Global| May 18 2021

Global| May 18 2021U.S. Retail Gasoline Price Breaches $3.00 For the First Time Since 2014

Summary

• Disruptions to the Colonial Pipeline operations pushed gasoline prices above the $3.00 per gallon for the first time since October 27, 2014. • The price of West Texas Intermediate crude oil held steady • Natural gas prices [...]

• Disruptions to the Colonial Pipeline operations pushed gasoline prices above the $3.00 per gallon for the first time since October 27, 2014.

• The price of West Texas Intermediate crude oil held steady

• Natural gas prices strengthened on May 17, following a pause in the week ended May 7.

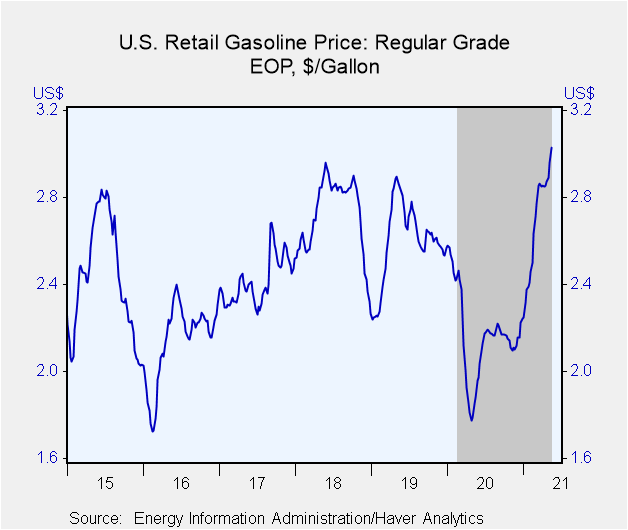

The price of retail gasoline jumped to $3.03 a gallon (61.24% y/y) in the week ended May 17, from $2.96 the prior week. Disruptions to the Colonial Pipeline operations prompted the increase above the $3.00 per gallon for the first time since October 27, 2014. Haver Analytics adjusts the gasoline price series for normal seasonal variation. The seasonally adjusted price rose 5 cents to $2.84 per gallon in the week ended May 17.

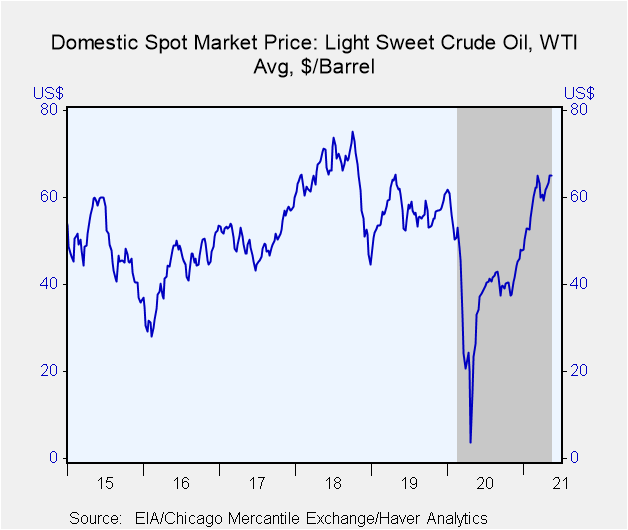

The price of West Texas Intermediate crude oil held steady at $65.1 per barrel (up 146.5% y/y) in the week ended May 14, unchanged from the week ended May 7. The price was $66.27 yesterday. The average price of Brent crude oil rose to $68.33 per barrel (124.0% y/y) in the week ended May 14 from $67.84 the week prior. The price was up again yesterday to $69.42.

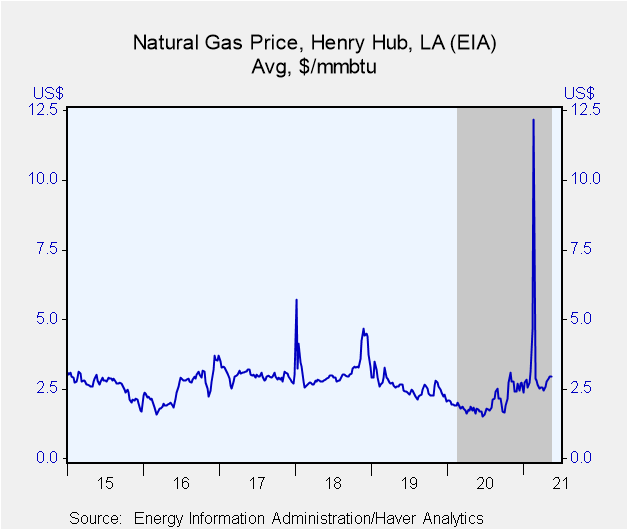

The price of natural gas softened to $2.93/mmbtu (79.75% y/y) in the week ended May 14, following a rise to $2.95/mmbtu the prior week. But this weekly price respite was short-lived. The price rebounded yesterday to $2.99/mmbtu.

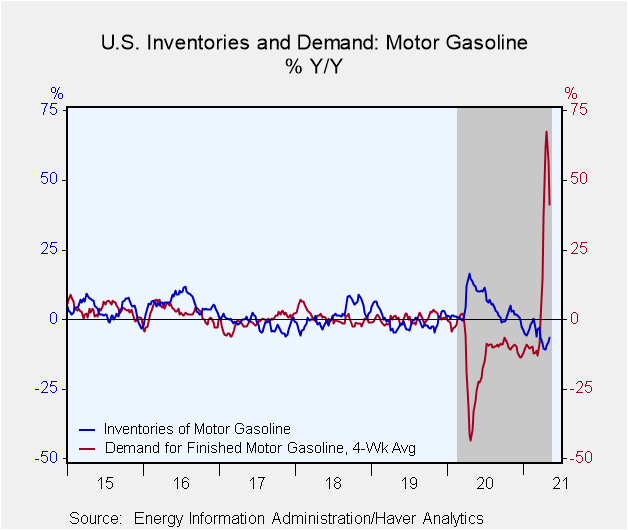

In the four weeks ended May 7, gasoline demand rose 41.3% y/y and demand for all petroleum products rose 23.1% y/y. Crude oil input to refineries rose 18.7% y/y. Gasoline inventories dropped 6.6% y/y, while crude oil inventories declined 5.8% y/y.

The supply of gasoline inventory in the week ending May 7 was 26.5 days, unchanged from the month of April. The supply of crude oil inventory eased slightly to 32.3 days from 33.2 days in April.

These data are reported by the Energy Information Administration of the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data are in USENERGY.

| Weekly Energy Prices | 5/17/21 | 5/10/21 | 5/3/21 | Y/Y % | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Retail Gasoline ($ per Gallon, Regular, Monday) | 3.03 | 2.96 | 2.89 | 61.24 | 2.24 | 2.57 | 2.27 |

| Light Sweet Crude Oil, WTI ($ per bbl, Previous Week's Average) | 65.10 | 65.10 | 63.48 | 146.50 | 39.43 | 56.91 | 64.95 |

| Natural Gas ($/mmbtu, LA, Previous Week's Average) | 2.93 | 2.95 | 2.88 | 79.75 | 2.03 | 2.57 | 3.18 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).