Global| Mar 15 2016

Global| Mar 15 2016U.S. Producer Prices Fall in February, Driven by Food and Energy

by:Sandy Batten

|in:Economy in Brief

Summary

The headline Final Demand Producer Price Index fell 0.2% m/m (0.0% y/y) in February after an unexpected 0.1% m/m rise in January. The February reading was spot on expectations from the Action Economics Forecast Survey. The unchanged [...]

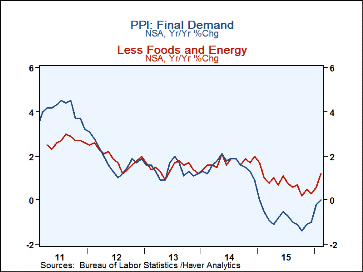

The headline Final Demand Producer Price Index fell 0.2% m/m (0.0% y/y) in February after an unexpected 0.1% m/m rise in January. The February reading was spot on expectations from the Action Economics Forecast Survey. The unchanged y/y reading in February was the first nonnegative monthly reading in 13 months. Final demand prices excluding food and energy prices were unchanged in February from January against an expectation of a 0.1% m/m increase; they had jumped 0.4% m/m in January. Compared to a year ago, this measure was up 1.2%, its highest reading since January 2015. Given the volatility and difficulty interpreting changes in prices of trade services, both the financial markets and the BLS have begun to shift their view of "core" PPI inflation to final demand prices excluding food, energy, and trade services prices from the historical "core" measure, which excluded only food and energy prices. This "new" core measure rose 0.1% m/m in February, down from +0.2% m/m in both January and December, to stand 0.9% higher than a year earlier.

The February decline in the headline index mostly reflected a 0.6% m/m decline (-2.7 y/y) in prices of final demand goods. The index for final demand services was unchanged in February (+1.5% y/y). The decline in goods prices was led by a 3.4% m/m drop in energy prices (gasoline prices fell 15.1% m/m) with an assist from a 0.3% m/m decline in food prices. Goods prices excluding food and energy edged up 0.1% m/m (+0.2% y/y) in February.

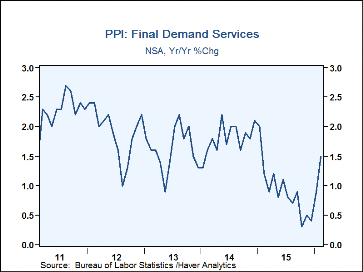

After three consecutive monthly increases, the index for final demand services was unchanged in February, but the 1.5% y/y increase was the highest since January 2015. In February, a 0.3% m/m increase in prices of final demand services excluding trade, transportation, and warehousing (led by a 4.8% m/m jump in prices for brokerage services, the third consecutive significant monthly increase--this index is now up 25% y/y) offset a 0.4% decrease in prices for final demand trade services (usually volatile and difficult to interpret change--this index had jumped 0.9% m/m in January) and a 0.7% drop in prices of final demand transportation and warehousing services.

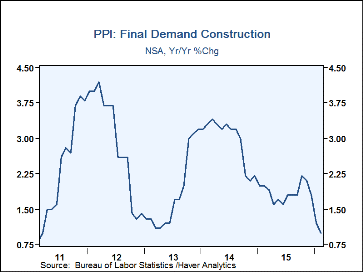

Final demand construction prices fell 0.1% m/m in February, the third monthly decline in the past four months, but were up 1.0% from a year earlier.

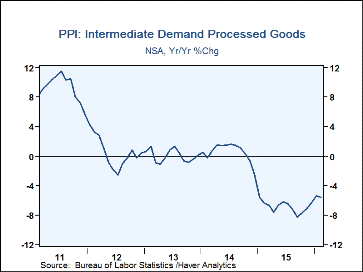

Prices of processed goods for intermediate demand slumped 0.7% m/m in February, their eighth consecutive monthly decline, and were 5.6% lower than a year earlier.

The PPI data are contained in Haver's USECON database with further detail in PPI and PPIR. The expectations figures are available in the AS1REPNA database.

| Producer Price Index (SA, %) | Feb | Jan | Dec | Feb Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Final Demand | -0.2 | 0.1 | -0.2 | 0.0 | -0.9 | 1.6 | 1.4 |

| Excluding Food & Energy | 0.0 | 0.4 | 0.2 | 1.2 | 0.8 | 1.7 | 1.5 |

| Excluding Food, Energy & Trade Services | 0.1 | 0.2 | 0.2 | 0.9 | 0.6 | 1.2 | -- |

| Goods | -0.6 | -0.7 | -0.7 | -2.7 | -4.3 | 1.3 | 0.8 |

| Foods | -0.3 | 1.0 | -1.4 | -2.5 | -2.6 | 3.2 | 1.7 |

| Energy | -3.4 | -5.0 | -3.5 | -14.5 | -20.6 | -0.9 | -0.8 |

| Goods Excluding Food & Energy | 0.1 | 0.0 | 0.1 | 0.2 | 0.4 | 1.5 | 1.1 |

| Services | 0.0 | 0.5 | 0.1 | 1.5 | 0.9 | 1.8 | 1.6 |

| Construction | -0.1 | -0.4 | 0.0 | 1.0 | 1.9 | 2.9 | 1.8 |

| Intermediate Demand - Processed Goods | -0.7 | -1.2 | -1.0 | -5.6 | -6.9 | 0.6 | 0.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates