Global| Jun 11 2014

Global| Jun 11 2014UK Claimant Count Continues to Decline

Summary

The UK economy continues to make progress. According to the National Institute of Economic and Social Research (NIESR), a respected think tank in the United Kingdom, the UK economy has surpassed its pre-recession peak reached in [...]

The UK economy continues to make progress. According to the National Institute of Economic and Social Research (NIESR), a respected think tank in the United Kingdom, the UK economy has surpassed its pre-recession peak reached in January 2008. The NIESR predicts just under 1% growth in the second quarter for the UK.

The UK economy continues to make progress. According to the National Institute of Economic and Social Research (NIESR), a respected think tank in the United Kingdom, the UK economy has surpassed its pre-recession peak reached in January 2008. The NIESR predicts just under 1% growth in the second quarter for the UK.

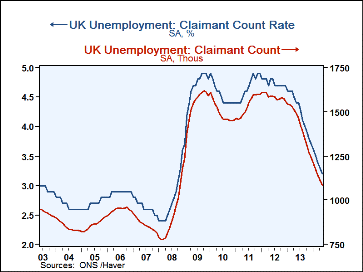

As the UK economy shows improvement, the gains in the labor market continue. The unemployment rate for claimants has fallen to 3.2% in May from 3.3% in April. This rate is down from a cycle high of 4.9%. The UK unemployment rate, the latest available for March, is down to 6.6%. The International Labor Organization (ILO) reported that the UK unemployment rate has declined to 6.6% for the three-month period ending in April from 7.2% during the previous November-January period. That's a sharp drop.

The number of unemployed fell by 25,000 in May after falling by 30,000 in April as the job market progress continues. The unemployment rate for claimants is in the bottom 25 percentile of its queue of rates back to January 2007. The overall unemployment rate, which is up-to-date through March, is in the lower 4.9% of its historic queue on that same timeline. The number of unemployed has fallen. It is also in the bottom 25th percentile of its historic queue, dating back to January 2007. All these statistics show that current levels of unemployment or of the number of unemployed have made substantial progress compared to past levels.

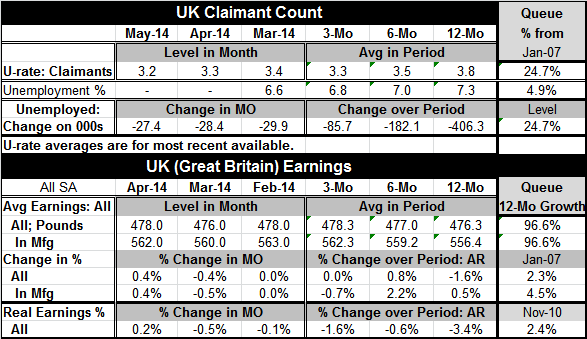

Turning to earnings, overall earnings rose by 1% in April. Manufacturing earnings rose in step. Over 12 months, total earnings are down by 1.6%; earnings in manufacturing have risen by 0.5% on that period. Expressed in real terms, total earnings grew by 0.2% in April after falling by 0.5% in March. Overall real earnings are falling at 1.6% annual rate over three months, a 0.6% annual rate over six months and are lower by 3.4% over 12 months. The UK real earnings figures are the one clear negative in the assessment of the UK labor market. What's good for employers' costs is not always good for workers' incomes. Total nominal earnings and manufacturing earnings are down by less than 4% from their past cycle peak. The year-over-year percent change in overall earnings is in the lower 2.3% of all year-over-year earnings growth figures back to January 2007. On the same basis, manufacturing earnings gains are in the bottom 4.5% of their queue. Expressed in real terms, overall earnings were in the bottom two and one-half percent of all annual earnings growth figures back to November 2010. Those are weak results

Overall the UK shows a strong progress in the improvement of its labor market. The number of unemployed is going down and the unemployment rate is falling steadily. However, the earnings made by workers are slow in advancing relative to inflation. This could be the weak spot in the UK recovery. As the Bank of England calibrates its policies based on the degree of slack in the labor market, the falling rate of unemployment keeps cutting the assessment of slack but the failure of labor compensation to rise significantly underscores the continuing presence of slack. In setting its policies, the central bank will have to sort out that dichotomy.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.