Global| Feb 18 2010

Global| Feb 18 2010U.S. PPI Jumps Again With Energy Price Strength

by:Tom Moeller

|in:Economy in Brief

Summary

Producer prices continued strong last month led by another jump in fuel costs. In addition, food price inflation has picked up considerably. Together, this strength lifted the finished goods PPI by 1.4% last month and increased the [...]

Producer

prices continued strong

last month led by another jump in fuel costs. In addition, food price

inflation has picked up considerably. Together, this strength lifted

the finished goods PPI by 1.4% last month and increased the 12-month

change to 5.0%; the strongest since late-2008. Finally, the January

increase exceeded Consensus expectations for a 0.8% rise.

Producer

prices continued strong

last month led by another jump in fuel costs. In addition, food price

inflation has picked up considerably. Together, this strength lifted

the finished goods PPI by 1.4% last month and increased the 12-month

change to 5.0%; the strongest since late-2008. Finally, the January

increase exceeded Consensus expectations for a 0.8% rise.

Higher energy costs led the strength in the PPI last month. The 5.1% m/m gain raised the y/y increase to 21.5%, its strongest since September 2008. Gasoline prices increased 10.4% (69.5% y/y) and fuel oil costs rose 11.0% (28.4% y/y). But elsewhere, the gain in energy prices was more moderate. Natural gas prices increased a lesser 2.4% and were down 12.5% from 12 months ago. Food prices were another source of price strength last month. They posted a 0.4% gain which raised the y/y change to 1.5% versus the low of -4.0% last summer. Fresh fruit & vegetable prices ballooned 43.8% y/y while pork prices jumped 11.8%. Also to the upside were dairy product prices by 5.1% and coffee prices by 2.3% y/y versus a 0.1% uptick last year..

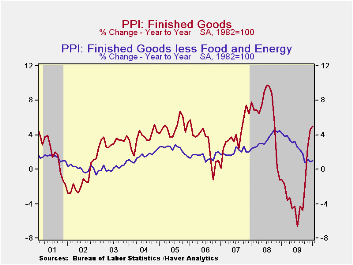

Producer prices excluding food & energy rose 0.3%. That was enough to stabilize the y/y change at 1.0% but it still was down from a 3.4% 2008 increase. The m/m increase in the core PPI also exceeded expectations for a modest 0.1% gain. The PPI for finished consumer goods less food & energy rose 0.4% (1.6% y/y) and was up from a 0.1% December gain. Finished durables prices increased 0.3% (0.7% y/y) while core finished consumer nondurable goods prices rose 0.4% (2.4% y/y). Capital equipment prices increased 0.3% which left prices up 0.1% y/y.

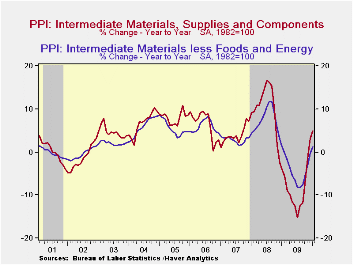

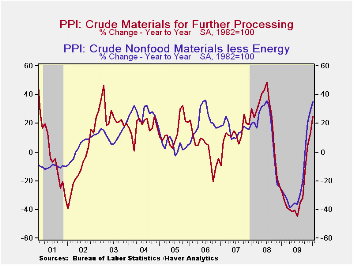

Prices for intermediate goods jumped 1.7% reflecting the strength in energy prices. The increase in core prices was, however, stable at 0.5%. Food prices fell 0.3% but the y/y gain at 1.7% was up from 8.2% price deflation during all of last year. Copper prices (55.3% y/y) and nonferrous wire & cable prices (25.1% y/y) have been notably strong. The crude materials PPI jumped again with the strength in energy prices. The 9.6% m/m increase was the strongest since 2006 and raised prices by one-quarter versus last January. Core prices also jumped. The 6.6% gain lifted prices by more than one-third y/y as economic growth strengthened following the recession.

The producer price data is available in Haver's USECON database. More detailed data is in the PPI and in the PPIR databases.

The minutes to the latest meeting of the Federal Open Market Committee can be found here.

| Producer Price Index(%) | January | December | November | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Finished Goods | 1.4 | 0.4 | 1.5 | 5.0 | -2.5 | 6.4 | 3.9 |

| Less Food & Energy | 0.3 | 0.0 | 0.5 | 1.0 | 2.6 | 3.4 | 2.0 |

| Intermediate Goods | 1.7 | 0.6 | 1.2 | 4.9 | -8.4 | 10.3 | 4.0 |

| Core Less Food & Energy | 0.5 | 0.5 | 0.3 | 1.1 | -4.2 | 7.4 | 2.8 |

| Crude Goods | 9.6 | 0.8 | 5.1 | 25.1 | -30.4 | 21.4 | 11.9 |

| Core Less Food & Energy | 6.6 | 4.5 | -1.0 | 35.1 | -23.5 | 14.8 | 15.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.