Global| Oct 05 2018

Global| Oct 05 2018U.S. Trade Deficit Widens for Third Consecutive Month in August

by:Sandy Batten

|in:Economy in Brief

Summary

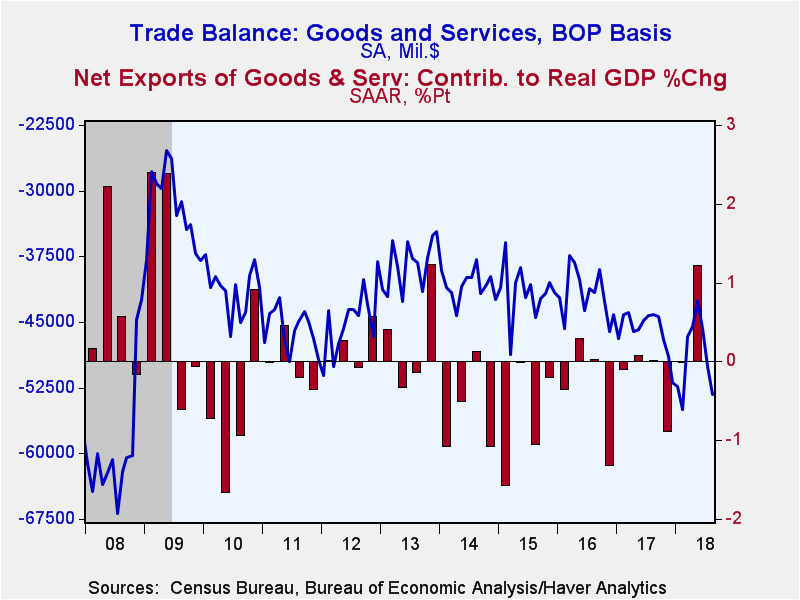

The U.S. trade deficit in goods and services widened to $53.24 billion in August from a slightly downwardly revised $50.04 billion in July. This was the widest deficit since February and in line with the advance trade report. A [...]

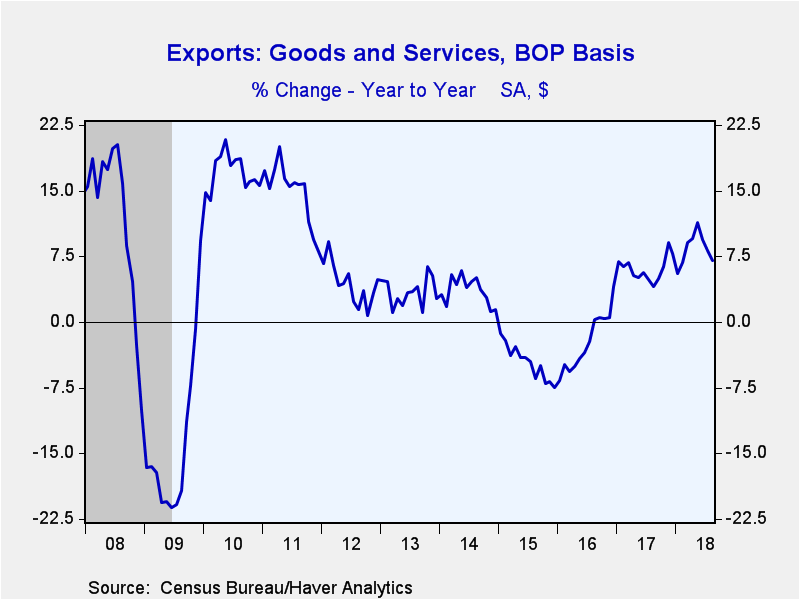

The U.S. trade deficit in goods and services widened to $53.24 billion in August from a slightly downwardly revised $50.04 billion in July. This was the widest deficit since February and in line with the advance trade report. A deficit of $53.0 billion had been expected in the Action Economics Forecast Survey. Exports fell 0.8% m/m (+7.1% y/y) in August, the third consecutive monthly decline. Imports were up 0.6% m/m (9.6% y/y), their fourth consecutive monthly increase.

The deficit on goods trade widened to $76.7 billion from $73.2 billion in July. Exports of goods fell 1.4% m/m (+8.0% y/y) following a 1.6% m/m decline in July. A 5.2% m/m drop in exports of industrial supplies led the overall decline in exports. Foods, feeds and beverages exports fell 9.2% m/m while consumer goods excluding autos jumped 10.3% m/m.

