Global| Jul 24 2009

Global| Jul 24 2009UK GDP Surprises with 0.8% Fall in Q2

Summary

UK forecasters were looking for Q2 GDP to be down 0.3% from Q1, so they were surprised today at the -0.8% preliminary estimate published by ONS. Press reports emphasize the magnitude of the overall decline, 5.6% year-on-year, and 5.7% [...]

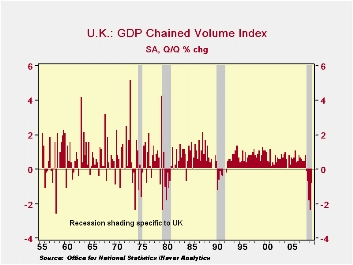

UK forecasters were looking for Q2 GDP to be down 0.3% from Q1, so they were surprised today at the -0.8% preliminary estimate published by ONS. Press reports emphasize the magnitude of the overall decline, 5.6% year-on-year, and 5.7% from the peak in Q1 2008. The year-on-year figure is the weakest of comparable GDP performances in the 54-year history of these quarterly series, and the peak-to-latest is perhaps tied with the 1979-81 recession as the largest total contraction in any recession.

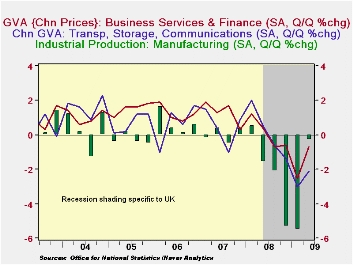

Forecasters apparently put the most store in the manufacturing

sector, which is doing better. Output there is reported down just 0.3%

in the quarter, a marked improvement from the 5.5% during Q1. Within

the monthly data, March was actually higher by 0.2% and April held

steady with that before a renewed decline in May, 0.5%, also reported

this morning. But that most cyclical sector seems to be on the verge of

turning around.

However, some service industries and construction remain feeble, even though they declined less that in prior recent periods. Construction had been down 5.0% and 6.9% in Q4 and Q1, respectively, so in one sense 2.2% in Q2 is "better". In an absolute sense, though, that's still quite weak. Similarly, services contracted 0.6%, somewhat less than 1.6% in Q1 and 1.0% in Q4. [All these growth rates are period-to-period, not annualized].

Within services, business services and finance apparently had the largest negative contribution, as they contracted 0.7%, with a weight of more than 30% in the total. The biggest single decline in a sector was 2.1% in transport, storage and communication, where activity fell 2.1% in Q2, but the industry group has only a 7% weight.

In such a severe recession as there's been, it might not be surprising that weakness has spilled more into services than we're used to. Further, the recession's origin in the over-extended financial sector suggests that it might well stay down longer than has been customary.

All this said, the 0.8% decrease in Q2 GDP is still much better than the prior two periods, and while the recession continues, the stabilization of manufacturing may well be a sign that recovery is developing.

| % Changes (not annualized), SA | 2005 Weight | Q2 2009 | Q1 2009 | Q4 2008 | 2008 | 2007 | |||

|---|---|---|---|---|---|---|---|---|---|

| Q/Q | Y/Y | Q/Q | Y/Y | Q/Q | Y/Y | ||||

| GDP | 1000 | -0.8 | -5.6 | -2.4 | -4.9 | -1.8 | -1.8 | 0.7 | 2.6 |

| Manufacturing | 133 | -0.3 | -12.6 | -5.5 | -13.8 | -5.2 | -8.2 | -2.8 | 0.6 |

| Construction | 63 | -2.2 | -14.7 | -6.9 | -13.2 | -5.0 | -5.3 | 0.2 | 2.7 |

| Services | 759 | -0.6 | -3.8 | -1.6 | -3.1 | -1.0 | -0.7 | 1.3 | 3.5 |

| Business & Finance | 304 | -0.7 | -4.4 | -2.5 | -3.4 | -0.6 | 0.3 | 2.4 | 5.5 |

| Transport, Storage & Communication | 72 | -2.1 | -7.0 | -3.0 | -4.5 | -1.4 | 0.5 | 2.0 | 3.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates