Global| Nov 04 2016

Global| Nov 04 2016U.S. Trade Deficit Narrows in September

Summary

The U.S. trade deficit in goods and services decreased to $36.4 billion in September from a marginally revised $40.5 billion in August. The Action Economics Forecast Survey expected a $38.7 billion deficit. Exports rose 0.6% (0.9% [...]

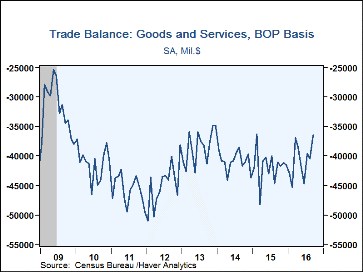

The U.S. trade deficit in goods and services decreased to $36.4 billion in September from a marginally revised $40.5 billion in August. The Action Economics Forecast Survey expected a $38.7 billion deficit.

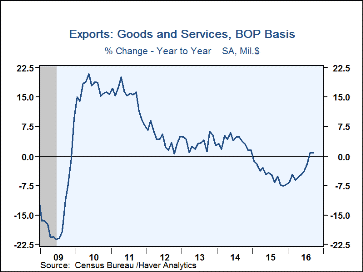

Exports rose 0.6% (0.9% y/y) in September following a 1.0% rise in August. Exports of goods also rose 0.6% (0.4% y/y) after a 1.0% increase. Nonauto consumer goods showed the largest gain in September, 4.6% (-0.3% y/y). Capital goods exports rose 3.7% (-3.2% y/y), industrial supplies & materials 1.5% (+0.3% y/y) and "other" goods exports 2.0% (+1.5% y/y). On the downside, automotive vehicle & parts reversed an August increase, as they fell 3.5% (-2.4% y/y) and foods, feeds & beverages were down 12.1% (+20.6% y/y). Services exports, as with the total and total goods, rose 0.6% (+1.3% y/y) in September after their 0.7% increase in August. Maintenance & repair services were up 4.4% (+15.9% y/y) and travel was up 2.0% (+5.1% y/y). Other categories of services exports, including finance, insurance and information had modest increases of 0.2% to 0.4%. Transport services did decrease 0.9% (-2.9% y/y), intellectual property revenue was down 0.4% (-4.3% y/y) and government services were off 0.2% (-3.9% y/y).

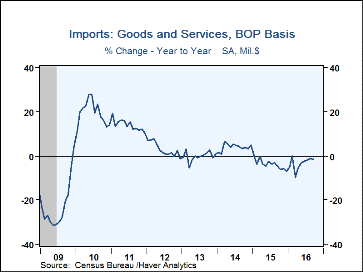

Total imports fell 1.3% (-1.3% y/y) in September after their 1.2% rise in August. Imports of goods decreased 1.0% (-2.0% y/y) following a 0.7% rise. Petroleum product imports were off 0.5% (-6.2% y/y), as the price per barrel of crude oil edged down to $39.02 from $39.38. Nonpetroleum goods were also down, these by 1.0% (-1.6% y/y). Among major categories, capital goods led the decline, falling 3.4% (-1.7% y/y) and reversing their August gain of 2.4%. Nonauto consumer goods imports fell 1.7% (-7.5% y/y), and industrial supplies & materials edged down 0.1% (-0.5% y/y). "Other" goods imports fell 4.7% (+2.5% y/y). Foods, feeds & beverages were unchanged in September (+1.9% y/y); autos & parts had the only gain, but it was a sizable one at 4.1% (+2.9% y/y). Services imports decreased 2.4% (+2.3% y/y), offsetting a good part of their August gain of 3.7%. The swing was largely accounted for by the Summer Olympics, which had pushed intellectual property payments up 37.7% in August; that item then dropped 27.0% in September. Otherwise, maintenance & repair, transport and travel imports all showed roughly 1.0% gains in September.

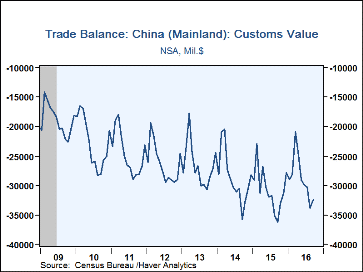

By country, the trade deficit with China improved a bit to $32.5 billion in September from $33.9 billion the month before. U.S. exports to China gained 1.8% in the month (+1.4% y/y), and imports from China fell 2.8% (-8.1% y/y). The trade deficit with Japan improved to $4.8 billion from $6.0 billion in August. Exports rose 2.1% (19.6% y/y), while imports declined 9.1% in the month, putting y/y growth at 5.2%. The trade deficit with the European Union (EU-28) decreased to $10.2 billion, as exports rose 6.0% (+2.0% y/y) and imports fell 6.7% (-3.7% y/y). These country data are not seasonally adjusted.

The international trade data can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in the AS1REPNA.

| Foreign Trade in Goods & Services (Current Dollars) | Sep | Aug | Jul | Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit | $36.4 bil. | $40.5 bil. | $39.5 bil. | $41.1 bil. (9/15) |

$500.4 bil. | $490.2 bil. | $461.9 bil. |

| Exports of Goods & Services (% Chg) | 0.6 | 1.0 | 1.9 | 0.9 | -4.9 | 3.6 | 3.4 |

| Imports of Goods & Services (% Chg) | -1.3 | 1.2 | -0.7 | -1.3 | -3.7 | 4.0 | 0.0 |

| Petroleum (% Chg) | -0.5 | 2.1 | -4.9 | -6.2 | -45.5 | -9.6 | -11.0 |

| Nonpetroleum Goods (% Chg) | -1.0 | 0.6 | -0.7 | -1.6 | 2.2 | 6.5 | 2.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.