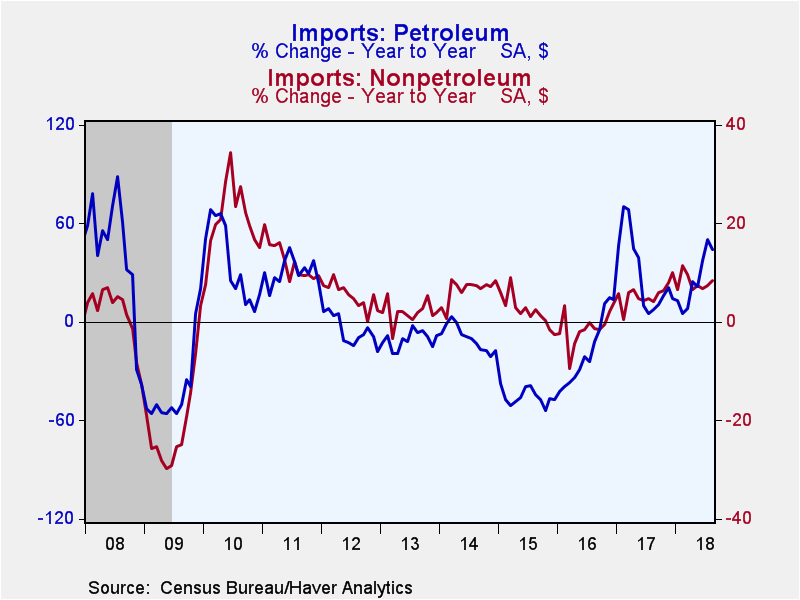

Imports of goods rose 0.8% m/m (11.1% y/y) in August following a 0.9% increase. Auto imports gained 3.3% m/m on top of a 1.7% m/m increase in July. Imports of consumer goods rebounded 1.6% m/m in August following a 1.5% m/m decline in July. Petroleum imports advanced 0.6% m/m in August to stand 44.1% higher than a year ago. The per barrel cost of crude oil slipped to $62.63 (-3.1% m/m, +41.9% y/y), its first decline in five months but remained elevated relative to its recent past.

The surplus on services trade edged higher to $23.5 billion in August from $23.1 billion in July. Services exports increased 0.3% m/m (5.4% y/y), the same monthly rise as in July. Imports of services slipped 0.3% m/m in August (+3.1% y/y), the first monthly decline in five months.

The real (inflation-adjusted) trade balance widened to $86.3 billion (chain weighted 2012$) in August from $82.4 billion in July. This put the real trade deficit in the third quarter on track to widen more than it had narrowed in Q2. The narrowing in Q2 added 1.2%-points to overall GDP growth. So, the performance of trade so far in Q3 puts it on track to subtract more than 1-1/2%-points from Q3 GDP growth.

The politically sensitive goods trade deficit with China widened to $34.4 billion (SA) in August from $34.1 billion in July. U.S. exports to China slumped 11.3% m/m (-14.6% y/y) while imports slipped 2.1% m/m (+5.4% y/y).

The international trade data can be found in Haver’s USECON database. Detailed figures are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in AS1REPNA.

| Foreign Trade in Goods & Services (Current $) | Aug | Jul | Jun | Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit ($ bil.) | 53.24 | 50.04 | 45.74 | 44.16 (8/17) |

552.28 | 502.00 | 498.53 |

| Exports of Goods & Services (% Chg) | -0.8 | -1.0 | -0.7 | 7.1 | 6.1 | -2.2 | -4.6 |

| Petroleum (% Chg) | -11.5 | 2.6 | 8.5 | 50.9 | 41.2 | -9.6 | -32.5 |

| Imports of Goods & Services (% Chg) | 0.6 | 0.9 | 0.7 | 9.6 | 6.8 | -1.7 | -3.5 |

| Petroleum (% Chg) | 0.6 | 3.8 | 4.2 | 44.1 | 27.2 | -19.5 | -45.5 |

| Nonpetroleum Goods (% Chg) | 0.8 | 0.6 | 0.4 | 8.4 | 5.6 | -1.2 | 2.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates