Global| Dec 21 2007

Global| Dec 21 2007UK Consumer Confidence Continues to Plunge

Summary

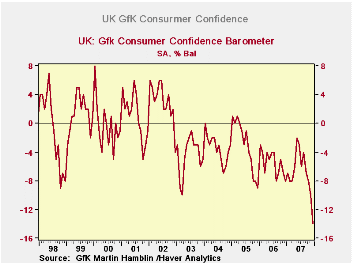

The GFK consumer sentiment report for the UK continues to plunge and it is one of the clearest signs of trouble in the UK economy. The CBI survey on retailing earlier had signaled some weakness and expectations of a softer January to [...]

The GFK consumer sentiment report for the UK continues to

plunge and it is one of the clearest signs of trouble in the UK

economy. The CBI survey on retailing earlier had signaled some weakness

and expectations of a softer January to boot. But actual sales data

(released today) showed a gain in November although food accounted for

all the volume increase. While the Bank of England struggles with

policy, consumers seem to have made up their minds about where the

balance of risk lies.

At a reading of -14 the GFK index is at its weakest point in

over 10 Years. Still, households rate their financial situation as the

best in 10 years currently. In this environment their plans for making

major purchases are the lowest they have been in 10 Years. Consumers

rate the general economic situation in the past 12-months as the worst

in the past two years and in the bottom four percent over ten years.

They assess inflation as the worst in 10 years.

While BOE is concerned about inflation too, a recent wage

survey finds that wages deals have been contained in their recent range

and in fact are not accelerating. Of course while that may be good news

to the BOE, it is another factor pressuring consumers as energy prices

rise.

The outlook for the next 12-months score very weak readings

for the household financial situation and the general economic

situation both in the bottom 15 percentile of their respective ranges

for two years and about the bottom quarter of the range over 10-years.

The major purchases index is at the 50% mark for the next 12 months

compared to the past two years’ range, but that is a bottom 25% reading

over the past 10 years. Obviously the consumer sector has been weak and

is weakening again. Stratified by income, both high and low income

respondents see conditions as among their poorest in 10 years.

| GFK Consumer Survey | ||||||

|---|---|---|---|---|---|---|

| % of 2Yr | % of 10Yr | |||||

| Dec-07 | Nov-07 | Oct-07 | Sep-07 | Range | Range | |

| Consumer Confidence | -14 | -10 | -8 | -7 | 0.0% | 0.0% |

| Current | ||||||

| Household Financial Situation | 25 | 25 | 25 | 25 | 100.0% | 100.0% |

| Major Purchases | -14 | -7 | -5 | -3 | 0.0% | 0.0% |

| Last 12 Months | ||||||

| Household Financial Situation | -1 | 0 | 2 | 4 | 37.5% | 40.0% |

| General Economic Situation | -36 | -32 | -30 | -29 | 0.0% | 4.2% |

| CPI | 74 | 73 | 69 | 64 | 100.0% | 100.0% |

| Savings | 33 | 35 | 38 | 38 | 52.6% | 84.5% |

| Next 12-Months | ||||||

| Household Financial Situation | 8 | 9 | 13 | 12 | 14.3% | 14.3% |

| General Economic Situation | -26 | -21 | -17 | -19 | 0.0% | 26.7% |

| Unemployment | 30 | 31 | 29 | 27 | 35.7% | 62.5% |

| Major Purchases | -19 | -20 | -18 | -20 | 50.0% | 25.0% |

| Savings | 19 | 20 | 19 | 17 | 63.6% | 85.2% |

| By Income | ||||||

| Lower | -19 | -16 | -14 | -13 | 0.0% | 0.0% |

| Upper | -7 | -6 | -3 | -1 | 0.0% | 0.0% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.