Global| Mar 05 2021

Global| Mar 05 2021U.S. Trade Deficit Widens to $68.2 Billion in January

Summary

• Exports grow 1%. Imports rise 1.2%. • This report suggests little impact on Q1 GDP forecasts. The U.S. trade deficit in goods and services widened to $68.2 billion in January from a slight upwardly revised $67 billion deficit in [...]

• Exports grow 1%. Imports rise 1.2%.

• This report suggests little impact on Q1 GDP forecasts.

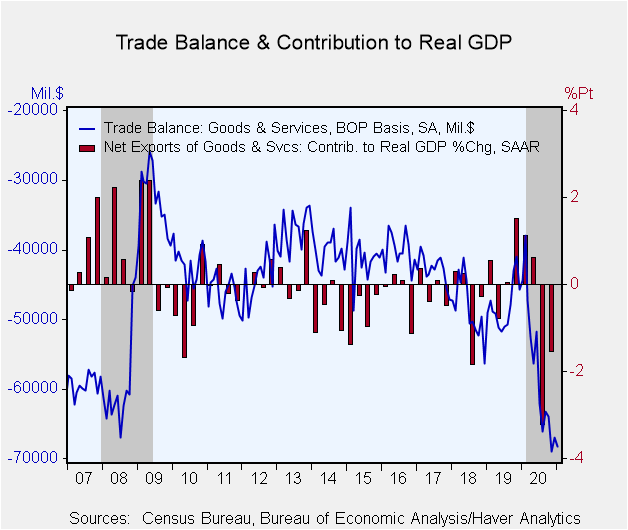

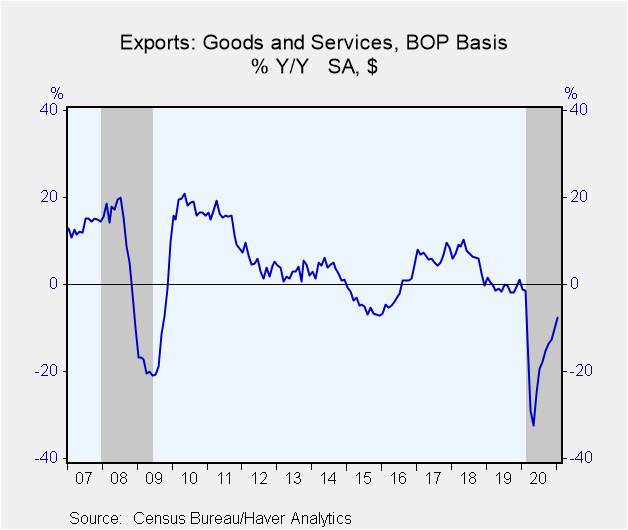

The U.S. trade deficit in goods and services widened to $68.2 billion in January from a slight upwardly revised $67 billion deficit in December (was $66.6 billion). The November deficit stood at $69.0 billion. The Action Economics Forecast Survey had anticipated a $67.3 billion deficit. Given the relatively small changes in the monthly deficits, the January report is unlikely to significantly change one's Q1 GDP estimates. Exports gained 1% (-7.6% year-over-year), while imports rose 1.2% (+3.2% year-over-year).

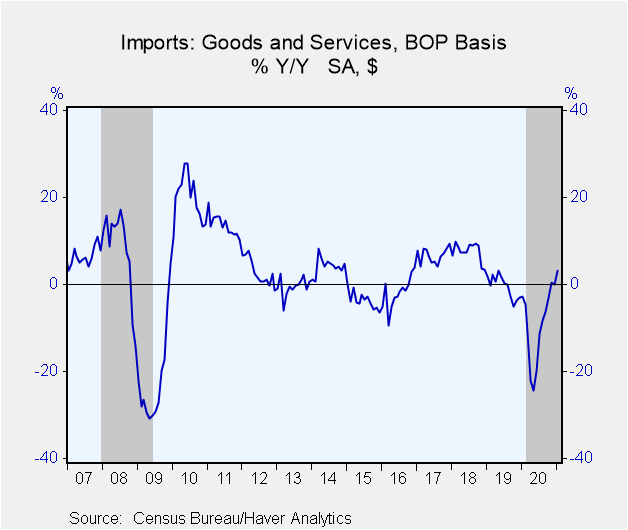

The nominal deficit in goods trade rose to $85.4 billion in January from $84.1 billion in December. The advanced trade data reported earlier showed an $83.7 billion goods deficit. Exports of goods rose 1.6% (-1% year-over-year), with only two of the main categories posting monthly gains (industrial supplies and capital goods). Imports of goods rose 1.6% (+8.5% year-over-year). Four of the five major categories of goods imports increased and one declined. Petroleum import volumes rose 3.1% in January (-4.3% year-over-year. The real (inflation-adjusted) goods trade deficit rose to $96.5 billion (chained-weighted 2012$) in January from a downwardly-revised $95 billion in December.

The January surplus on trade in services rose to $17.2 billion from a slight downwardly-revised $17.2 billion in December (was $17.5 billion). The value of services exports declined 0.5% (-20.3% year-over-year), led by a 2.8% decline in travel (-68.8% year-over-year). Imports of services declined 0.9% over the month (-19.1% year-over-year), driven by declines in transport, travel and maintenance and repair services.

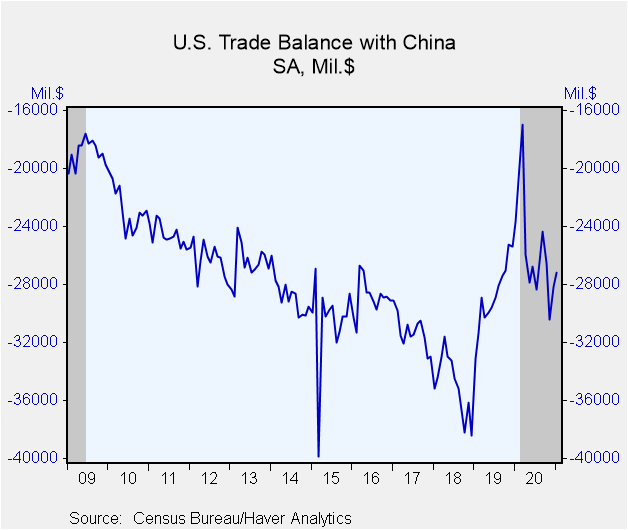

The goods trade deficit with China narrowed slightly in January to $27.2 billion from 28.1 billion in December. Exports were up 10.2% (+92.7 year-over-year) and imports rose 1% (+34% year-over-year). The trade deficits with the European Union stood at $20.1 billion and with Japan at $5.2 billion.

The international trade data, including relevant data on oil prices, can be found in Haver's USECON database. Detailed figures on international trade are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in AS1REPNA.

| Foreign Trade in Goods & Services (Current $) | Jan | Dec | Nov | Jan'20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit ($ bil.) | 68.21 | 66.97 | 69.04 | 44.38 | 681.70 | 576.86 | 579.94 |

| Y/Y% | |||||||

| Exports of Goods & Services (% Chg) | 1.0 | 3.4 | 1.2 | -7.6 | -15.9 | -0.4 | 6.4 |

| Imports of Goods & Services (% Chg) | 1.2 | 1.7 | 3.0 | 3.2 | -9.5 | -0.5 | 7.5 |

| Petroleum (% Chg) | 15.9 | 10.6 | 1.7 | -20.7 | -39.9 | -14.0 | 20.8 |

| Nonpetroleum Goods (% Chg) | 0.9 | 0.9 | 3.2 | 11.1 | -3.6 | -0.4 | 7.4 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).