Global| Sep 20 2017

Global| Sep 20 2017UK Sales Volumes Hold Ground-What Does That Mean?; Expected Orders Improve But Do Not Impress

Summary

With the Bank of England having met and put markets on notice that at some point rates would go up and with BOE Governor Mark Carney being outspoken about how Brexit will not be good for U.K. growth, many are simply holding their [...]

With the Bank of England having met and put markets on notice that at some point rates would go up and with BOE Governor Mark Carney being outspoken about how Brexit will not be good for U.K. growth, many are simply holding their breath for the next BOE chance to hike rates. Against that background, the August U.K. retail sales gain of 1% on the heels of a 1% gain in July has the economy looking pretty strong. Or does it?

With the Bank of England having met and put markets on notice that at some point rates would go up and with BOE Governor Mark Carney being outspoken about how Brexit will not be good for U.K. growth, many are simply holding their breath for the next BOE chance to hike rates. Against that background, the August U.K. retail sales gain of 1% on the heels of a 1% gain in July has the economy looking pretty strong. Or does it?

Retail trends

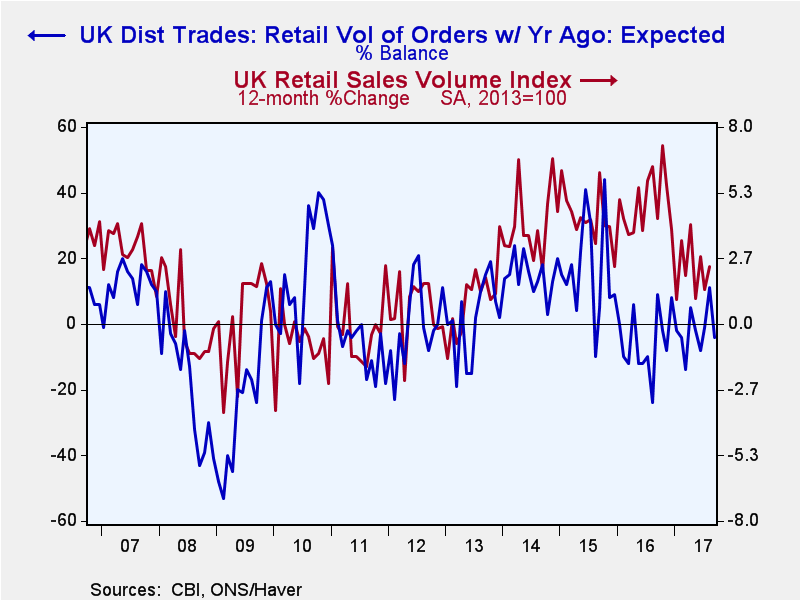

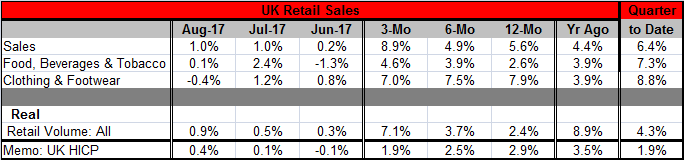

The U.K. nominal sales pace is up from the 5% to 5.5% pace over 12 months and six months to log a three-month growth rate of 8.9%. The volume series shows volume growth rates expanding from 2.4% over 12 months to a 3.7% pace over six months to a 7.1% pace over three months. Still, the 12-month growth rate has been hovering below 3% for some time. The CBI survey on retailing for September had expected orders as weaker only 21% of the time historically and expected sales for September were placed just a touch above their median historic value. Sales adjusted for the time of year were assessed as just a few bits below their median. Retailers have not been overly impressed by sales performance.

Retail sales: accelerating or having accelerated?

