Global| Dec 12 2017

Global| Dec 12 2017U.S. Small Business Optimism Highest Since 1983

Summary

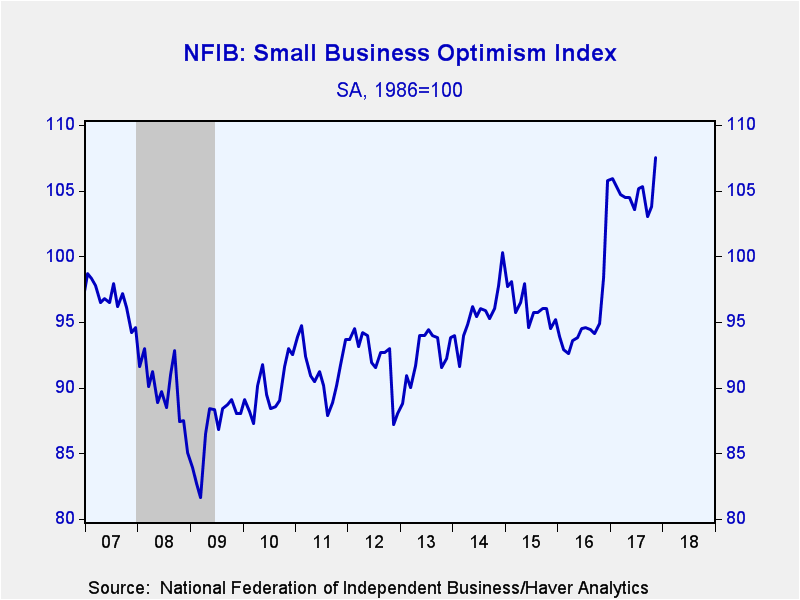

Small business optimism in the U.S. rose 3.7 points in November to 107.5 (1986=100), the second highest reading of this index in the 44-year history of the survey conducted by the National Federation of Independent Business; the only [...]

Small business optimism in the U.S. rose 3.7 points in November to 107.5 (1986=100), the second highest reading of this index in the 44-year history of the survey conducted by the National Federation of Independent Business; the only reading higher was 108.0 in July 1983. The November number is up 9.2% from a year ago. There were gains in several of the index components and other survey questions, and a couple of those had quite sizable movements.

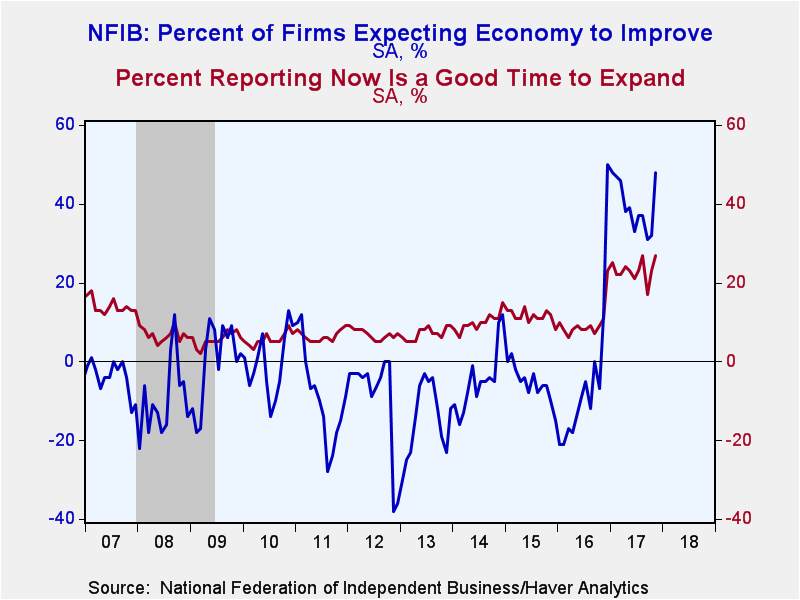

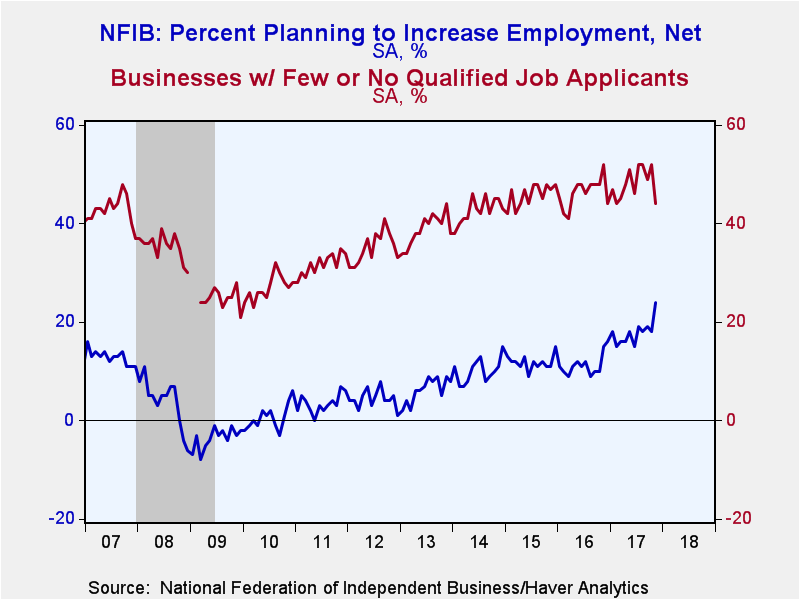

Perhaps most notable, 48% of firms expect the economy to improve, up 16 points from October's reading and 36 points from November 2016. Higher sales volume is expected by 34% of firms, compared with 21% in October and just 11% a year ago. Twenty-four percent plan to increase employment, up 6 points from October and 9 points from a year ago. There was a four-point improvement in the share of firms believing that now is a good time to expand, reaching 27% and up from just 11% in November 2016.

