Global| Sep 09 2016

Global| Sep 09 2016U.S. Wholesale Sales Slip While Inventories Are Unchanged in July

by:Sandy Batten

|in:Economy in Brief

Summary

Wholesale sector sales slipped 0.5% m/m (-1.0% y/y) in July following an outsize 1.7% m/m (revised from 1.9% m/m) jump in June. The Action Economics Survey had looked for a 0.2% m/m increase. Nondurable goods sales, which had led the [...]

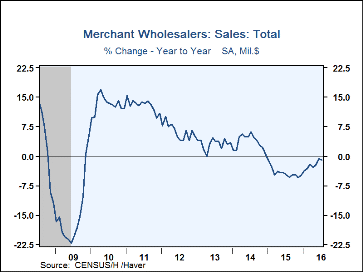

Wholesale sector sales slipped 0.5% m/m (-1.0% y/y) in July following an outsize 1.7% m/m (revised from 1.9% m/m) jump in June. The Action Economics Survey had looked for a 0.2% m/m increase. Nondurable goods sales, which had led the June jump, also led the July slide. They fell 1.0% m/m (-2.6% y/y) after a downwardly revised 2.2% m/m surge in June. Sales of petroleum and petroleum products slumped 3.5% m/m in July, nearly offsetting a 3.9% m/m jump in June. Sales fell generally across the major nondurable goods product groups. Durable goods purchases edged up 0.2% m/m (0.7% y/y) in July despite modest monthly declines in sales of motor vehicles and machinery. Furniture and lumber sales rebounded smartly in July after declines in June.

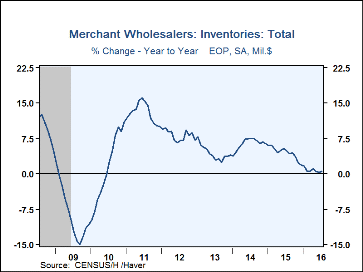

Inventories at the wholesale level were essentially unchanged in July (+0.5% y/y) from a slightly upwardly revised June level (though the 0.3% m/m increase initially reported for June was not revised). July inventories were also revised up slightly from the advance report released on August 26. Inventories of durables goods rose 0.3% m/m in July while inventories of nondurable goods slipped 0.3% m/m. Five of the major durable good product groups experienced a rise in inventories (led by 1.4% m/m rise in professional and commercial equipment inventories) with the remaining four groups experiencing a decline. The monthly decline in nondurable goods inventories was relatively widely spread across major product groups (led by a 2.0% decline in farm products raw materials).

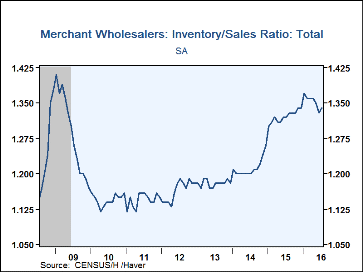

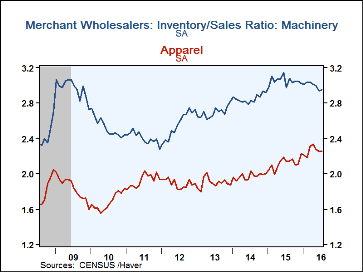

With sales slipping and inventories essentially unchanged, the inventory-to-sales ratio in the wholesale sector edged up to 1.34 in July from 1.33 in July. It had either declined or remained unchanged for five consecutive months. The expansion high was 1.37 reached in January 2016. The nondurable goods ratio rose to 1.04 in July from 1.03 in June while the durable goods ratio was unchanged at 1.65, well below its cycle peak of 1.72 (reached in August 2015).

The wholesale trade figures are available in Haver's USECON database. The Action Economic Survey results are contained in AS1REPNA.

| Wholesale Sector - NAICS Classification (%) | Jul | Jun | May | Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Inventories | 0.0 | 0.3 | 0.2 | 0.5 | 1.8 | 6.4 | 3.8 |

| Sales | -0.4 | 1.7 | 0.7 | -1.0 | -4.3 | 3.6 | 3.0 |

| I/S Ratio | 1.34 | 1.33 | 1.35 | 1.32 (Jul '15) | 1.32 | 1.21 | 1.18 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates