Global| Oct 18 2007

Global| Oct 18 2007UK Retail Sales Accelerate

Summary

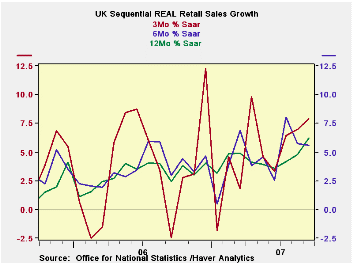

UK retail sales are accelerating. The acceleration is real as the volume graph on the left shows. The tables growth calculations show that upsurge has not been steadily building but is nonetheless across the main categories over the [...]

UK retail sales are accelerating. The acceleration is real as the volume graph on the left shows. The table’s growth calculations show that upsurge has not been steadily building but is nonetheless across the main categories over the past three months with food sales leading the nominal acceleration part of that due to prices, no doubt. Clothing sales are accelerating too, but that is after a flat six-month growth rate, and to a growth rate marginally stronger than the 12-month rate. The surge in volume growth in the last three months is striking. In the quarter now complete sales volumes are up at a 7.1% annualized pace.

| Nominal | Sep-07 | Aug-07 | Jul-07 | 3-MO | 6-MO | 12-MO | YrAGo |

| Retail Total | 0.5% | 0.9% | -0.4% | 4.1% | 3.2% | 4.6% | 2.9% |

| Food Beverages & Tobacco | 0.9% | 1.8% | -0.5% | 8.8% | 3.9% | 3.6% | 4.0% |

| Clothing footwear | 0.6% | 1.3% | -0.4% | 6.0% | 0.0% | 5.8% | 2.1% |

| Real | |||||||

| Retail Ex Auto | 0.6% | 0.7% | 0.7% | 7.9% | 5.6% | 6.2% | 2.4% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates