Global| Jun 24 2008

Global| Jun 24 2008UK Mortgage Approvals By Banks Continue To Fall

Summary

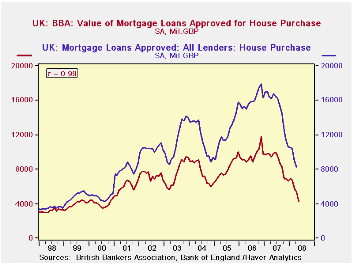

The British Bankers Association (BBA) announced today that mortgage approvals for house purchases by banks in the United Kingdom continued to fall in May. At 4,289 million GBP (Great Britain Pounds) they are now 64% below the peak of [...]

The British Bankers Association (BBA) announced today that

mortgage approvals for house purchases by banks in the United Kingdom

continued to fall in May. At 4,289 million GBP (Great Britain Pounds)

they are now 64% below the peak of 11,811 million GBP reached in

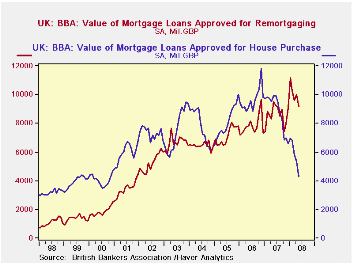

November of 2006. Approvals for re-mortgaging, on the other hand, are

rising. In May they were 9,165 million GBP, more than twice approvals

for house purchases. In the past approvals for refinancing were

generally lower than those for house purchases as can be seen in the

first chart.

In addition to banks, building societies, non bank credit grantors and specialist mortgage lenders are in the business of providing loans for house purchase and re-mortgaging. The Bank of England publishes data on all the sources of mortgage finance, usually about three weeks after the BBA release. As banks are the major supplier of mortgage credit, there is a close correlation between the two series as can be seen in the second chart.

| UNITED KINGDOM | May 08 | Apr 08 | Mar 08 | Peak | % Chg from peak | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|

| BRITISH BANKERS ASSOCIATION (mil GBP) | ||||||||

| Mortgage Approvals for House Purchase | 4289 | 5354 | 5806 | 11811* | -63.69 | 105727 | 115475 | 97175 |

| Mortgage Approvals for Refinancing | 9165 | 9987 | 9632 | 11160# | -17.88 | 103155 | 94351 | 85802 |

| BANK OF ENGLAND | ||||||||

| Mortgage Approvals for House Purchase | -- | 8268 | 8997 | 17933* | -53.90 | 180494 | 192325 | 146750 |

| Mortgage Approvals for Refinancing | -- | 14133 | 13627 | 15072# | -6.23 | 150744 | 138590 | 128970 |

| * November, 2006 | ||||||||

| # January, 2008 | ||||||||

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates