Global| Feb 17 2021

Global| Feb 17 2021U.S. Retail Sales Soar Much More than Expected in January

by:Sandy Batten

|in:Economy in Brief

Summary

• After three consecutive monthly declines, retail spending rebounded strongly in January. • Rebound aided by another round of stimulus checks from the federal government. • The January surge in spending was widespread across [...]

• After three consecutive monthly declines, retail spending rebounded strongly in January.

• Rebound aided by another round of stimulus checks from the federal government.

• The January surge in spending was widespread across categories.

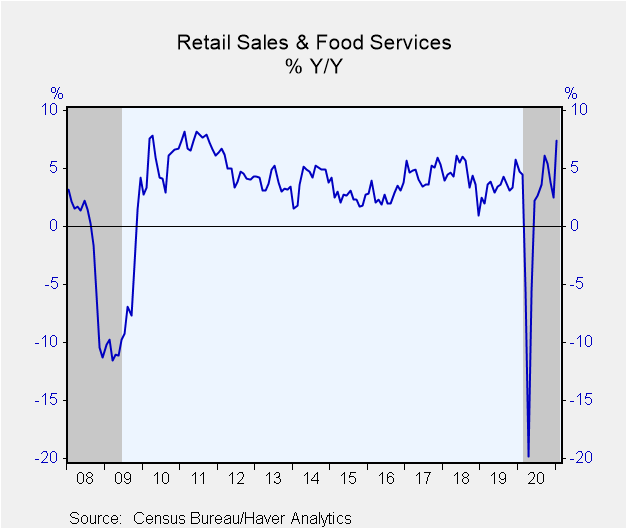

Total retail sales including food service and drinking establishments jumped up 5.3% m/m (+7.4% y/y) after having declined in each of the previous three months. January sales were likely boosted meaningfully by a second round of stimulus checks from the federal government that were sent out in early January. The 0.7% m/.m decline initially reported for December was revised down to a 1.0% m/m drop. The Action Economics Forecast Survey had expected a 0.9% monthly gain. Retail sales excluding motor vehicles and parts were even stronger, up 5.9% m/m (+6.1% y/y) after having also declined in each of the three previous months. These sales had been expected to rise only 0.9% m/m.

The retail control group, the component of retail sales used to construct the monthly consumption figures in the national accounts and excludes autos, gas stations, building materials and food services, soared 6.0% m/m (+11.8% y/y), auguring a strong gain in monthly consumption in January to be released on February 26. Consumer spending slowed sharply in Q4. So, the January rebound in retail sales likely means that consumption in the national accounts got off to a great start for the first quarter.

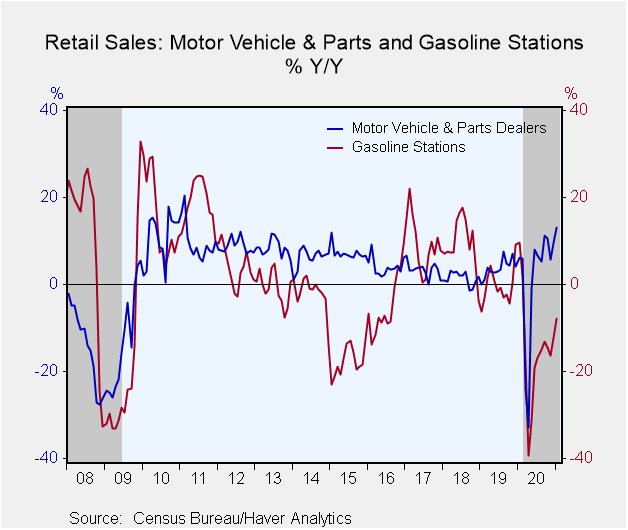

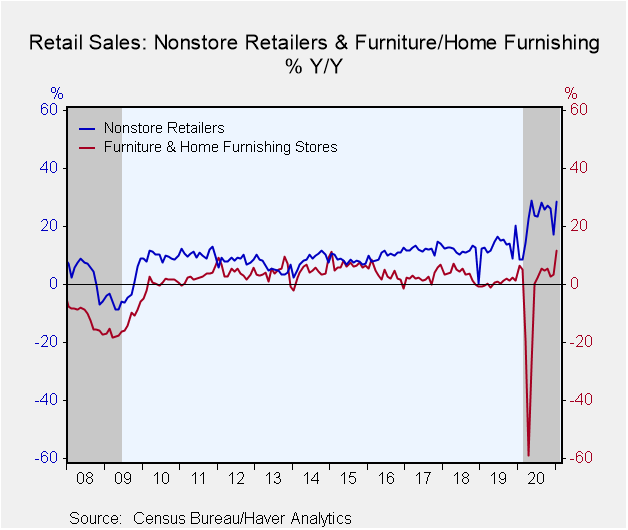

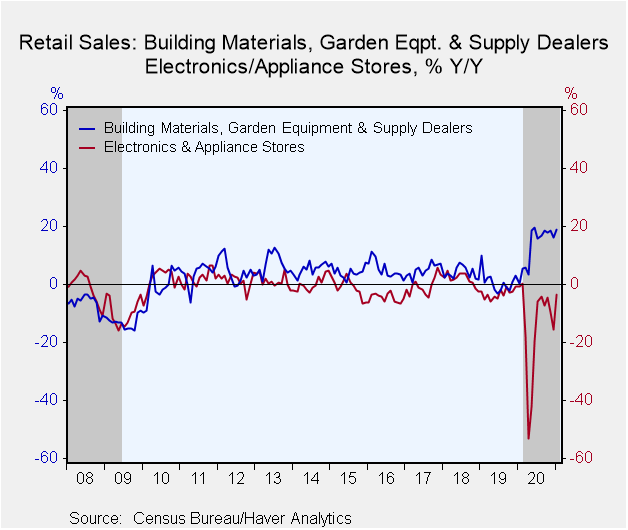

Sales of motor vehicles increased a more modest 3.1% m/m in January (+13.0% y/y). Sales at furniture and home furnishing stores surged 12.0% m/m and sales at electric appliance stores soared 14.7% m/m. Sales of building materials and garden supplies rose 4.6% m/m. Gasoline sales increased 4.0% m/m. Department store sales exploded 23.5% m/m in January after having declined in four of the previous five months. Even though consumers appeared to have returned to bricks and mortar stores in January, sales by nonstore retailers were also very strong, rising 11.0% m/m.

Sales at restaurants and drinking establishments rebounded 6.9% m/m (-16.6% y/y) in January after increased social distancing and new restrictions on in-restaurant dining had led to sharp declines in November (-3.6% m/m) and December (-4.6% m/m). The accelerating pace of vaccinations could initiate a more sustained revival in eating out going forward.

The retail sales data can be found in Haver's USECON database. The Action Economics forecast is in the AS1REPNA database.

| Retail Spending (% chg) | Jan | Dec | Nov | Jan Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total Retail Sales & Food Services | 5.3 | -1.0 | -1.3 | 7.4 | 0.4 | 3.5 | 4.4 |

| Excluding Autos | 5.9 | -1.8 | -1.2 | 6.1 | 0.3 | 3.5 | 5.2 |

| Retail Sales | 5.1 | -0.6 | -1.0 | 10.8 | 3.2 | 3.4 | 4.2 |

| Retail Less Autos | 5.7 | -1.4 | -0.8 | 10.2 | 3.8 | 3.3 | 5.1 |

| Motor Vehicle & Parts | 3.1 | 2.0 | -1.6 | 13.0 | 1.0 | 3.7 | 1.4 |

| Food & Beverage Stores | 2.4 | -1.4 | 1.5 | 11.8 | 11.2 | 2.5 | 2.9 |

| Gasoline Service Stations | 4.0 | 6.5 | -1.7 | -7.8 | -15.6 | -0.5 | 9.3 |

| Food Service & Drinking Places | 6.9 | -4.6 | -3.6 | -16.6 | -19.2 | 4.6 | 5.8 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates