Global| Jun 11 2009

Global| Jun 11 2009U.S. Retail Sales Rise With Higher Gas Prices; Underlying Trend Is Flat

by:Tom Moeller

|in:Economy in Brief

Summary

Despite the latest increase in overall retail sales, U.S. consumer spending remains constrained by weak job growth and rising gasoline prices. The restraint was evident in a modest, expected 0.5% increase in May retail sales which [...]

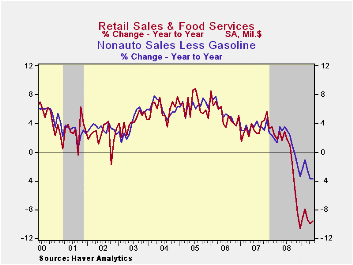

Despite the latest increase in overall retail sales, U.S. consumer spending remains constrained by weak job growth and rising gasoline prices. The restraint was evident in a modest, expected 0.5% increase in May retail sales which followed a little-revised 0.2% decline during April. Highlighting the stress on spending was the magnitude of the year-to-year drop in retail sales. They are off 9.6% in the twelve months ended in May, nearly the sharpest shortfall on record. Consumers remain disinclined to shift the dollars saved because of lower gasoline prices versus last summer. The retail sales data are available in Haver's USECON database.

Much of the gain in retail spending last month owed to a 3.6% rise (-33.8% y/y) in sales of gasoline service stations. That gain was certainly powered by the 10.6% (NSA) rise in the retail price for a gallon of gasoline. In addition, mirroring the earlier report of higher May unit sales of motor vehicle sales, retail vehicle sales rose 0.5% and made up the April decline. The slight dollar gain lagged the 6.4% rise last month in unit vehicle sales, but both indicate flat sales over the last two months.

Emphasizing a persistent weakness in underlying consumer spending were retail sales excluding both autos and gasoline. They ticked up just 0.1% last month following a 0.1% dip during April. The best that can be said about consumption is that the earlier downward momentum in sales may have stabilized. These sales have risen at a 2.7% annual rate since December following last year's 2.8% decline from December-to-December last year.

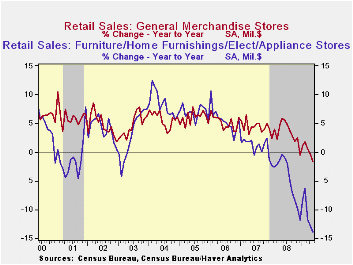

Detail of the report show was just how weak discretionary spending remains. Sales at furniture, electronics & appliance stores fell another 0.5% (-13.9% y/y) following the 1.0% drop during April. So far this year these sales have fallen at a 7.1% annual rate after last year's 4.5% decline. Furniture store sales alone ticked down 0.4% (-14.7% y/y) while sales of electronics & appliances slipped 0.5% (-13.0% y/y). In the soft goods area, May apparel store sales rose by 0.4% (-7.0% y/y) following a 0.7% decline during April. Also restrained were sales at general merchandise stores during the last three months. Last month they fell 0.2% (-1.7% y/y) for the third consecutive monthly slip.

Not only are folks not visiting the stores, but they're not spending freely when at home. Lower internet and catalogue purchases pulled sales of non-store retailers down last month by another 0.4% (-7.1% y/y) and they have fallen slightly since December. Bucking the overall trend in spending, consumers continue to dine out. Restaurant sales rose just slightly last month but so far this year they have risen at a 5.3% annual rate (1.2% y/y).

Building materials sales increased all of 1.3% last month but they still are down by 10.3% from last May.

The Fed's latest Beige Book covering regional U.S. economic conditions can be found here.

| May | April | March | Y/Y | 2008 | 2007 | 2006 | |

|---|---|---|---|---|---|---|---|

| Retail Sales & Food Services (%) | 0.5 | -0.2 | -1.2 | -9.6 | -0.7 | 3.3 | 5.3 |

| Excluding Autos | 0.5 | -0.2 | -1.1 | -7.3 | 2.5 | 3.9 | 6.3 |

| Less Gasoline | 0.1 | -0.1 | -0.9 | -3.1 | 1.6 | 3.6 | 5.7 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates