Global| Jun 30 2009

Global| Jun 30 2009UK GDP Is Officially A Train Wreck Impact Of GDP-Gap To Become A More Serious Matter For Argumentation

Summary

‘Official’ train wreck?? Maybe I shouldn’t say ‘officially’ since no one in officialdom has really declared it so. And I don’t want those with policies at Lloyds to come running for remuneration because they are insured against injury [...]

‘Official’ train wreck?? Maybe I shouldn’t

say ‘officially’ since no one in officialdom has really declared it so.

And I don’t want those with policies at Lloyds to come running for

remuneration because they are insured against injury inflicted by a

train gone amok. Still, the sharp downward revision to UK GDP is

stunning and it gives us a new take on reality.

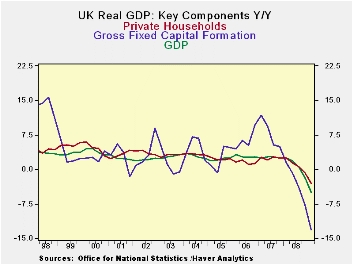

Capital spending takes a dive – If capital

spending were a prize-fighter, the boxing officials would be streaming

in for an investigation of such a sudden dive. UK capital spending in

Q1 ‘did in’ an already weak UK GDP showing in 2009-Q1 by falling at an

even steeper 27% annual rate. The annualized drop in UK GDP as a result

has sunk back to near double digit losses, showing a decline of at a

pace of 9.3% compared to -7.3% as last reported. And, yeah, they are

both bad numbers, but 9.3% is simply awful.

Bigger than a pot-hole: The GDP hole that

the UK must dig itself out of is deeper than we thought. And in this,

the UK is not alone. Not seasonally adjusted Irish GDP was revised

lower in Q1 to an annual rate drop of 8.5% from 7.5% previously.

Excluding its key international sector, Ireland’s GDP fell 12% in Q1.

Downward revisions have been an ongoing theme…

Yes we have no INFLATION!!! (for now) --

These sorts of downward revisions business activity help to explain

some of the other ‘news du jour’ such as the lowest inflation rate in

40 years in Italy (+0.5% Yr/Yr in June); the first-time-ever drop in

the EMU CPI (-0.1% in the twelve months ended in June); and, the lowest

inflation reading in at least 38 years for the OECD area (+0.1% Yr/Yr

in May).

Let’s do the twist...or let’s not -- There

has been some great twisting of inflation trends recently. As short a

time ago as July of 2008 OECD inflation had reached an 11-year high at

4.9% Yr/Yr; the plunge in the rate of inflation has a lot to do with

the global credit crisis and the deflating of the individual OECD

economies as well as the global economy. To the extent we may wish to

consider it a separate event, it also has to do with oil prices

falling. Energy prices in the OECD fell by 16.2% in the 12 months to

May obviously having a lot to do with the drop in that headline

inflation rate. That which twists can untwist…

The GDP-Gap trap - These huge hits to GDP

are behind us. The legacy of those hits is something economists call

the GDP-Gap. The Gap is the difference between where GDP is currently

compared to where it could have been had the economy grown at its

‘full-potential’. You get a good simple approximation of this by just

extending GDP’s growth trend before the economy slowed and fell and

looking at the resulting gap of that extrapolated line Vs actual GDP.

That gap will persist for some time into the future even if the economy

grows swiftly for several quarters.

The plot thickens - While no one expects

declines of the past order of magnitude to continue going forward,

there is considerable debate about the speed of the individual

economies and of the global economy. The turning point location for GDP

growth rates to become positive and the pace at which growth will

proceed once that happens are critical ingredients in the outlook for

inflation.

Risk source: Gap trap Vs central bankers at nap -

To Keynesian types these issues are the key; to others ‘the Gap’ is

still an issue that matters but monetarists look for the impact on

inflation to come from all the special reserve injections by various

central banks.

Market pricing, or groping - So the stage

is set. We can expect these issues to continue to be contentious as the

recession slows and recoveries re-start. Stock markets have rebounded

less on the expectation of strong GDP recovery growth rates and more on

the notion that huge drops in GDP are behind us and the companion

thought that at least some growth lies ahead. Bonds have been battered

back by those with fears of inflation from central-bank reserve growth

and the notion that the special times for distress pricing and the

flight to quality are behind us.

Markets will continue to toss and turn on these issues. Some

will revel in the existence of the GDP-Gap as a protector against

inflation. Others will dismiss it or diminish it. It is the wave of the

future.

| UK GDP | ||||||||

|---|---|---|---|---|---|---|---|---|

| Consumption | Capital Formation | Domestic | ||||||

| GDP | Private | Public | Total | Housing | Exports | Imports | Demand | |

| % change Q/Q | ||||||||

| Q1-09 | -9.3% | -5.0% | 0.9% | -26.9% | -41.5% | -25.0% | -24.1% | -9.5% |

| Q1-09 Previous | -7.3% | -4.7% | 1.2% | -14.2% | #N/A | -22.1% | -21.5% | -7.6% |

| Q4-08 | -7.0% | -4.3% | 4.3% | -4.7% | -12.7% | -15.6% | -20.2% | -8.7% |

| Q3-08 | -2.9% | -1.5% | 1.9% | -10.7% | -25.6% | -1.7% | -2.8% | -3.1% |

| Q2-08 | -0.2% | -1.5% | 4.0% | -8.8% | -21.9% | -1.8% | -5.3% | -1.2% |

| % change Yr/Yr | ||||||||

| Q1-09 | -4.9% | -3.1% | 2.8% | -13.2% | -26.2% | -11.6% | -13.6% | -5.7% |

| Q4-08 | -1.8% | -0.8% | 3.5% | -7.8% | -15.9% | -3.8% | -7.7% | -2.9% |

| Q3-08 | 0.5% | 0.7% | 2.6% | -3.9% | -14.8% | 0.5% | -1.7% | 0.1% |

| Q2-08 | 1.8% | 1.4% | 2.9% | -0.8% | -8.6% | 2.8% | 3.5% | 2.2% |

| 5-Yrs | 0.9% | 1.2% | 1.8% | 0.7% | -5.1% | 1.7% | 1.1% | 0.8% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.