Global| Oct 15 2008

Global| Oct 15 2008U.S. Retail Sales Drop 1.2% in September

Summary

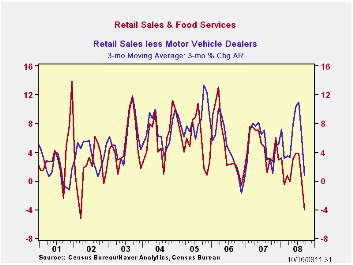

Retail sales fell 1.2% last month, the Commerce Department reported this morning. Both August and July sales were revised lower, August to a 0.9% decrease from 0.7% reported last month, and July to a 0.1% increase from 0.3% in last [...]

Retail sales fell 1.2% last month, the Commerce Department reported this morning. Both August and July sales were revised lower, August to a 0.9% decrease from 0.7% reported last month, and July to a 0.1% increase from 0.3% in last month's data. This puts the entire Q3 down at a 4% annual rate from Q2. The Action Economics survey shown in Haver's AS1REPNA database looked for a 1.0% decline in September. All the retail sales data are contained in Haver's USECON database.

Not only were total sales down in September, but every major store group saw lower sales, except for stores and gas stations. Drug stores, more formally known as "health & personal care stores", were up 0.4%, and gas stations, 0.1%. [This latter seems odd, in view of falling gasoline prices, but it seems to be a seasonal phenomenon; sales not seasonally adjusted were down 7.8%, while September's seasonal factor falls 8.1%.]

Among other major store groups, the biggest decline was at auto dealers, which saw a 3.8% plunge after their brief recovery in August, which itself was revised a bit lower. Furniture stores and electronics & appliance stores continued their steep downtrends, losing 2.3% and 1.5%, respectively. Furniture sales were off 10.7% from a year ago, their 13th consecutive year-on-year decline.

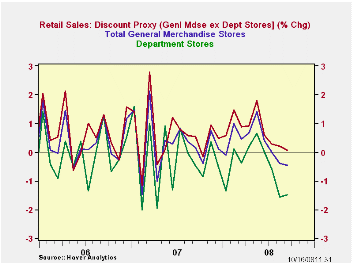

Individual store reports made a week ago indicated that discounters had done better than full-price retailers. This was evident in today's data in the comparative performance of general merchandise stores as a whole, which were off 0.4%, and mainline department stores down 1.5%. The subcategory we might call "discounters", that is, the whole general merchandise group less the department stores, rose 0.1% (see second graph). This isn't great, but it is in fact better than other segments.

Other noteworthy sectors include restaurants, down 0.5% in September, and nonstore retailers (mostly electronic shopping), down 0.8%. This latter group, as Tom Moeller has highlighted here before, has been weakening. A month ago, he reported it down 3.9% annualized from three months before; the comparable number this month is 10.7%! This category also includes fuel oil dealers, so falling oil prices could be pulling it down. This level of detail won't be published until next month's release.

| September | August | July | Y/Y | 2007 | 2006 | 2005 | |

|---|---|---|---|---|---|---|---|

| Retail Sales & Food Services (%) | -1.2 | -0.5 | -0.6 | -1.0 | 4.0 | 5.8 | 6.4 |

| Excluding Autos | -0.6 | -0.9 | 0.1 | 3.6 | 4.4 | 6.8 | 7.5 |

| Less Gasoline | -0.7 | -0.6 | 0.1 | 1.6 | 4.1 | 6.2 | 6.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates