Global| Jan 23 2007

Global| Jan 23 2007UK CBI Industrial Survey: Lower Exports and Price Rises Ahead

Summary

In the current survey, the British industrialists surveyed quarterly by the Confederation of Business Industries (CBI) were less pessimistic regarding the general business situation than they had been last October. They were, however, [...]

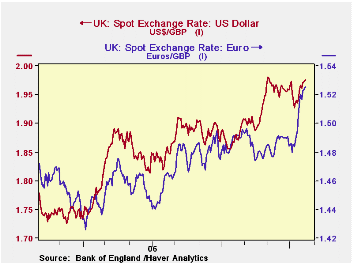

In the current survey, the British industrialists surveyed quarterly by the Confederation of Business Industries (CBI) were less pessimistic regarding the general business situation than they had been last October. They were, however, more pessimistic regarding export prospects for the next twelve months. This overall impression is due in part to the volume of new orders. The percent balance on the volume of total new orders over the past three month rose from -5% to 10% and expectations for the next 3 months are for an even higher balance of 15%. The respondents to the survey see more improvement in domestic orders than in export orders, both for the past three months and for the next three month as can be seen in the table below. Part of the reason for the dampening of export expectations is the strengthening of the pound against the dollar and the euro as can be seen in the first chart.

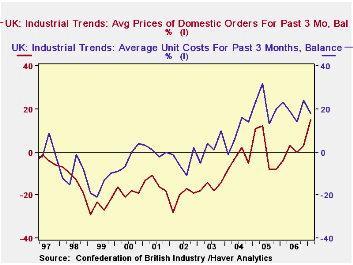

One of the most notable details of the current survey was the increase in the balance between those raising prices over the past three months and those lowering them. The percent balance was 15%, an increase of 12 percentage points from the 3% of the October survey and the highest since July, 1995. At the same time, the balance between those experiencing higher costs and those experiencing lower costs was 18%, down from 24% in the October survey.

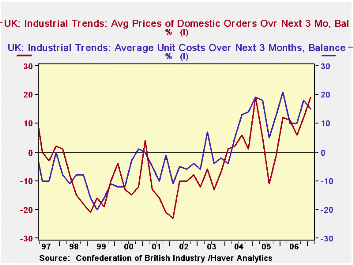

As a result of these trends, the excess of costs over prices was the smallest recorded over the past 10 years as can be seen in the second chart. For the next three months, 19% more respondents expect prices to rise than to fall and 15% more expect costs to rise than to fall. This is the first time since the first quarter of 2004, that the percent balance of those expecting price increases in the three months ahead will exceed the percent balance of those expecting cost increases, as can be seen in the third chart.

These trends auger well for profits, but they raise concerns for inflation and the possibility of further interest rate rises. The December inflation rate of 3.0% prompted the unexpected rise in the Bank of England's core interest rate from 5.00% to 5.25% on January 11, 2007.

| CBI INDUSTRIAL SURVEY (% Balances) | Q1 07 | Q4 06 | Q1 06 | Q/Q dif | Y/Y dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Optimism General Business Situation | -7 | -10 | -14 | 3 | 7 | -8 | -19 | 7 |

| Optimism Export Situation Next 12 mos | -2 | 1 | -5 | -3 | 3 | 1 | -6 | 7 |

| Prices past 3 mos | 15 | 3 | -4 | 12 | 19 | 1 | 2 | -4 |

| Costs past 3 mos | 18 | 24 | 23 | -6 | -5 | 20 | 22 | 9 |

| Prices next 3 mos | 19 | 12 | 12 | 7 | 7 | 10 | 3 | 3 |

| Costs next 3 mos | 15 | 18 | 21 | -3 | -6 | 15 | 14 | 7 |

| Total Orders past 3 mos | 10 | -5 | -8 | 15 | 18 | -2 | -11 | 9 |

| Total Orders next 3 mos | 15 | 3 | -2 | 12 | 17 | 4 | 1 | 8 |

| Export orders past 3 mos | 2 | -1 | -5 | 3 | 7 | -1 | -7 | 1 |

| Export orders next 3 mos | 6 | 3 | -2 | 3 | 8 | 4 | -2 | 4 |

| Domestic orders past 3 mos | 7 | -11 | -15 | 18 | 22 | -8 | -15 | 5 |

| Domestic orders next 3 mos | 8 | 0 | -9 | 8 | 17 | 1 | -2 | 7 |