The question is whether retail sales are really accelerating or not. The U.K. HICP pace has been dropping from 2.9% over 12 months to 2.5% over six months to a 1.9% pace over three months. The year-on-year pace of nominal sales is up compared to a year ago at this time while the growth of retail sales volumes is lower. A year ago volumes were expanding at an 8.9% clip while now that pace is down to a 2.4% pace. The BOE in its policy statement noted that it expected the inflation overshoot to last for three years. But wages continue to lag inflation and inflation is not creating knock-on impacts and instead seems to be cooling faster even as growth has continued to surprise on the upside. The BOE has noted that economic slack is being used up and that policy may need to be adjusted faster than the markets now assume. That was taken as warning shot. On the other hand, the BOE has a lot of trends to handicap here and the situation is in flux.

U.K. retail sales were up by an ordinary 0.2% in nominal terms in June and solid 0.3% real pace in June. Since then, the sales pace has increased. But will that continue?

Brexit uncertainty

The U.K. is still embroiled in formulating and negotiating its Brexit plans. As Governor Carney notes, Brexit is not going to be good for U.K. growth. The EU is complaining that it still does not have a concrete proposal from the U.K. about its Brexit desires. However, if Governor Carney is right and if leaving the EU will slow U.K. growth and damp productivity, the post-EU UK economy eventually may be a candidate for higher rates to meet its inflation objective.

The Brexit entanglement

What the BOE has to sort out is if it makes sense for it to hike rates 'soon' in the wake of inflation's gain which is only a response to the BOE's own action to give the economy a shot of monetary stimulus in the wake of the unexpected Brexit vote result. With all the Brexit uncertainty hanging in the air and with investment being tied up until what Brexit 'is' becomes clear, U.K. growth is going to be adversely affected in the run up to the actual U.K. departure. So should the BOE accept the current growth/inflation overshoot without addressing it with a 'typical' policy tightening move knowing that the overshoot is temporary? Or should policy begin the process now of bringing inflation to heel and of clamping down on an economy with less slack and with a more limited upside than it used to have? Is the optimal monetary policy channel getting narrower?

Past inflation is like spilled milk

The danger here is that the U.K. begins to follow an almost Germanic style tightening process for the sake of getting its policy in alignment sooner rather than later when the economy might already be headed there. Inflation as measured by the HICP or the CPIH - as well as by the CPIH excluding energy - shows that the inflation rate is ratcheting down with the three-month pace already below 2% or close to it on all this measures. Hiking rates now for a past inflation overshoot when inflation is already beginning to slow back to target does not seem to be a very defensible strategy. After a relatively brief period when sterling weakness permitted the U.K. to have some inflation, that historic episode is fast drawing to a close in a global environment in which inflation is not a player.

Vehicle registrations are less solid already

The U.K. car market has been blowing hot and cold. In August, motor vehicle registrations were up by a strong 4.2% month-on-month. But over 12 months and six months, U.K. vehicle registrations are lower on balance. Compared to the EMU's big four economies, the U.K. is the only one with vehicle registrations lower on balance over the last 12 months ending in August.

Policymaking and Catch-22

In monetary policymaking, perception is at least 50% of the job. The monetary authority has to know the facts and see the economy and evaluate how it is doing while understanding its behavior relative to its own business cycle and in the midst of various global forces. The BOE will have to render a judgment call from a committee with members who have at least slightly divergent views. Perhaps in the wake of this retail sales report, the economy looks strong enough that a tick up in interest rates does not seem likely to damage growth prospects very much. But markets rarely think central banks are going to 'tick' interest rates up once then leave things alone. Markets will extrapolate a single move into a program of moves and may or may not 'believe' central bank boiler-plate to the contrary.' Since 25bp is such a puny move if a central bank is going to hike rates, why do that? The point is that such a move would be pointless! That's the Catch-22 of central-bank watching. Moreover, with inflation already slowing what's the rush and what's the point of a rate hike with all the stress of Brexit all around and more it on the near horizon? We will find out soon what the BOE really thinks and what it really fears. A solid retail sales report could give it some cover for a rate hike, but that still does make it such a good idea.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.