Global| Mar 14 2018

Global| Mar 14 2018U.S. Producer Prices Continue Upward Trend

Summary

The headline Final Demand Producer Price Index using new methodology increased 0.2% in February following a 0.4% gain in January. The year-on-year (y/y) growth edged up to 2.8%. A 0.1% February rise had been expected in the Action [...]

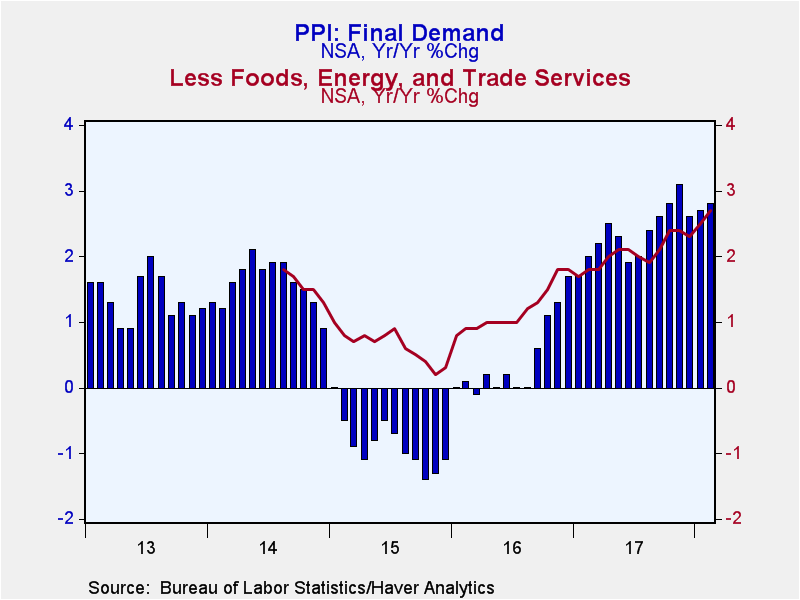

The headline Final Demand Producer Price Index using new methodology increased 0.2% in February following a 0.4% gain in January. The year-on-year (y/y) growth edged up to 2.8%. A 0.1% February rise had been expected in the Action Economics Forecast Survey. The PPI excluding food & energy also increased 0.2% in February, in line with the Actions Economics median forecast. Year-on-year gains accelerated to 2.5% from 2.2% in January. This is the fastest y/y growth rate in six years. An updated measure of core producer price inflation -- the overall index excluding food, energy and trade services jumped 0.4% for the second consecutive month. This took the y/y increase to 2.7%, the strongest reading since the series began in August 2013.

Using the old methodology for the Producer Price Index, prices fell -0.3% (+2.7% y/y) in February reversing some of January's 0.7% gain. Excluding food & energy, the index was unchanged (1.9% y/y).

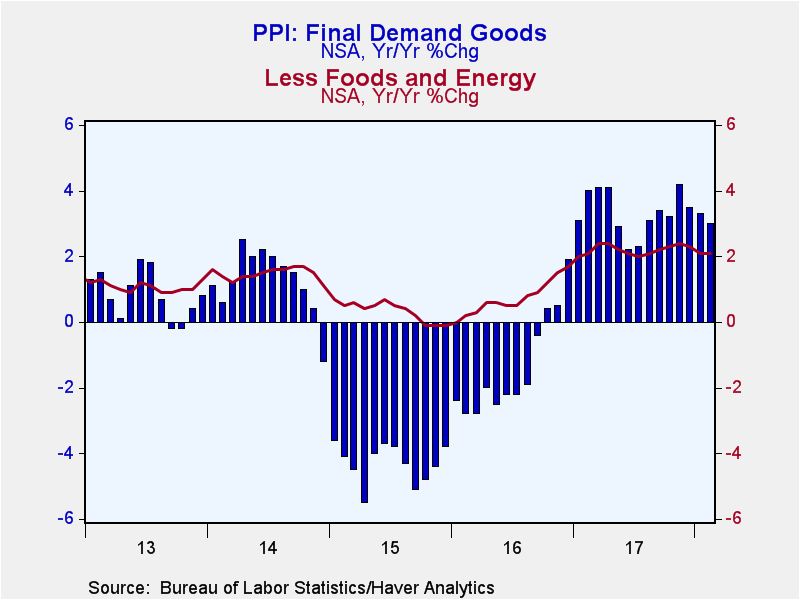

Final demand goods prices edged down 0.1% (+3.0% y/y) following a 0.7% gain. The goods price index excluding food & energy increased 0.2% for the third consecutive month (2.1% y/y).

Food prices declined 0.4% (+0.6% y/y) in February. Energy prices fell 0.5% (+9.1% y/y), as the price of West Texas Intermediate Crude Oil dropped 2.3% in February (+16.4% y/y). Thus gasoline prices dropped 1.6% (+14.3% y/y) and home heating oil prices declined 0.2% (+25.8% y/y). Meanwhile natural gas prices rose 3.7% (3.8% y/y) and electric power costs edged down 0.1% (+2.7% y/y).

Nondurable consumer goods prices less food & energy increased 0.3% (3.6% y/y) in February. Durable consumer goods prices declined 0.3% (1.3% y/y). Passenger car prices fell 0.6% (-1.4% y/y) and light truck prices dropped 1.1% (+1.0% y/y). Private capital equipment prices were unchanged (+0.9% y/y). Manufacturing capital equipment rose 0.3% (1.6% y/y), while nonmanufacturing capital equipment edged down 0.1% (+0.7% y/y).

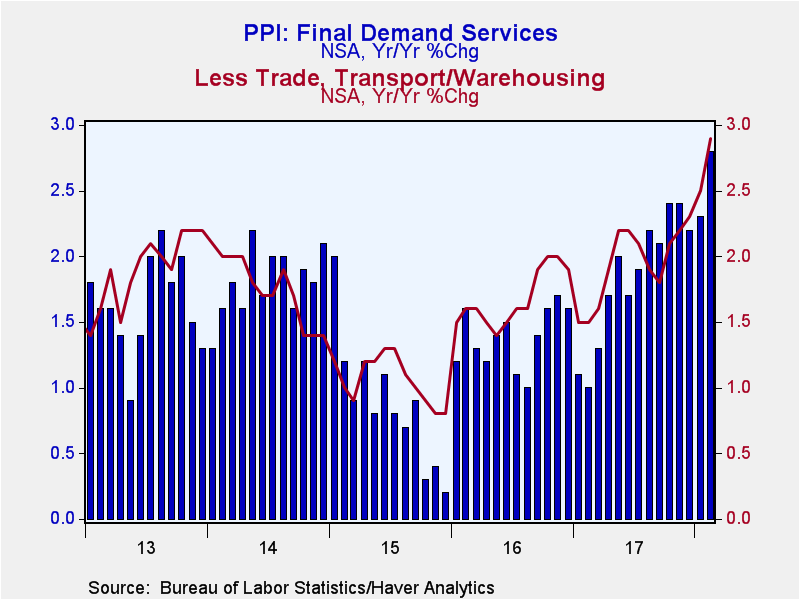

Final demand for services prices increased 0.3% (+2.8% y/y) in February. Prices less trade, transportation & warehousing gained 0.3%, bringing the y/y growth to 2.8%, the strongest reading since the series began in November 2009. Trade services prices declined 0.2% (+2.6% y/y) while transportation and warehousing prices rose 0.9% (3.2% y/y).

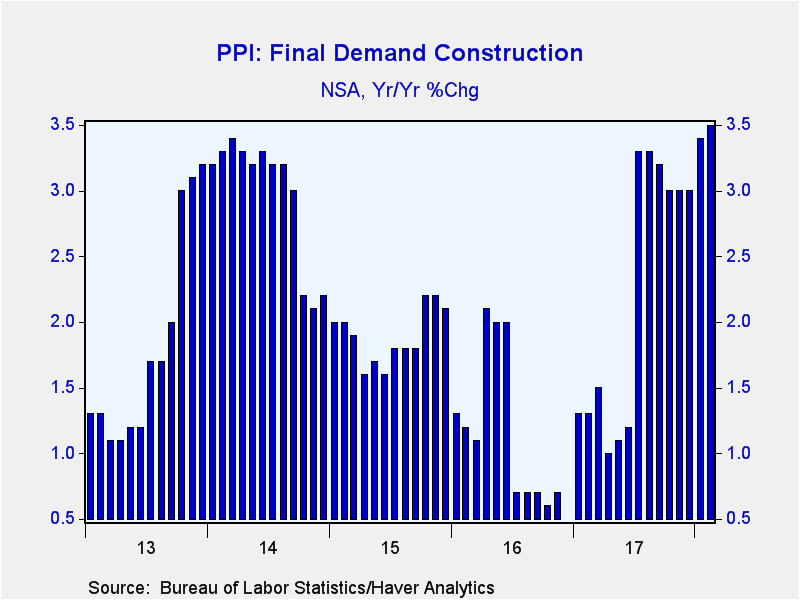

Final demand construction prices edged up 0.1% (+3.5% y/y) with private capital investment construction growing 0.1% (+3.4% y/y) and government unchanged (3.6% y/y).

Prices for intermediate demand goods strengthened 0.7% (4.8% y/y). This is the seventh consecutive month of gains of 0.5% or greater.

The PPI data are contained in Haver's USECON database with further detail in PPI and PPIR. West Texas Intermediate Crude Oil prices are found in the USECON database while the expectations figures are available in the AS1REPNA database.

| Producer Price Index (SA, %, New Methodology) | Feb | Jan | Dec | Feb Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Final Demand | 0.2 | 0.4 | 0.0 | 2.8 | 2.3 | 0.4 | -0.9 |

| Excluding Food & Energy | 0.2 | 0.4 | -0.1 | 2.5 | 1.9 | 1.2 | 0.8 |

| Excluding Food, Energy & Trade Services | 0.4 | 0.4 | 0.1 | 2.7 | 2.1 | 1.2 | 0.6 |

| Goods | -0.1 | 0.7 | 0.1 | 3.0 | 3.3 | -1.4 | -4.3 |

| Foods | -0.4 | -0.2 | -0.4 | 0.6 | 1.2 | -2.8 | -2.6 |

| Energy | -0.5 | 3.4 | 0.5 | 9.1 | 10.4 | -8.4 | -20.6 |

| Goods Excluding Food & Energy | 0.2 | 0.2 | 0.2 | 2.1 | 2.2 | 0.7 | 0.4 |

| Services | 0.3 | 0.3 | -0.1 | 2.8 | 1.8 | 1.4 | 0.9 |

| Trade Services | -0.2 | 0.3 | -0.4 | 2.6 | 1.5 | 1.3 | 1.3 |

| Construction | 0.1 | 0.8 | -0.1 | 3.5 | 2.2 | 1.1 | 1.9 |

| Intermediate Demand - Processed Goods | 0.7 | 0.7 | 0.5 | 4.8 | 4.7 | -3.1 | -6.9 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.