...]

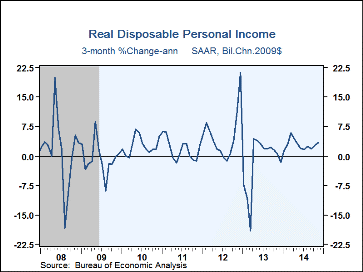

Personal income rose 0.4% in November (4.2% y/y) after October's 0.3%, revised modestly from 0.2%. The November increase was slightly below expectations in the Action Economics Forecast Survey for a 0.5% gain. Wages & salaries were up 0.5% (4.5% y/y) as was proprietors income (4.9% y/y). Rental income edged up just 0.1% (6.3% y/y) while personal transfer receipts were flat (5.0% y/y). Earnings from dividends continued strong, with a 0.9% gain (6.9% y/y) even as interest income had another 0.2% fall and was down 0.4% y/y. Disposable income increased 0.3% (4.1% y/y) and in real terms it was firmer with a 0.5% increase (2.9% y/y).

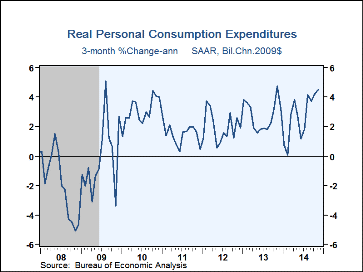

Personal consumption expenditures grew 0.6% in November (4.0% y/y) after 0.2% in October. The Action Economics survey had projected 0.5%. Motor vehicle purchases gained 3.2% (+7.7% y/y) following a 0.5% rise. Spending on furnishings & durable household equipment improved 0.7% (3.5% y/y) after a 0.2% increase. Apparel outlays were up 1.1% (3.3% y/y) after a 0.3% rise while spending on gasoline continued down with falling prices, this time by 2.3% (-7.2% y/y) following a 2.8% drop. Services spending was up 0.6% (4.3% y/y), again with restaurants and accommodations up noticeably, 0.7% (6.8% y/y), after October's upwardly revised 1.2%. In chained dollars, overall spending increased 0.7% (2.8% y/y).

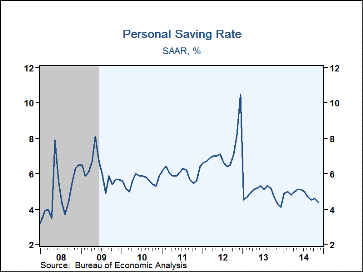

The personal saving rate was 4.4%, and October's rate was revised to 4.6% from 5.0%. Personal saving fell 4.2% (+5.5% y/y) following a 2.1% increase.

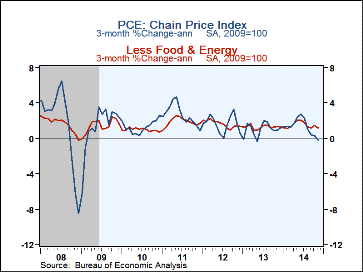

The chain price index fell 0.2% last month (1.2% y/y), following no change in October. Energy prices were down 4.0% (-5.4% y/y) while food prices rose 0.3% (2.8% y/y). Durable goods prices also fell, by 0.7% (-2.6% y/y) and nondurable goods prices fell 1.0% (-0.1% y/y). Gasoline prices dropped 6.2% m/m and were an even 10.0% below a year ago. Services prices rose 0.2% (2.2% y/y). The price index excluding food & energy was flat m/m and up 1.5% y/y.

The personal income & consumption figures are available in Haver's USECON database with detail in the USNA database. The consensus expectation figures are in the AS1REPNA database.

| Personal Income & Outlays (%) | Nov | Oct | Sep | Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Personal Income | 0.4 | 0.3 | 0.2 | 4.2 | 2.2 | 5.2 | 6.2 |

| Wages & Salaries | 0.5 | 0.3 | 0.2 | 4.5 | 2.8 | 4.5 | 4.0 |

| Disposable Personal Income | 0.3 | 0.3 | 0.1 | 4.1 | 1.0 | 4.9 | 5.0 |

| Personal Consumption Expenditures | 0.6 | 0.2 | 0.2 | 4.0 | 3.6 | 3.7 | 4.8 |

| Personal Saving Rate | 4.4 | 4.6 | 4.5 | 4.3 (Nov. '13) |

4.9 | 7.2 | 6.0 |

| PCE Chain Price Index | -0.2 | 0.0 | 0.1 | 1.2 | 1.2 | 1.8 | 2.5 |

| Less Food & Energy | 0.0 | 0.2 | 0.1 | 1.4 | 1.3 | 1.8 | 1.5 |

| Real Disposable Income | 0.5 | 0.3 | 0.1 | 2.9 | -0.2 | 3.0 | 2.5 |

| Real Personal Consumption Expenditures | 0.7 | 0.2 | 0.2 | 2.8 | 2.4 | 1.8 | 2.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.