Global| Jun 04 2009

Global| Jun 04 2009U.S. Worker Productivity Increase Stronger, But Underlying Cost Pressures Mount

by:Tom Moeller

|in:Economy in Brief

Summary

Labor productivity in the nonfarm business sector was revised higher for last quarter to 1.5% (AR) from the initial estimate of a 0.8% increase. The Consensus expectation was for revision to 1.2% growth. (Earlier figures also were [...]

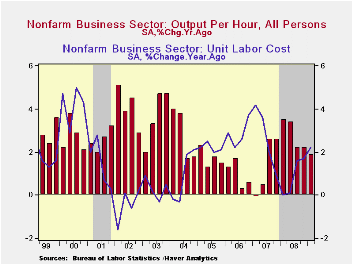

Labor productivity in the nonfarm business sector was revised higher for last quarter to 1.5% (AR) from the initial estimate of a 0.8% increase. The Consensus expectation was for revision to 1.2% growth. (Earlier figures also were revised slightly.) Productivity growth has weakened sharply with the current economic downturn. During the last nine months productivity has risen just 0.8% which is the weakest performance since early-2007. Nevertheless, any positive growth during a recessionary period contrasts with the declines in during the downturns of the 1950s through the 1980s.

Though productivity growth has slowed dramatically, businesses were quick in responding to the output shortfall by cutting employment and hours-worked. Output fell at a 7.6% annual rate last quarter after falling 8.8% during 4Q '08. These declines marked the quickest back-to-back since early 1958. However, businesses responded quickly by cutting employment & hours worked at a 9.0% rate last quarter and by 8.3% during 4Q.

The drop in productivity growth has hurt corporations' bottom lines due to the fact that growth in compensation costs has remained firm. It rose an upwardly revised 4.6% last quarter and that left y/y growth at 4.1%. Annually, growth in compensation has been roughly stable near the 4% level since 2001.

The combination of recently diminished productivity growth and stable, firm gains in compensation has increased costs. However, for last quarter growth in unit labor costs was revised down slightly to 3.0% following the 5.1% jump during 4Q. The increases raised the six-month growth in costs to a downwardly revised 4.0% versus just 0.9% during all of last year.

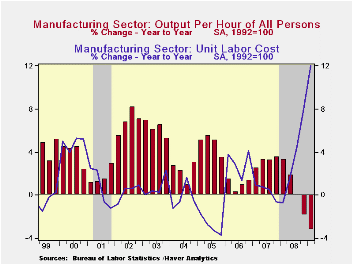

In the factory sector, the pressure on corporations' bottom lines has been more intense. Worker productivity was revised up slightly but it still fell 2.7% during 1Q (-3.2% y/y), down for the fourth consecutive quarter. Year-to-year, the drop in productivity came as output fell faster (-13.9%) than hours worked (-11.0%). That decline in productivity growth has outpaced firms' ability to cut compensation costs. In fact, there's been no cut at all. Compensation growth of 13.4% last quarter lifted the y/y gain to 8.4%, nearly double last year's 4.1% advance. As a result, unit labor cost growth in the factory sector surged again. The 1Q increase of 16.6% lifted the annual gain to 12.0% which compares to just a 3.2% gain during all of last year.

The productivity & cost figures are available in Haver's USECON database.

Today's remarks at the Federal Reserve Board Conference on Financial Markets and Monetary Policy by Fed Chairman Ben S. Bernanke are available here.

| Nonfarm Business Sector (SAAR, %) | 1Q '09 (Revised) | 4Q '08 | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Output per Hour | 1.6 | -0.6 | 1.9 | 2.8 | 1.4 | 0.9 |

| Compensation per Hour | 4.6 | 4.5 | 4.1 | 3.7 | 4.1 | 3.8 |

| Unit Labor Costs | 3.0 | 5.1 | 2.2 | 0.9 | 2.7 | 2.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates