Global| Feb 15 2017

Global| Feb 15 2017U.S. Retail Sales Slow with Lower Auto Sales; Other Spending Firms

Summary

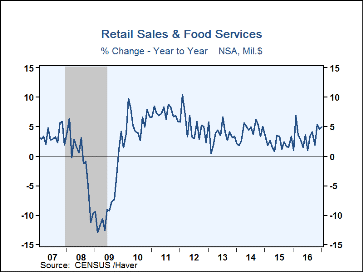

Total retail sales and spending at restaurants increased 0.4% (4.9% y/y) in January following a 1.0% December rise, which was revised from 0.6%. A more modest 0.1% increase had been expected in the Action Economics Forecast Survey. [...]

Total retail sales and spending at restaurants increased 0.4% (4.9% y/y) in January following a 1.0% December rise, which was revised from 0.6%. A more modest 0.1% increase had been expected in the Action Economics Forecast Survey.

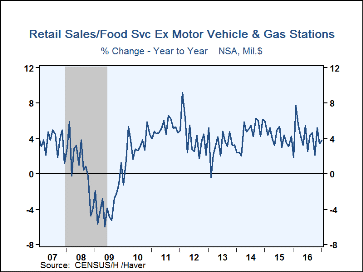

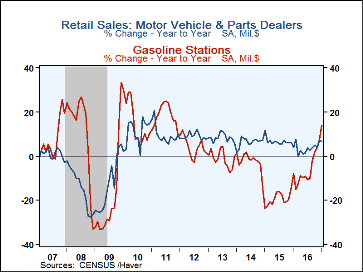

Sales at motor vehicles & parts dealers accounted for the January slowdown in the total; these fell 1.4% (5.8% y/y), after their sizable 3.2% gain in December. The decline compared to a 4.4% decrease in unit sales of light vehicles. Excluding autos, retail sales increased 0.8% (4.7% y/y). clearly more than December's a 0.4% rise. A 0.4% increase had been expected. Sales at gasoline service stations again lifted retail spending last month, as they went up 2.3% (13.9% y/y); December's gas stations sales increase was revised from 2.0% to 3.2%. In the CPI array for January, gasoline prices are seen to have risen 7.8% in the month. Retail sales excluding both auto dealers & gas stations rose 0.7% (3.8% y/y) in January following a 0.1% rise.

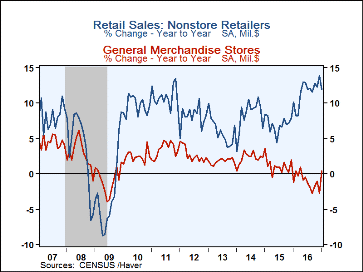

In other discretionary spending categories, furniture store sales were flat in January (-0.3% y/y) after a 0.9% fall in December. In contrast, several other store groups had January gains after a slow December; electronics & appliance store sales rebounded 1.6% (-1.7% y/y) from December's 1.7% decline. Clothing store sales gained 1.0% (0.4% y/y) after December's slim 0.1% rise. General merchandise store sales advanced 0.9% (-1.4% y/y) following a 0.4% decrease. Sporting goods store sales gained 1.8% (-3.7% y/y) after easing 0.2% in December.

In the non-discretionary spending categories, health & personal care store sales increased 0.7% (9.4% y/y) in January, similar to December's 0.6% rise. Food & beverage store sales rose 0.4% (+0.4% y/y) following a slippage of 0.2%.

Nonstore retailers had flat sales in January (14.5% y/y), but that followed a 1.9% gain in December.

Sales at food service & drinking places advanced 1.4% (3.4% y/y), following December's 1.1% decline.

The retail sales data can be found in Haver's USECON database. The Action Economics forecast expectations are included in the AS1REPNA database.

| Retail Spending (%) | Jan | Dec | Nov | Jan Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Total Retail Sales & Food Services | 0.4 | 1.0 | 0.2 | 4.9 | 3.3 | 2.3 | 4.2 |

| Excluding Autos | 0.8 | 0.4 | 0.3 | 4.7 | 3.1 | 1.2 | 3.7 |

| Non-Auto Less Gasoline | 0.7 | 0.1 | 0.3 | 3.8 | 4.2 | 4.2 | 4.6 |

| Retail Sales | 0.2 | 1.2 | 0.0 | 5.1 | 2.9 | 1.6 | 4.0 |

| Motor Vehicle & Parts | -1.4 | 3.2 | -0.3 | 5.8 | 3.9 | 6.5 | 6.5 |

| Retail Less Autos | 0.7 | 0.6 | 0.1 | 4.9 | 2.6 | 0.2 | 3.3 |

| Gasoline Stations | 2.3 | 3.2 | 0.0 | 13.9 | -6.2 | -19.2 | -2.3 |

| Food Service & Drinking Places Sales | 1.4 | -1.1 | 1.2 | 3.4 | 5.9 | 8.1 | 6.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.