Global| Dec 06 2018

Global| Dec 06 2018U.S. Trade Deficit Widens to 10-Year High; Record Goods Shortfall

Summary

The U.S. trade deficit in goods and services widened for the fifth consecutive month to $55.49 billion in October from an upwardly revised $54.56 billion in September. This was the largest deficit since October 2008. A deficit of [...]

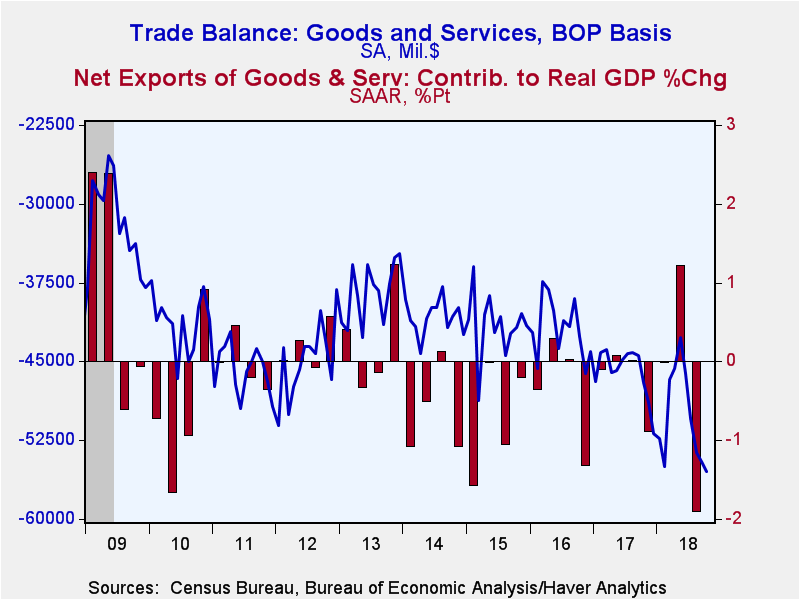

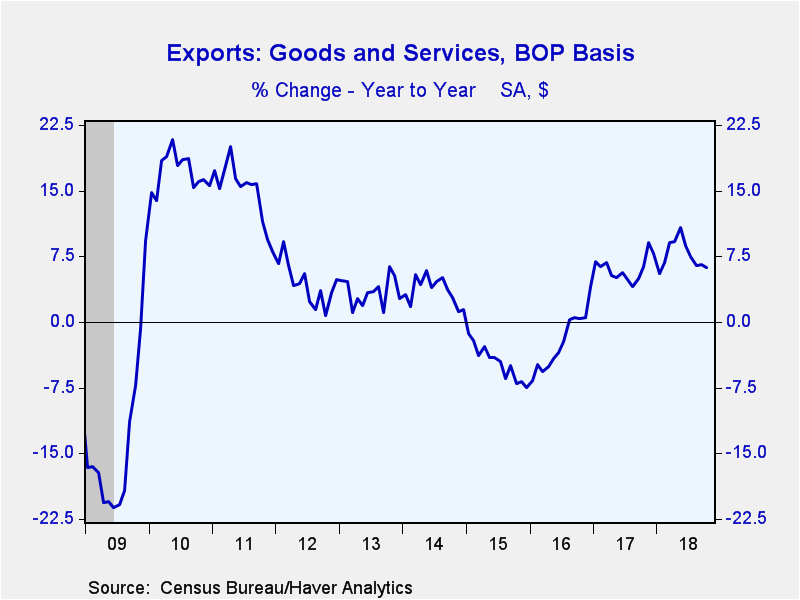

The U.S. trade deficit in goods and services widened for the fifth consecutive month to $55.49 billion in October from an upwardly revised $54.56 billion in September. This was the largest deficit since October 2008. A deficit of $54.9 billion had been expected by the Action Economics Forecast Survey. Exports edged down by 0.1% month-on-month (+6.3% year-over-year), while imports rose 0.2% (8.5% y/y) in October. Though the difference between the change in exports and imports is small, the trade deficit widened so much because the U.S. imports roughly 25% more than it exports.

The deficit in goods trade increased to a record $78.1 billion in October from $77.3 billion (data goes back to 1992). Exports of goods decreased 0.3% m/m (+8.1% y/y). Foods, feeds and beverage exports dropped 6.1% (-2.0% y/y), the fifth consecutive monthly decline. Auto exports fell 1.8% while non-auto capital goods were down 1.1%. Consumer goods ex. food and autos grew 1.0% and industrial supplies (which include oil) were up 0.6%. Exports of petroleum increased as both the price and quantity rose in October.

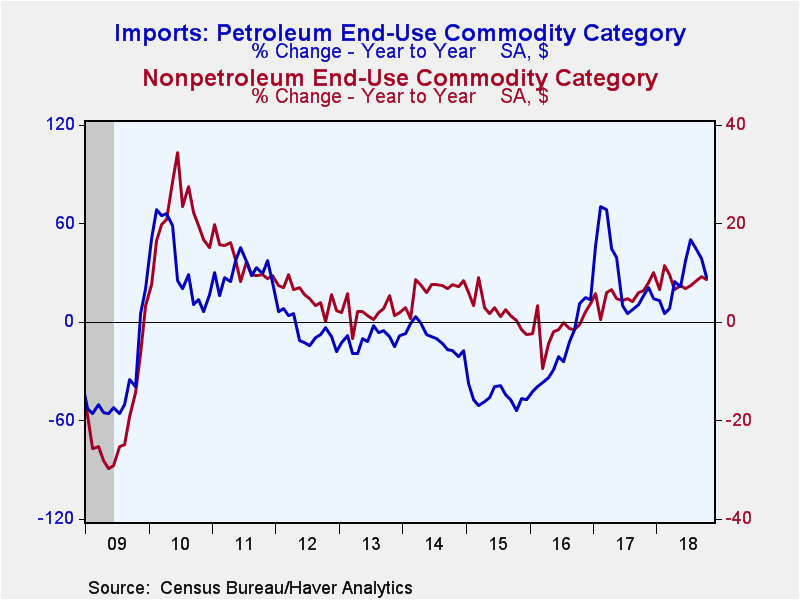

Imports of goods increased 0.2% (10.1% y/y) in October, the sixth consecutive monthly gain. Healthy growth in consumer goods, autos, as well as foods, feeds and beverages -- 3.5%, 2.3% and 1.3% respectively -- were somewhat offset by a 5.3% drop in imports of capital goods. Industrial supplies declined 0.5% driven by a 3.6% decrease in the quantity of petroleum imports. The inflation-adjusted petroleum trade balance was the narrowest since the series began in 1994.

The surplus on services trade edged down to $22.6 billion in October from $22.7 billion. Services exports increased 0.1% m/m (2.8% y/y). Imports of services rose 0.4% (1.6% y/y).

The real (inflation-adjusted) goods trade balance widened to a record $87.9 billion (chain weighted 2012$) in October from $87.2 billion in September (series goes back to 1994). This data suggests that the trade balance will be a drag on fourth quarter GDP growth.

The politically sensitive goods trade deficit with China rose to $38.2 billion (seasonally adjusted) in October. This is the largest deficit recorded outside of the port-strike related $40.5 billion reading in March 2015. U.S. exports to China fell a record 25.9% (-29.7% y/y) after a 4.4% gain in September. Imports declined 4.0% (+6.4% y/y) following a 7.8% rise.

The international trade data as well as oil prices can be found in Haver's USECON database. Detailed figures on international trade are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in AS1REPNA.

| Foreign Trade in Goods & Services (Current $) | Oct | Sep | Aug | Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit ($ bil.) | 55.49 | 54.56 | 53.69 | 46.99 (10/17) |

552.28 | 502.00 | 498.53 |

| Exports of Goods & Services (% Chg) | -0.1 | 1.5 | -0.7 | 6.3 | 6.1 | -2.2 | -4.6 |

| Imports of Goods & Services (% Chg) | 0.2 | 1.5 | 0.7 | 8.5 | 6.8 | -1.7 | -3.5 |

| Petroleum (% Chg) | -2.6 | -1.6 | 0.6 | 26.9 | 27.2 | -19.5 | -45.5 |

| Nonpetroleum Goods (% Chg) | 0.4 | 2.1 | 0.8 | 8.6 | 5.6 | -1.2 | 2.2 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates