Global| Aug 02 2013

Global| Aug 02 2013U.S. Personal Income Slows in June; Revisions Raise Saving Rate

Summary

Personal income growth moderated in June, with a 0.3% rise (3.1% y/y) after May's 0.4%, which was revised from 0.5% reported before. Consensus forecasts had looked for 0.4% in June. This report is part of the BEA's comprehensive [...]

Personal income growth moderated in June, with a 0.3% rise (3.1% y/y) after May's 0.4%, which was revised from 0.5% reported before. Consensus forecasts had looked for 0.4% in June. This report is part of the BEA's comprehensive revisions to the national accounts, and while the monthly changes in the total seem modest, they do encompass some major differences.

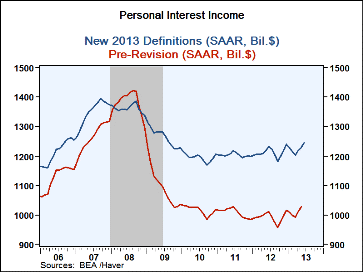

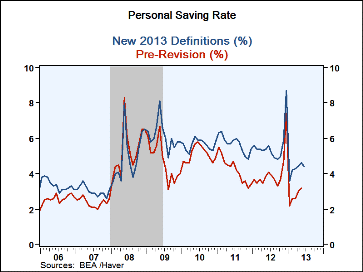

In particular, the treatment of defined benefit pension plans has shifted from a cash accounting basis for employers' contributions to an accrual basis that highlights the recipients' presumed future benefits. Interest income shows the biggest change, with the amount of that income in 2012 raised by 22.1%. In June interest income showed a 1.1% increase, the same as in May and April. The historical revision shifted the saving rate considerably higher; it was 4.6% in May instead of the 3.2% in the previous compilation. June's saving rate was then 4.4%. Other conceptual revisions affect proprietors' income and rental income, although the numerical amounts are much more modest. These are discussed in the March 2013 issue of the Survey of Current Business, found here.

Wages and salaries were up 0.5% in June (3.5% y/y) after May's 0.3%, the same as reported last time. The historical revisions to this item were marginal. Supplements to wages and salaries were also affected by the accounting change for pension plans, but the amounts vary over time and the trend shows little growth in recent months.

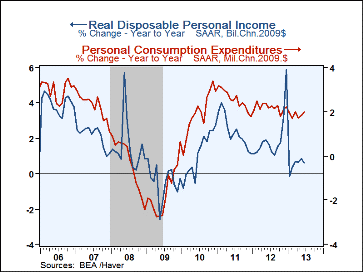

Personal consumption expenditures were up 0.5% in June (3.3% y/y), following just a 0.2% rise in May; that was revised from 0.3% initially. The result was in line with the Consensus forecast of 0.5%. Durable goods outlays picked up by 0.9% (6.4% y/y) from May's 0.6%, which was revised from 0.9%. The breakdown is not yet available from the BEA. Nondurable goods spending was up 1.3% (3.3% y/y) after 0.5% in May, revised upward from 0.3% initially. Outlays for services rose just 0.2% in June (2.9% y/y) and were flat in May, revised from a 0.1% rise.

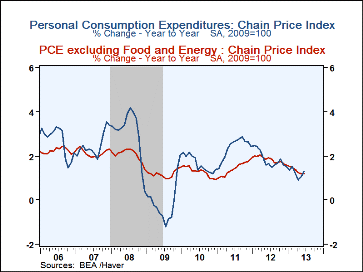

The PCE chain price index increased 0.4% in June (1.3% y/y) after May's 0.1%. Energy goods and services prices rose 3.5% after a May increase of just 0.2%. Durable goods prices were virtually unchanged for a second month in June (-1.8% y/y) and nondurable goods prices rose 1.1% in June (+0.9% y/y).

Adjusted for price changes, real disposable income edged down 0.1% in June (+0.6% y/y) while real spending was up just 0.1% (2.0% y/y).

The personal income & consumption figures are available in Haver's USECON and USNA databases. The consensus expectation figure is in the AS1REPNA database.

| Personal Income & Outlays (%) | June | May | Apr | Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Personal Income | 0.3 | 0.4 | 0.0 | 3.1 | 4.2 | 6.1 | 2.9 |

| Wages & Salaries | 0.5 | 0.3 | 0.1 | 3.5 | 4.3 | 4.1 | 2.0 |

| Disposable Personal Income | 0.3 | 0.3 | -0.1 | 1.9 | 3.9 | 4.8 | 2.8 |

| Personal Consumption Expenditures | 0.5 | 0.2 | -0.3 | 3.3 | 4.1 | 5.0 | 3.8 |

| Personal Saving Rate | 4.4 | 4.6 | 3.0 | 5.6 (Jun'12) |

5.6 | 5.7 | 5.6 |

| PCE Chain Price Index | 0.4 | 0.1 | -0.3 | 1.3 | 1.8 | 2.4 | 1.7 |

| Less Food & Energy | 0.2 | 0.1 | 0.0 | 1.2 | 1.7 | 1.4 | 1.3 |

| Real Disposable Income | -0.1 | 0.2 | 0.2 | 0.6 | 1.7 | 2.4 | 1.1 |

| Real Personal Consumption Expenditures | 0.1 | 0.1 | 0.1 | 2.0 | 1.9 | 2.5 | 2.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.