Global| May 12 2020

Global| May 12 2020U.S. Small Businesses Optimism Drops to Seven-Year Low

Summary

• NFIB Small Business Optimism Index falls to a seven-year low 90.7 in April. • Nine out of ten components decline except expectations economy will improve. • Deflationary pressures set in with a record net 3% of firms planning on [...]

• NFIB Small Business Optimism Index falls to a seven-year low 90.7 in April.

• Nine out of ten components decline except expectations economy will improve.

• Deflationary pressures set in with a record net 3% of firms planning on reducing prices.

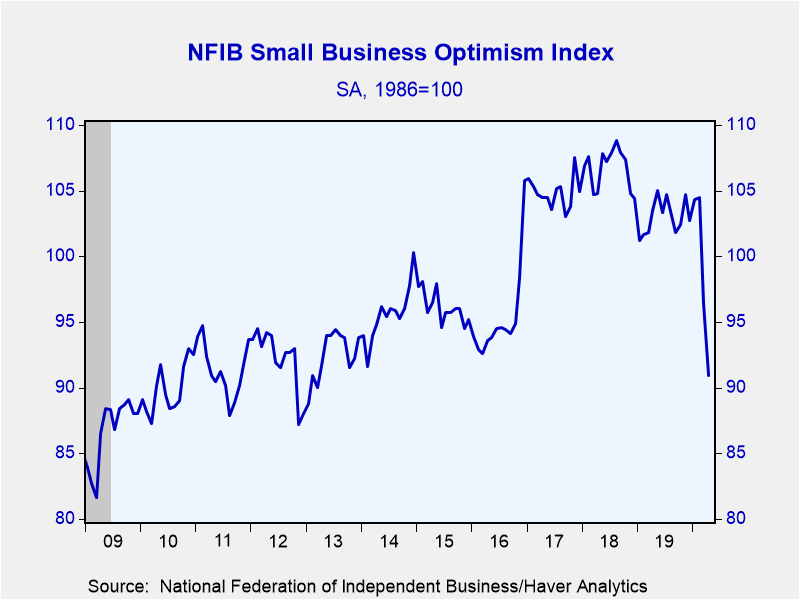

The National Federation of Independent Business (NFIB) Small Business Optimism Index for April fell 5.5 points to 90.9, its lowest level since March 2013. This follows a record 8.1 point drop in March.

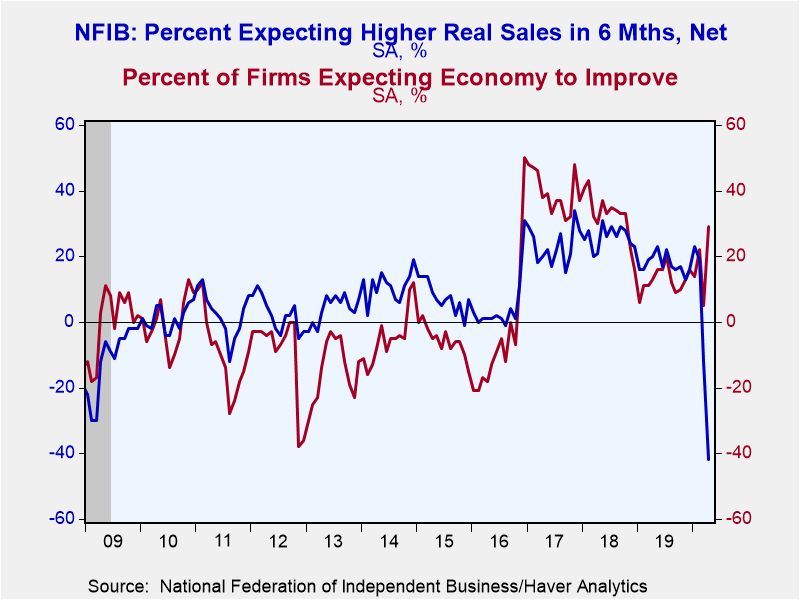

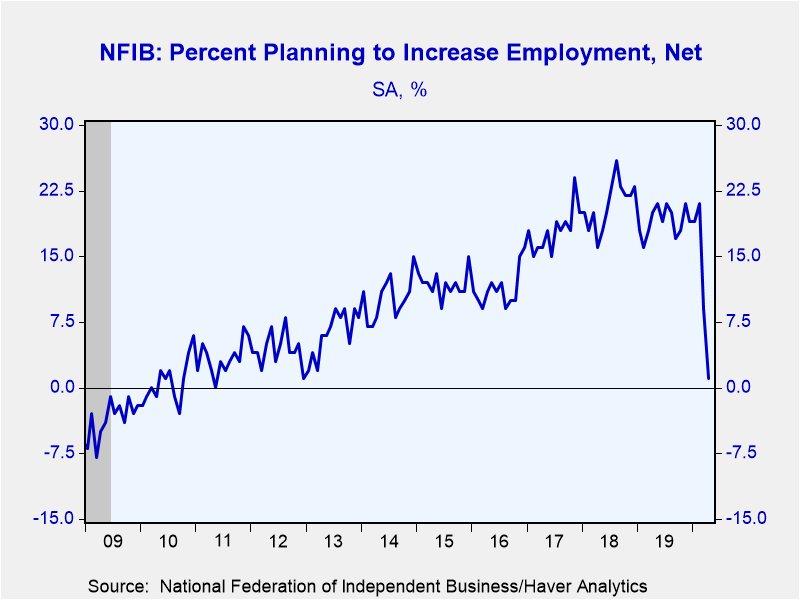

Nine out of ten components of the index fell, led by 30 percentage point drop in the share of firms expecting higher real sales to a record -42% (data goes back to 1973). This implies that a net 42% of firms anticipate sales to decline over the next three months. A net 1% of firms planned on increasing employment in April – a nine year low – down from 9% in March. Only a net 3% of firms felt it was a good time to expand their business, the third lowest level on record; the first and second occurred during the 1980 and 2008-09 recessions respectively.

A net 29% of firms now expect the economy to improve in six months, up from 5% in March. This is the highest level since late 2018. Interestingly, after rising to a three-year high of 92, the small business uncertainty index fell to 75 with the NFIB noting “most owners were quite certain that the economy will weaken in the near-term”.

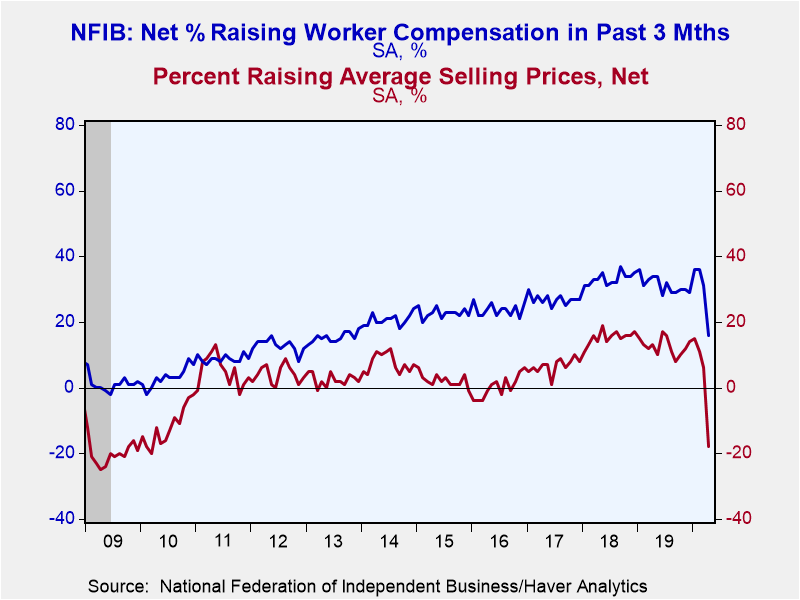

Deflationary pressures set in with a net -18% of firms raising average selling prices in April down from +6% in March. This is the lowest level in ten years. A record net 3% of small planned on reducing prices. Wage pressures declined with a net 16% of firms raising wages over the next three months – a seven year low- down from 31% in March. The share of firms expecting to increase compensation decreased to 7% from 16%.

Surprisingly only 4% of firms noted that credit was harder to get, up from 3% last month. However, the NFIB noted “owners are starting to benefit from the PPP and EIDL small business loan programs as they try to reopen and keep employees on staff”.

This survey inquires about problems facing small business. The most pressing problem in April was poor sales; a seven-year high 19% of firms, up from 9% in March. In contrast, access to quality labor, which had been the biggest problem, fell from 24% to 15%. A 28-year-high 14% percent of firms reported an undefined “other” as their greatest issue.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Apr | Mar | Feb | Apr'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 90.9 | 96.4 | 104.5 | 103.5 | 103.0 | 106.7 | 104.9 |

| Firms Expecting Economy to Improve | 29 | 5 | 22 | 13 | 13 | 32 | 39 |

| Firms Expecting Higher Real Sales | -42 | -12 | 19 | 20 | 18 | 26 | 23 |

| Firms Reporting Now Is a Good Time to Expand the Business | 3 | 13 | 26 | 25 | 25 | 30 | 23 |

| Firms Planning to Increase Employment | 1 | 9 | 21 | 20 | 19 | 21 | 18 |

| Firms With Few or No Qualified Applicants for Job Openings (%) | 41 | 47 | 52 | 49 | 52 | 51 | 49 |

| Firms Reporting that Credit Was Harder to Get | 4 | 3 | 1 | 4 | 4 | 4 | 4 |

| Firms Raising Average Selling Prices | -18 | 6 | 11 | 13 | 13 | 15 | 7 |

| Firms Raising Worker Compensation | 16 | 31 | 36 | 34 | 31 | 33 | 27 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates