Global| Sep 13 2013

Global| Sep 13 2013U.S. PPI Rises 0.3% in August due to Food and Energy; Core Prices Remain Flat Overall

Summary

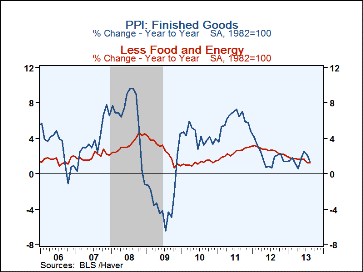

The producer price index for finished goods rose 0.3% in August (+1.4% y/y) following an unchanged performance during July, which was unrevised. Consensus expectations were looking for a 0.1% rise. Prices excluding food & energy, [...]

The producer price index for finished goods rose 0.3% in August (+1.4% y/y) following an unchanged performance during July, which was unrevised. Consensus expectations were looking for a 0.1% rise. Prices excluding food & energy, however, were unchanged (1.2% y/y) after a 0.1% July rise and lower than August forecasts of a 0.2% gain.

The producer price index for finished goods rose 0.3% in August (+1.4% y/y) following an unchanged performance during July, which was unrevised. Consensus expectations were looking for a 0.1% rise. Prices excluding food & energy, however, were unchanged (1.2% y/y) after a 0.1% July rise and lower than August forecasts of a 0.2% gain.

Both food and energy prices pushed up on the total. Energy was up 0.8% in the month, which, given a strong move in the year-ago month, resulted in a year-on-year increase of just 0.7%. Gasoline prices more than reversed their 0.8% July decline with a 2.6% rise this August but compared to August 2012, they were down 2.2%. Residential natural gas prices fell 1.7% m/m in August (+7.7% y/y) after July's 3.9% decline. Home heating oil prices in August decreased 5.7% m/m and also decreased 5.1% y/y. Residential electric power went up 0.2% (3.2% y/y). Food prices rose 0.6% on the month in August (+2.6% y/y) following July's unchanged performance. The August advance came largely from fresh and dried vegetables, which jumped 26.9% in the month (+47.1% y/y). Processed fruit and vegetable prices, in contrast, fell in August, by 1.0%, and were down 0.3% from August 2012.

Finished consumer goods prices excluding foods rose 0.3% (+1.3% y/y), including the energy price upturn. Finished consumer goods prices excluding food & energy were unchanged (1.7% y/y) following July's 0.1% rise. Within the components, women's apparel prices rose 2.2% y/y while men's apparel prices were up 1.4% y/y. Furniture prices were up 2.2% y/y but household appliance prices fell 0.4% y/y and home electronic equipment was down 2.3% y/y. Passenger car prices fell 0.5% m/m and were off 2.0% y/y. Capital equipment prices fell 0.1% last month (+0.6% y/y) after being unchanged in July.

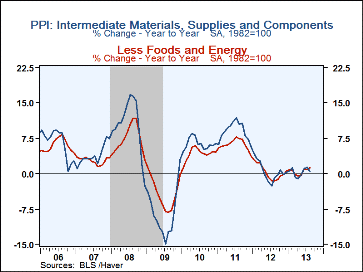

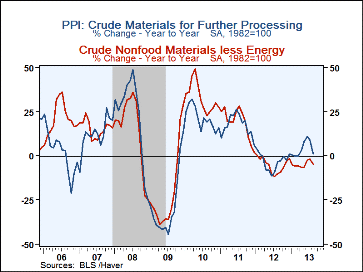

Intermediate goods prices were unchanged m/m for a second consecutive month (+0.5% y/y in August) as core prices rose 0.2% (+1.3% y/y) after falling 0.3% in July. Intermediate foods and feeds fell 2.3% in August (-1.0% y/y) while intermediate energy goods prices increased 0.6% (+1.3% y/y). Crude goods prices dropped 2.7% last month (+1.5% y/y); crude foodstuffs and feedstuffs fell 4.2% (-3.2% y/y), and crude energy materials fell 2.7% m/m even as they were up 10.3% y/y. Crude goods core prices excluding food & energy slipped 0.4% m/m (-4.6% y/y).

The PPI data are contained in Haver's USECON database with further detail in PPI and PPIR. The expectations figures are available in the AS1REPNA database.| Producer Price Index (%) | Aug | Jul | Jun | Aug Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Finished Goods | 0.3 | 0.0 | 0.8 | 1.4 | 1.9 | 6.0 | 4.2 |

| Less Food & Energy | 0.0 | 0.1 | 0.2 | 1.2 | 2.6 | 2.4 | 1.2 |

| Foods | 0.6 | 0.0 | 0.2 | 2.6 | 2.6 | 6.3 | 3.9 |

| Energy | 0.8 | -0.2 | 2.9 | 0.7 | -0.2 | 15.5 | 13.5 |

| Intermediate Goods | 0.0 | 0.0 | 0.5 | 0.5 | 0.5 | 9.0 | 6.4 |

| Less Food & Energy | 0.2 | -0.3 | 0.1 | 1.3 | 0.3 | 6.2 | 4.3 |

| Crude Goods | -2.7 | 1.2 | 0.0 | 1.5 | -3.3 | 17.4 | 21.3 |

| Less Food & Energy | -0.4 | -0.3 | 0.1 | -4.6 | -5.2 | 18.5 | 32.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.