Global| Oct 10 2017

Global| Oct 10 2017U.S. Small Business Optimism Wanes

by:Tom Moeller

|in:Economy in Brief

Summary

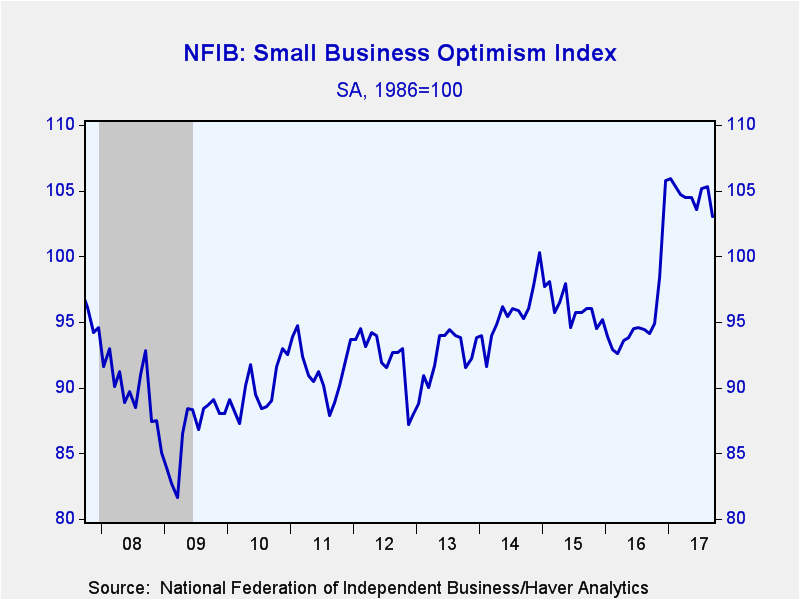

The National Federation of Independent Business reported that its Small Business Optimism Index declined to 103.0 during September following little change during August. In was the lowest level of confidence since November, but [...]

The National Federation of Independent Business reported that its Small Business Optimism Index declined to 103.0 during September following little change during August. In was the lowest level of confidence since November, but remained up y/y.

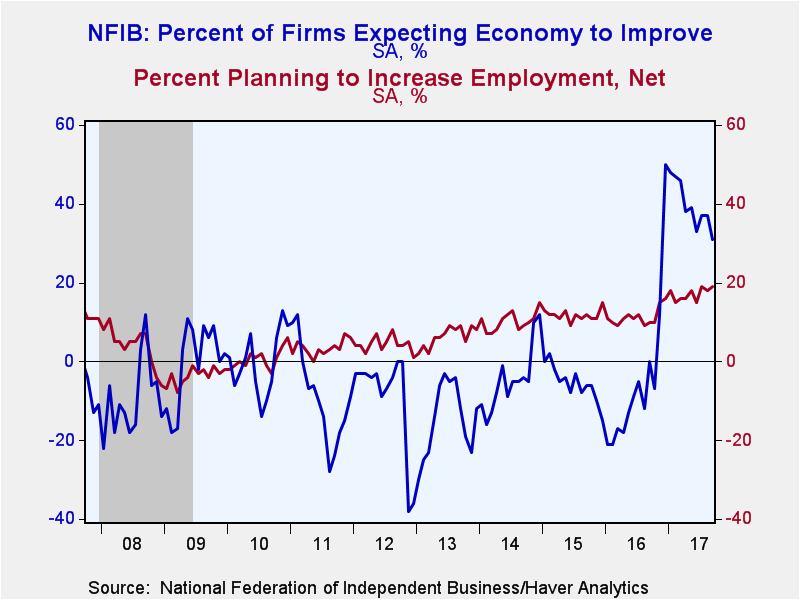

A greatly lessened 17% of firms reported that now was a good time to expand the business and a lower 15% of firms reported that they were expecting higher real sales. Both of these indications were the weakest since November. A much weaker 27% of firms planed to make capital outlays in the next 3-to-6 months. Showing a lesser decline was the percentage of firms which were expecting the economy to improve. Moving higher was the percentage of firms indicating that credit was harder to get.

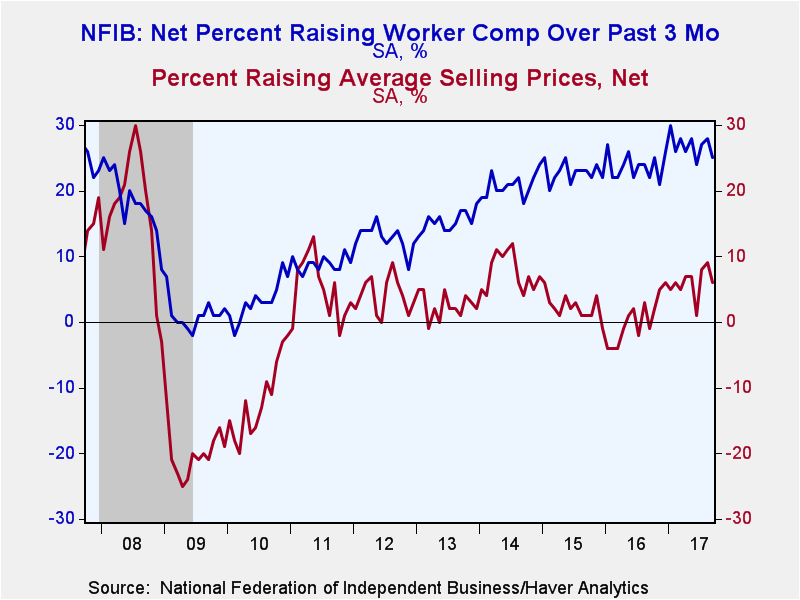

On the labor front, an improved 19% of firms planned to raise employment, equaling the most since November 2006. Finding employees was a little easier m/m as a lessened 49% of firms indicated they had few or no qualified candidates to fill job openings, but that remained up from 46% during all of last year. Twenty-five percent of firms raised worker compensation. That's below a high of 30% in January, but up from 24% three months ago. A higher 18% of firms planned to raise compensation in the next three months.

On the inflation front, a lessened six percent of firms actually raised average selling prices last month following strength in July and August. The percentage of firms planning to raise average selling prices also eased to 19% and has moved sideways this year.

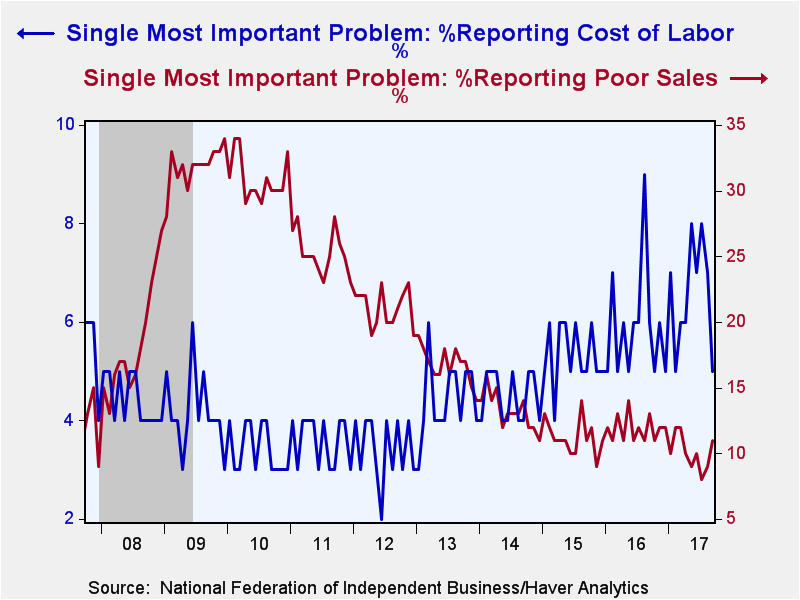

A slightly higher 21% of firms indicated that taxes were the single most important problem. A sharply higher 19% felt challenged by the quality of labor, equaling the most since 2001. A steady 16% reported that government requirements were the largest single problem. A greatly lessened seven of firms reported insurance cost & availability as the largest hurdle, but a slightly higher eleven percent of firms indicated that poor sales were the largest single problem. A strengthened eight percent reported competition from large businesses as the largest problem. A greatly lessened five percent felt that cost of labor was the largest single problem. Inflation was reported as the largest problem by a low two percent of respondents.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Sep | Aug | Jul | Sep'16 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 103.0 | 105.3 | 105.2 | 94.1 | 95.3 | 96.1 | 95.6 |

| Firms Expecting Economy To Improve | 31 | 37 | 37 | 0 | -5 | -5 | -5 |

| Firms Expecting Higher Real Sales | 15 | 27 | 22 | 4 | 5 | 8 | 11 |

| Firms Reporting Now is a Good Time To Expand the Business | 17 | 27 | 23 | 7 | 10 | 12 | 10 |

| Firms Planning to Increase Employment | 19 | 18 | 19 | 10 | 11 | 12 | 10 |

| Firms With Few or No Qualified Applicants For Job Openings (%) | 49 | 52 | 52 | 48 | 46 | 46 | 43 |

| Firms Reporting That Credit Was Harder To Get | 6 | 3 | 3 | 5 | 5 | 4 | 6 |

| Firms Raising Average Selling Prices | 6 | 9 | 8 | -1 | 0 | 2 | 8 |

| Firms Raising Worker Compensation | 25 | 28 | 27 | 22 | 24 | 23 | 21 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.