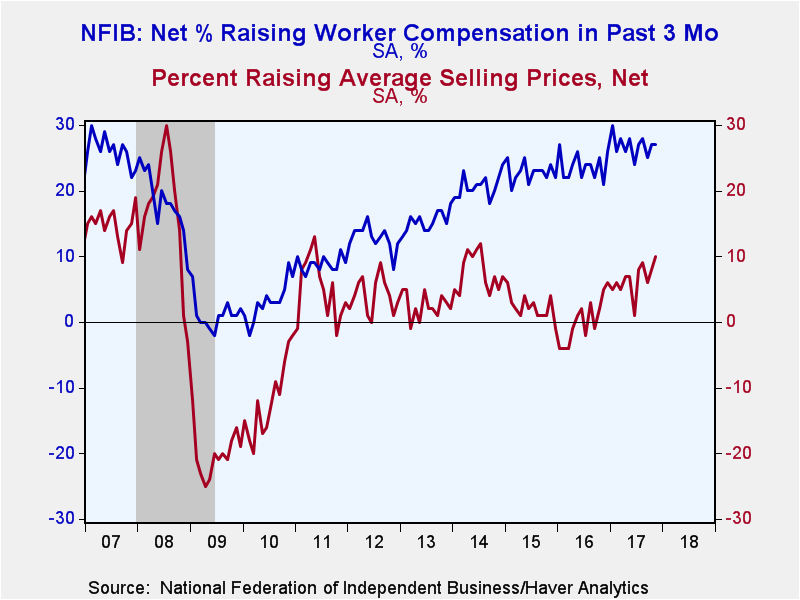

Other survey items moved more moderately. Selling price increases remain modestly positive, with 10% of firms raising them in November, up from 8% in October and 5% a year ago. This is, though, the largest share raising prices since July 2014. More firms plan to raise prices, 23%, up from October's 22% and the largest since 24% in December 2016. Twenty-seven percent raised worker compensation in recent months, the same amount as in October and up from 21% a year ago; the number planning to raise compensation decreased, however, to 17% from 21% the previous month, although it was a bit firmer than the 15% a year ago. Labor supply seemed less constrained in November, with 44% of firms reporting few or no qualified applicants for openings, down from 52% in October and in the year-ago month. Credit remained available, with just 4% of firms reporting more constrained credit conditions, the same as the month before and the year-ago month.

This survey inquires about problems facing small business. Government issues are the most widespread: taxes are the biggest problem for 22% of firms, up from 21% in October and 19% in November 2016, while government requirements burdened 16% of firms in November, up from 14% in October and down from 18% a year ago. Labor quality is a major issue for 18% of firms, down from 20% in October and up from 16% a year ago; labor costs, though, are a major concern for just 7% of companies, up slightly from 6% the month before and the year before. Poor sales bother just 11% of firms, a bit more than October's 10%, but less than 12% a year ago; these compare to 32% during the slow periods of 2009 and 31% in 2010. Competition from large firms is the biggest problem for 8% of small firms, up from 7% a month ago and a year ago. As might be inferred from the current environment, inflation is mentioned by just 3% of firms, up from 2% in October and the same as the 3% a year ago. Similarly, just a small number report that financial conditions and interest rates are problematic, 2% in November and in the month-ago and year-ago periods. Insurance costs and availability are mentioned by 10% of firms in the November tally, down from 11% in October and the same as the year-ago 10%.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Nov | Oct | Sep | Nov'16 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 107.5 | 103.8 | 103.0 | 98.4 | 95.3 | 96.1 | 95.6 |

| Firms Expecting Economy To Improve | 48 | 32 | 31 | 12 | -5 | -5 | -5 |

| Firms Expecting Higher Real Sales | 34 | 21 | 15 | 11 | 5 | 8 | 11 |

| Firms Reporting Now is a Good Time To Expand the Business | 27 | 23 | 17 | 11 | 10 | 12 | 10 |

| Firms Planning to Increase Employment | 24 | 18 | 19 | 15 | 11 | 12 | 10 |

| Firms With Few or No Qualified Applicants For Job Openings (%) | 44 | 52 | 49 | 52 | 46 | 46 | 43 |

| Firms Reporting That Credit Was Harder To Get | 4 | 4 | 6 | 4 | 5 | 4 | 6 |

| Firms Raising Average Selling Prices | 10 | 8 | 6 | 5 | 0 | 2 | 8 |

| Firms Raising Worker Compensation | 27 | 27 | 25 | 21 | 24 | 23 | 21 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates